By Vignesh Lakshmanan, Manager & Benson Augustine, Program Manager – Mobility

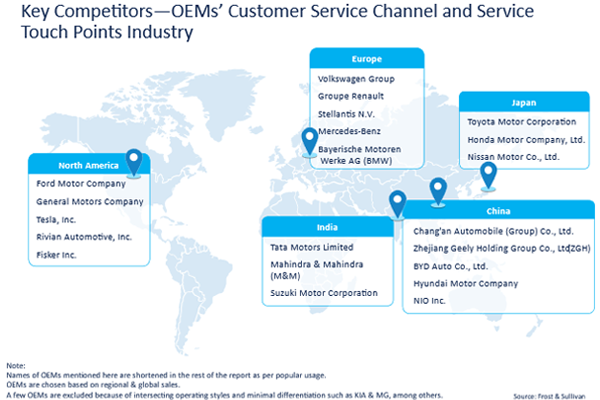

As the automotive landscape shifts, Original Equipment Manufacturers (OEMs) are under increasing pressure to innovate within their service ecosystems to secure alternative revenue streams. The saturation of the maintenance parc and the growing influence of the Independent Aftermarket (IAM) have pushed OEMs to either adapt or risk losing periodic demand. Key segments within the aftersales ecosystem, such as maintenance financing and electronic retail (eRetail) for parts and services, are already experiencing the impact of these changes. Over the next 3 to 5 years, OEMs are expected to broaden their service coverage across multiple maintenance segments, driven by technological advancements and strategic partnerships.

In response to these challenges, OEMs are increasingly integrating cutting-edge technologies like blockchain, the Internet of Things (IoT), and telematics throughout their value chains. These innovations enable the development of curated services that cater to the on-demand needs of the Original Equipment Supplier (OES) channel. The next few years will witness significant adoption of these enabling technologies, particularly in OES dealerships, where blockchain will be implemented to enhance transparency and security in maintenance records.

Furthermore, OEMs are forming strategic alliances with technology companies to create high-end computing solutions. Although these partnerships primarily focus on OEM-level services, they are expected to yield aftermarket solutions within the next few years, offering new avenues for growth and customer engagement.

To learn more, please access: Growth Opportunities from Benchmarking Global Passenger Vehicle OEMs’ Customer Service Channels, Growth Opportunities from Digital Retail Initiatives for New Electric Vehicles in Europe, North America, and China, or contact sathyanarayanak@frost.com for information on a private briefing.

OES to Benefit from Increasing Complexity of Parts and Components Replacement in New Vehicles and EVs

The increasing complexity of automotive parts and replacement components is driving demand toward the OES channel, with new vehicle sales being the primary source of this demand. The servicing of electric vehicles (EVs) is particularly inclined toward the OES channel, as there are few well-rounded alternatives available. These trends are expected to significantly influence growth within OEMs’ customer service channels and service touchpoints.

However, the path forward is fraught with challenges. In regions like North America and Europe, the IAM has made significant inroads by offering services that rival the quality and standards of the OES channel, often at a lower price point. This has led to a growing trend where customers shift from OES to IAM services after their warranty periods expire, seeking cost-effective solutions. This shift is a common industry norm globally and poses a significant challenge to OEMs.

Currently, OEMs offer a range of maintenance services, including basic roadside assistance (RSA), scheduled maintenance, quick service, and replacement maintenance, either as paid services or complimentary during the warranty period. In their digital retail and omnichannel strategies, OEMs have pivoted to offering parts for eRetail, app-based services, and telematics. They are also exploring value line offerings, where established North American and European OEMs have launched affordable parts targeting both the OES and IAM channels.

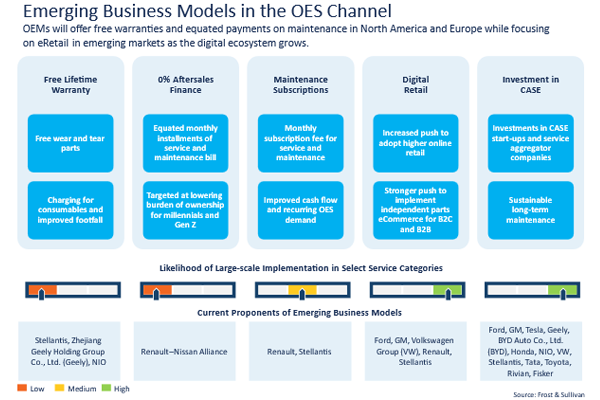

Despite these efforts, many OES loyalty programs remain underdeveloped, necessitating updates to offer tangible mobility-based services that can retain customers within the OES channel. Additionally, while some OEMs are experimenting with lifetime warranties and free replacements for wear-and-tear parts, most traditional OEMs continue to offer standard and extended warranty services.

OEMs are also testing alternative revenue models, such as offering maintenance as a subscription service. This model is particularly attractive to younger customers who are weary of conventional ownership and maintenance trends. Partnerships with new mobility providers and fleets are another area of focus, enabling OEMs to tap into consistent demand. As EV adoption increases globally, OEMs are investing in training and building EV-specific services, which will be integrated into the OES channel. They are also testing new business models that incorporate third-party providers to enable seamless maintenance.

Our Perspective

OEMs face three major challenges regarding service and maintenance: the need for consistent demand in the OES channel beyond just sales and in-warranty vehicles, the widespread perception that OE service and maintenance are high-quality but expensive, and the growing influence of the IAM, which offers comparable quality at lower prices. To address these challenges, OEMs must innovate in their approach to value line labels and workshop concepts.

Some OEMs, like Ford with its Motorcraft and Omnicraft brands, have successfully developed value line labels that cater to both their customer base and the growing IAM in North America. Similarly, Stellantis’ Distrigo in Europe offers a robust private label and workshop concept that serves both its OES channel requirements and the IAM. For larger OEMs such as Volkswagen and Toyota, developing and launching similar value line labels and workshop concepts could unlock alternative revenue streams, especially in emerging markets where such initiatives could lead to long-term success.

Meanwhile, customer buying behavior is increasingly shifting toward web- and app-based purchasing, creating a demand for more accessible and convenient options. This shift can be categorized into three main areas: DIY components, push services (e.g., services marketing and calls to action), and pull or on-demand services (e.g., app-based service aggregation, RSA, and online scheduling).

OEMs like Ford, GM, and Volkswagen have already launched their parts catalogs on eRetail platforms, setting a precedent for others to follow. However, the challenge lies in creating a seamless integration between online and offline channels. For instance, Rivian’s strong online presence needs to be complemented by a robust offline presence to avoid long-term negative impacts on service and maintenance in its OES channel. By leveraging strong value line labels and multi-brand workshop concepts, OEMs can offer service aggregation platforms that tap into demand and generate long-term revenue streams.

Currently, the rise of Generation Z and millennial customers is reshaping the way businesses offer services. Vehicle ownership is less attractive to these demographics, who often prefer shared mobility options and well-connected urban living. Consequently, traditional service models are losing their appeal, and OEMs must adapt to meet the changing needs of this customer base.

In response, some European OEMs have started offering vehicle ownership on a subscription model, a trend that is now extending to aftersales services. For example, Renault offers 0% financing on aftersales maintenance, with easy payment options spread over several months. OEMs are also introducing maintenance subscriptions at affordable rates, allowing customers to access free maintenance and repair services during the subscription period. Such initiatives could prove particularly effective in markets like India, where subscription models are gaining traction. By embracing these new business models, OEMs can secure steady cash flows through the OES channel, even during periods of low maintenance demand.

With inputs from Amrita Shetty, Senior Manager, Communications & Content –Mobility