Chinese Tier 1 automotive suppliers have emerged as pivotal players in the rapidly transforming global automotive market, leveraging their technological capabilities and innovation to capture significant global market share. Frost & Sullivan’s analysis identifies these suppliers as key to the industry’s future, especially in the realms of electric vehicles (EVs), autonomous driving, and connected cars.

Technology, Partnerships, and R&D

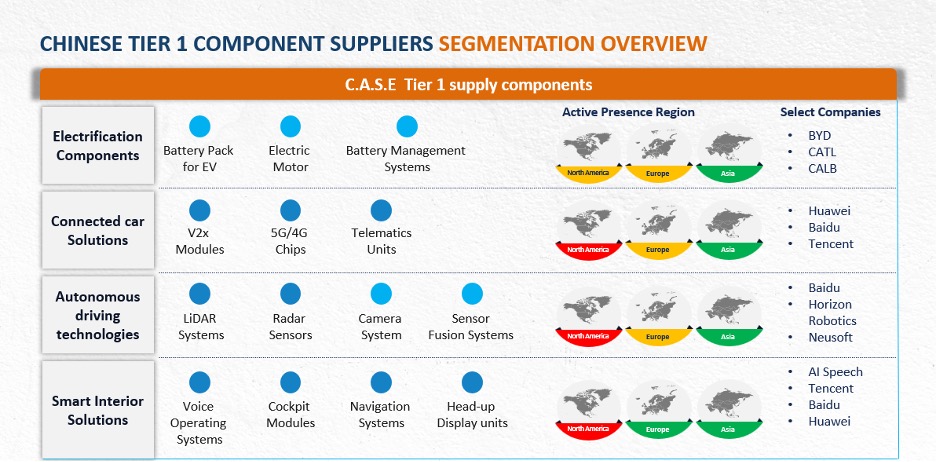

Several key drivers are fueling the growth of Chinese Tier 1 automotive suppliers. First, the rapid adoption of EVs and advancements in autonomous driving technologies are creating unprecedented demand for their products. Chinese suppliers are well-positioned to capitalize on this trend due to their expertise in battery technology, sensor integration, and telematics.

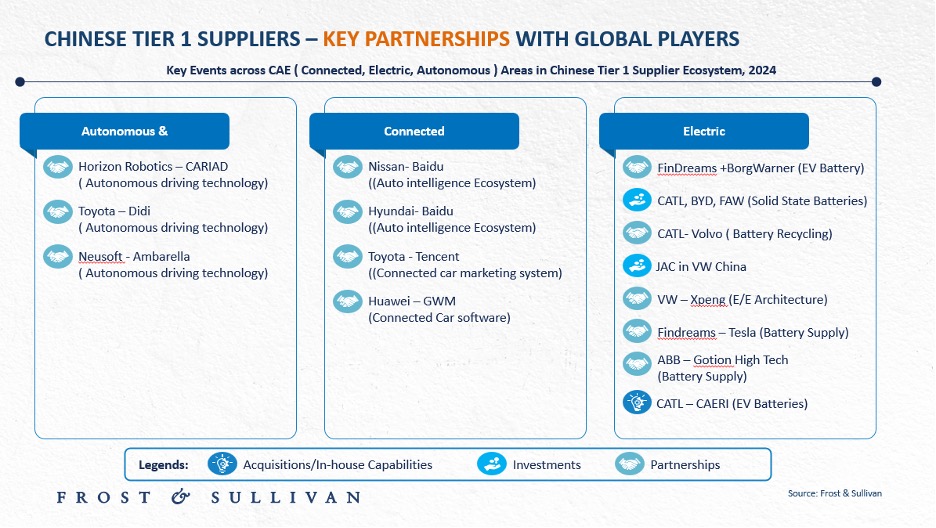

Strategic partnerships with established global players are another significant growth driver. By collaborating with automotive OEMs and technology leaders, Chinese suppliers are accessing new technologies, distribution networks, and market knowledge, accelerating their international expansion.

Companies like Baidu and Huawei, for example, are setting up dedicated R&D facilities focused on autonomous driving, while forming partnerships with global automotive giants to develop software and hardware solutions.

Moreover, the emphasis on R&D and innovation is critical to the long-term success of Chinese suppliers. By investing in technologies such as LiDAR, radar sensors, and advanced data analytics, these companies are not only improving the performance and safety of their products but are also creating a competitive edge in the global market.

Geopolitics, Localization, and Market Adaptation

Despite their impressive growth, Chinese Tier 1 suppliers face several challenges in their quest for global dominance. Geopolitical tensions, particularly between China and the US, pose significant risks to supply chains, technology transfers, and market access. Trade barriers, tariffs, and restrictions on Chinese tech companies like Huawei further complicate global expansion efforts.

Localization demands from automakers are another challenge. As automakers increasingly seek to reduce transportation costs and cater to regional preferences, Chinese suppliers are under pressure to establish overseas manufacturing facilities. This requires substantial capital investment and logistical expertise, which could slow their international growth.

Adapting to local market preferences is yet another factor to consider. Understanding regional consumer behaviors and regulatory requirements is essential for Chinese suppliers to tailor their products and services effectively. Failure to do so could hinder their ability to compete in diverse global markets.

To learn more, please access: Chinese Tier 1 Automotive Suppliers Market, Global, 2024-2030, Growth Opportunities in China’s Electric Vehicle Industry, 2024-2030, or contact [email protected] for information on a private briefing.

Dominance in EV Components and Battery Technology

China’s dominance in the EV components market, particularly in battery production, is reshaping the global automotive supply chain. Chinese companies now control 68% of the global lithium-ion battery production capacity for EVs. This is largely due to their vertical integration strategies and investments in processing key minerals such as lithium, cobalt, and graphite. Companies like BYD and CATL are leading the charge, accounting for nearly a quarter of the global battery management system (BMS) market.

In 2023 alone, China exported $9.3 billion worth of lithium-ion batteries to the United States, underscoring its critical role in the global EV supply chain. Beyond batteries, Chinese suppliers are making significant strides in EV components such as electric drivetrains and charging infrastructure. By 2025, these suppliers are expected to hold over 50% of the global EV battery market, with companies like FinDreams Battery and CATL securing dominant positions.

Sodium-ion batteries, seen as a more cost-effective alternative for low-speed EVs and energy storage, are also gaining traction among Chinese suppliers. This emerging technology could help diversify China’s product offerings and reduce reliance on lithium-ion batteries, positioning Chinese firms for continued leadership in EV component manufacturing.

Connected Car and Autonomous Vehicle Advancements

In the connected car and autonomous vehicle segments, Chinese suppliers are establishing themselves as formidable competitors through innovations in vehicle-to-everything (V2X) modules, telematics units, and advanced driver-assistance systems (ADAS). Companies like Huawei are at the forefront of this technological shift, offering 5G modules, telematics units, and cloud platforms for connected vehicles. Huawei with its HiCar system, an intelligent in-vehicle platform, has already partnered with global automotive giants such as Volkswagen, Audi, and BMW, paving the way for Chinese suppliers to expand internationally.

Chinese suppliers are focusing on autonomous driving technologies such as LiDAR and millimeter-wave radars and are increasingly collaborating with global automotive OEMs like Volkswagen and General Motors. Such collaborations are enhancing their R&D capabilities, allowing them to develop cutting-edge software and sensor technologies crucial for autonomous vehicles.

Expanding into New Markets with Smart Interior Solutions

Chinese Tier 1 suppliers are also gaining a foothold in the smart interiors market, offering a range of innovative solutions such as voice search systems, navigation, and cockpit modules. Companies like Neusoft Corporation and Huizhou Desay SV are key players in this segment, providing OEMs with intelligent cockpit components that integrate voice recognition, wireless charging, and heads-up display (HUD) systems. Their growing influence in smart interiors is supported by partnerships with leading global automakers like General Motors, Nissan, and Volkswagen. This cross-pollination of innovation is positioning them to further solidify their role in the global automotive supply chain, particularly as smart interior components become more integrated into future vehicle designs.

Our Perspective

Looking ahead, Chinese Tier 1 suppliers are expected to continue their global expansion, driven by their technological capabilities and strategic partnerships. The EV components market will remain a key focus, with Chinese companies likely to maintain their leadership in lithium-ion and sodium-ion battery production. Meanwhile, the connected car and autonomous vehicle segments will offer new growth opportunities, particularly as 5G technology and V2X communication become more integrated into vehicle systems.

In the smart interiors space, Chinese suppliers will increasingly collaborate with global automakers to develop innovative cockpit solutions, enhancing their presence in the high-end automotive market. While geopolitical and localization challenges remain, Chinese suppliers are well-positioned to overcome these obstacles through strategic partnerships, R&D investments, and a focus on scalability.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility