History is repeating itself with the return of Trump-era tariffs and trade wars. However, today’s trade and supply chain realities are markedly different from those of previous years. – Since then, global governments and businesses have navigated disruptions from the US-China trade war, the pandemic, the Russo-Ukrainian war, and conflicts in the Middle East – whether through diversifying trade beyond China or forging new energy supply partnerships. Consequently, globalization paired with diversification has undeniably become the new blueprint for trade and business. So, what comes next with new trade wars? Let us explore shifting trade and supply chain dynamics and scenario possibilities

China-US and US Metal Tariffs Begin; What’s Next for Trade Wars?

Thus far, under the new Trump administration, the US has imposed new 10% blanket tariffs on China, with China retaliating with 10-15% tariffs on select US goods, amongst other Chinese measures. The US has also imposed 25% tariffs on all steel and aluminum imports, with no country exemptions for now, thus giving way to retaliatory global measures.

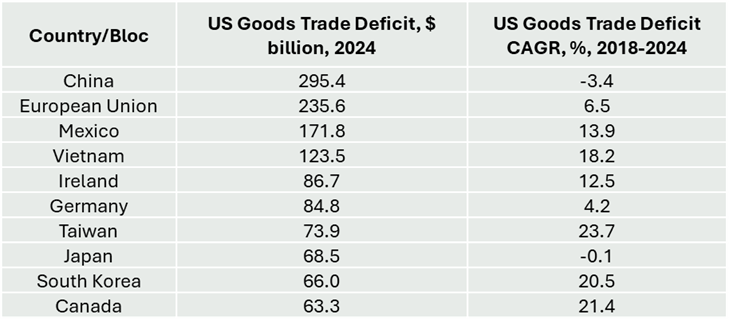

The graphic below explores countries/blocs which are at a higher risk of tariffs purely based on trade deficit figures. President Donald Trump has constantly reiterated the need to cut the US’s trade deficit (indicative of higher US imports compared to US exports).

Top 10 High Risk Countries/Blocs for Punitive Tariffs based on US Trade Deficit, Global, 2018-2024

Interestingly, the US goods trade deficit surged to $1.2 trillion in 2024, a 13.2% increase from $1.06 trillion in 2023.. The increase in the deficit can be pegged to factors such as the stronger dollar, robust US consumer spending, and pre-stocking of imports before Trump tariffs. In the context of trade wars, the widening US trade deficit raises the propensity for the Trump administration to continue to impose punitive tariffs.

Diminished Risk of ~60% China Tariffs: China’s goods trade deficit with the US, although the highest, has declined at a CAGR of 3.4% between 2018-2024. The falling deficit partially shows that earlier imposed punitive tariffs by the US have been working as intended (Trump administration started to impose tariffs on China in 2018). Considering the declining deficit, the already imposed new 10% tariffs, and the need to maintain a lid on US inflation, the probability of extreme tariffs of China (~60%) is on the lower side. However, beyond economic data, this situation could shift if US-China trade negotiations break down—particularly over issues like fentanyl distribution.

Mexico/Canada 25% Tariffs Can be Averted with Earlier USMCA Upgrade The US has wavered on tariffs for Mexico and Canada, with the latest policy offering temporary exemptions from the 25% tariffs. Mexico, importantly, is on the top 3 list for trade deficit size. However, it is also quite possible that tariffs could be leveraged as a tool for earlier-than-scheduled renegotiation of the United States-Mexico-Canada agreement (USMCA; free trade pact). USMCA review is presently scheduled only for July 2026.

Higher Trade Deficit and Higher MFN Rates Combine for Higher Country Risk: The latest development, of course, is for the US to potentially impose tariffs based on differences between US most favored nation (MFN) tariff rates and trading partner MFN rates, i.e., reciprocal tariffs. So, for example, if country X levies a 5% tariff on a product, and the US only levies 2%, the idea would be to raise the US’s tariff level to 5% as well. It would therefore appear that countries with a combination of large trade surpluses with the US as well as higher tariff rates are particularly susceptible to newer US tariff measures.

The Future of Trade and Supply Chains Under Trump 2.0 and Beyond

Irrespective of the level of tariffs and the countries targeted, one thing is clear, diversification of production, trade, and supply chains is here to stay. For one, we will continue to see China+1 pivots, whereby companies maintain some production in China while also diversifying beyond to circumvent tariffs. Additionally, based on the set of target countries and industries under Trump 2.0, we could even see the evolution of say Mexico+1 or Taiwan+1 supply chains. These moves will be driven not only by US policy announcements, but also in response to rising geopolitical risks and other factors.

Like how Vietnam’s manufacturing industry benefited from earlier US-China trade war, we will also see new emerging winners and preferred production locations this time around.

Finally, there are multiple scenarios that could unfold under trade wars 2.0, underling the need for adequate scenario planning and strategic adaptability to navigate upcoming US policy announcements. Companies with improved foresight of potential outcomes are better positioned to benefit from first-mover advantages and competitive differentiation. Likewise, governments that proactively align and improve manufacturing policies with shifting trade dynamics can capture new FDI inflows.

Take the opportunity to schedule a Growth Pipeline Dialog™ with our economists and growth experts to drive organizational growth priorities: https://frost.ly/bx5