Investor Transformation: Reshaping the Investment Lifecycle

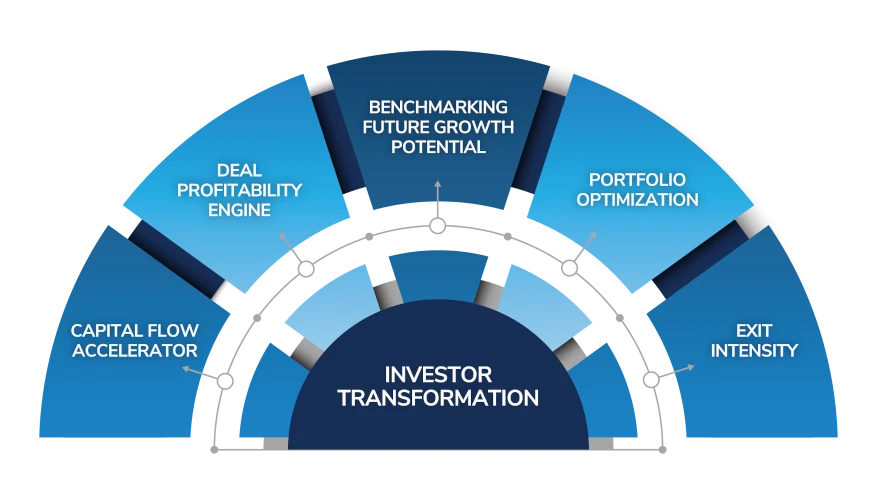

Frost & Sullivan’s Investor Transformation Practice empowers forward-thinking investors to reshape acquisition strategies, enhance due diligence, and execute with confidence across the full investment lifecycle.

From deal sourcing and M&A advisory to value creation and strategic exit planning, our experts combine deep industry knowledge, proprietary tools, and global benchmarking to drive faster, more profitable investment outcomes.

Are your investment strategies built to lead the market — or follow it?

Five Strategic Pillars Driving Investor Success

Key Strategic Imperatives for Investors

Why Now? Why This? Why You?

- How can I innovate through investments to stay ahead of disruption?

- What synergies exist across sectors, and when is the right time to act?

- Which emerging technologies offer the greatest long-term ROI?

- How is value chain disruption opening new paths to competitive advantage?

- How should our portfolio evolve in light of global and regional shifts?

- How can I accelerate sustainable transformation and enhance asset value?

- Can diversification help my investment strategy stand out in the market?

Targeted Solutions by Investor Segment

| Investor Type | Value Delivered | Frost & Sullivan Differentiators |

| Private Equities Family Businesses |

|

|

| Investment Banks Venture Capital Corporate Venture Capital Sovereign Wealth Funds |

|

|

| Corporates Holdings |

|

|

| Hedge Funds & Mutual Funds |

|

|

| Startups & Incubators |

|

|

Investor Value Proposition Across Investor Groups

| Value Proposition | Unique Selling Points | PE, Families | Investment Banks, VC, CVC, SWF | Holdings, Corporates | Hedge Funds, Mutual Funds | Startups & Incubators |

| M&A – Portfolio strategy |

|

✔ | ✔ | ✔ | ||

| M&A – Long /short list – target profiling |

|

✔ | ✔ | |||

| M&A – Commercial Due Diligence |

|

✔ | ✔ | ✔ | ✔ | |

| M&A – Business Plan Due Diligence |

|

✔ | ✔ | |||

| M&A – Go/no-go |

|

✔ | ||||

| Integration |

|

✔ | ✔ | |||

| Asset optimization |

|

✔ | ✔ | ✔ | ||

| IMR for IPO FID |

|

✔ | ✔ | |||

| Company / Tech Valuation |

|

✔ | ✔ | ✔ | ✔ | |

| Investor search | ✔ | ✔ |

Meet Our Investor Transformation Experts

Our global team brings unmatched experience, cross-industry specialization, and insight across industries and geographies.