By Paul Santilli

By Paul SantilliWorldwide OEM Industry Intelligence and Strategy

Hewlett Packard Enterprise

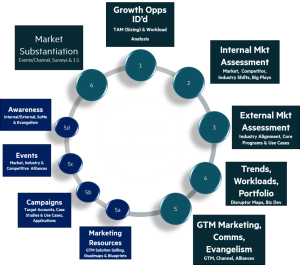

Part two of my three-part series focused on execution and extracting value from the large volume of data available to organizations today. In my third and final article, I will discuss best practices for developing a sales enablement and go-to-market strategy. Up to this point, I’ve outlined the requirements around a Go-to-Market roadmap on using the business intelligence and insights from your customer ecosystem to drive an intelligence-based strategy for business growth enablement.

At this juncture, we should have the necessary information on opportunities to pursue for best ROI and business growth. Now we have to target sales enablement and a GTM strategy that allows for awareness of activities and offerings, and also includes a focus on lead generation and areas to exploit the competitive advantage your company offers in this space. An effective GTM strategy consists of combining both internal and external sales organizations (B2B, B2C) to effectively deliver your company’s value proposition to your customers and outperform competitive offerings. Equipping your sales force with the necessary training, tools and knowledge to best outfit them with the ability to out maneuver the competition and offer a better solution set around your portfolio offering than the competition is necessary. This not only includes a marketing plan, but also product introduction and related strategies to fully exploit the window of opportunity around consumer needs and market acceptance (5a thru 5d) Marketing, Communications and Evangelism.

Additionally, creating campaigns around different marketing program mechanisms is a required investment for successful business growth. Depending on the industry, product, services, and geography, different marketing platforms can be used. This would include but certainly not be limited to, social network and some marketing, paid media, e-mail and direct marketing, account based marketing, and co-branding / channel partner relationship marketing, etc. And, as part of the marketing effort, a clear and comprehensive evangelism program needs to be put in place to not only heighten brand and product awareness and the company value proposition, but to also offer customer testimonials, showcase user experiences, and validate business-solving applications for your customer base. These efforts can be drawn from opportunities that are cited from within the intelligence analyses on how and where to best focus investments and resources to achieve an optimal marketing and evangelism model that maximizes growth opportunities.

Substantiate via User Community

This is an important component of your overall business life cycle that I believe often gets overlooked, or at a minimum, under emphasized. Of course, sales and related metrics can always tell you about consumer acceptance and the success of your business offerings. But gathering customer insight, both informally and formally, is a critical component of understanding the elements of your strategy that worked or didn’t work, and how to best correct them for next time. This is really a determination around a return on investment (ROI) that can then provide you intelligence on where to (re)invest or where to not invest and change course based on business conditions and/or competitive or consumer profiles.

Metrics and the Circular Model

Lastly, all of the findings from the customer feedback and marketing ROI insights will yield a wealth of information that would naturally be fed back into the overall research data population. From the extensive metrics modeling that is applied to each of the components of the intelligence driven demand model, information on what did and did not work is extremely valuable. This can include re-investment areas for those successful outcomes, and de-investment / reallocation of resources to areas that did not live up to the ROI potential. Therefore, it becomes a self-perpetuating circular model that essentially drives content off of both the marketing findings and the GTM campaign performance from your company. Over time, the maturity of the process intersection points becomes more and more connected and resembles a partial-automation platform. Eventually, the overall time for the entire circular model to play out becomes condensed, and results in faster outcomes, quicker execution around campaigns and growth initiatives, and faster abilities to recognize investment opportunities that will ultimately out-perform your competitors.

Implementation and Execution

Here is where I believe the most value can be seen with a good Data Analytics model. Developing processes that better target customers with improved servicing models and better customer experiences leads to higher revenue growth. But the most important aspect of this process is that these actions need to be done quickly and efficiently in order to keep pace with the changing business outcomes that the market brings. And remember, by definition, everything that you are referencing as a data source, whether it is through manual primary and secondary research that is AI/ML automated, is based on historical performance. A high-magnitude disruption unforeseen by all the automated tool indicators can completely flip the narrative on strategy and direction. So organizations must have fluid capabilities, flexible product and service portfolios, highly efficient and flexible supply chains and moreover, an emphasis on digital transformational capabilities that are internally and externally customer facing – these are essential foundational platforms in today’s successful intelligence-driven organization.

Paul Santilli currently leads the HPE Worldwide (WW) Industry Intelligence & Strategy Organization for the Original Equipment Manufacturer (OEM) Solutions Business for Hewlett Packard Enterprise (HPE). He is a recognized thought leader in Data Analytics Modeling around Industry Intelligence, Insights and Strategy, and chairs Executive Customer Councils and Industry Advisory Boards globally.

Paul also serves as Chairman Emeritus of the Strategic Competitive Intelligence Professionals (SCIP) Board of Directors Executive Committee and is active in several advisory roles to industry conferences and forums. Paul presents worldwide on Intelligence, Innovation, and Strategy in keynote and executive coaching capacities, and has published numerous papers in industry and academic journals related to Intelligence Modeling, Innovation, Disruption, and Strategy. Paul is also Founder and CEO of Strategence LLC, a company that provides proprietary advisory and business insights & analytics to companies for intelligence-based business growth.

Recent Comments