With the climate change crisis looming large, governments worldwide are focusing on ways to make the transport sector – indicted for its disproportionately high contributions to carbon emissions – more accountable. The United States of America is pursuing strategies to decarbonize the transport sector and accelerate the overall push to a clean energy economy.

In support of this objective, the US has been introducing a series of progressive measures; among them is the commitment that by 2030 – EVs and hybrids will comprise half of all new vehicle sales in the country and that the government’s fleet of cars and trucks will be electrified. Simultaneously, it has drawn up an ambitious bipartisan infrastructure plan that includes a $5 billion funding pledge to help states develop EV chargers over the next five years.

Now comes the recent proposal to set up comprehensive unified standards— from real-time information on pricing to prescribed type/quantity of chargers at each station—for a planned network of 500,000 EV charging stations across the country by 2030.

This initiative will create a strong springboard for EV adoption by improving the affordability and accessibility of charging networks. Standardization and expansion of charging networks will also be critical to allaying range anxiety while boosting EV uptake.

To learn more, please access our research report North American Electric Truck Charging Infrastructure – Revenue Opportunities, or for information on a private briefing, please contact Sathyanarayana Kabirdas at [email protected].

Our Perspective on Electric Commercial Vehicle Charging Infrastructure

Greener, more sustainable transportation is one of the key pillars in the US’ transition to a clean energy economy. In May 2021, governors of 12 states wrote to President Biden demanding a regulatory framework that promoted zero-emission vehicles. Among other things, the letter urged the administration to implement standards and incentives that would support medium-duty and heavy-duty vehicle sales being zero emissions by 2045. It also recommended “substantial funding for investment in charging and fueling infrastructure”.

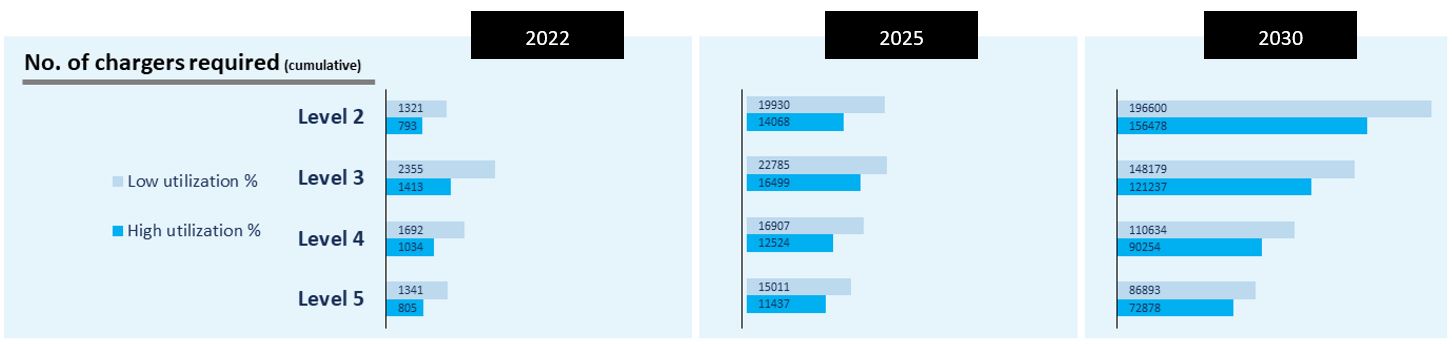

Standards, incentives, and investments are important factors to consider because, by 2030, more than half the trucks operating in North America are expected to be powered by an electric powertrain. Light-duty vehicles are forecast to be the early adopters, accounting for nearly 86% of the EV trucks market in 2030. Among the several EV truck charging types, AC and DC charging are expected to be the most widely adopted in North America. Level 2 (20kW) to Level 5 chargers (350kW) will be the predominant charging solutions in this decade, with even higher charging power developed by the end of the decade.

“To cater to this level of electricity demand, the government has had to step in at the earliest and support the setting up state-of-the-art, user-friendly charging stations at accessible locations for users. The Biden administration’s plan to build a national network of 500,000 EV charging stations by 2030 is commendable and marks an important step towards making clean energy accessible to most of the trucking community” – Saideep Sudhakar, Research Manager, Mobility Practice at Frost & Sullivan.

Frost & Sullivan’s analysis, based on the level of utilization in each charging station, forecasts the need for around 440k to 542k chargers (at varying levels of power) solely for commercial vehicles to cater to the demand for ~130TWh of energy required for the 7.2 million electric trucks that will be in operation on US roads by 2030.

Source: Frost & Sullivan

The new standards will be important since they not only expand the availability of EV charging networks across the country but also make it simpler for customers, both individual and commercial, to use EVs since it is proposed that they be EV brand and charging company agnostic. In cohesion, they will drive EV adoption and push the US closer to its zero-emissions transport vision.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.