Understanding the concept of decarbonization

Decarbonization refers to the process of reducing or eliminating the amount of carbon dioxide and other greenhouse gases released into the atmosphere because of human activities, such as the burning of fossil fuels. The goal of decarbonization is to mitigate climate change by reducing the concentration of greenhouse gases in the atmosphere.[1][2]

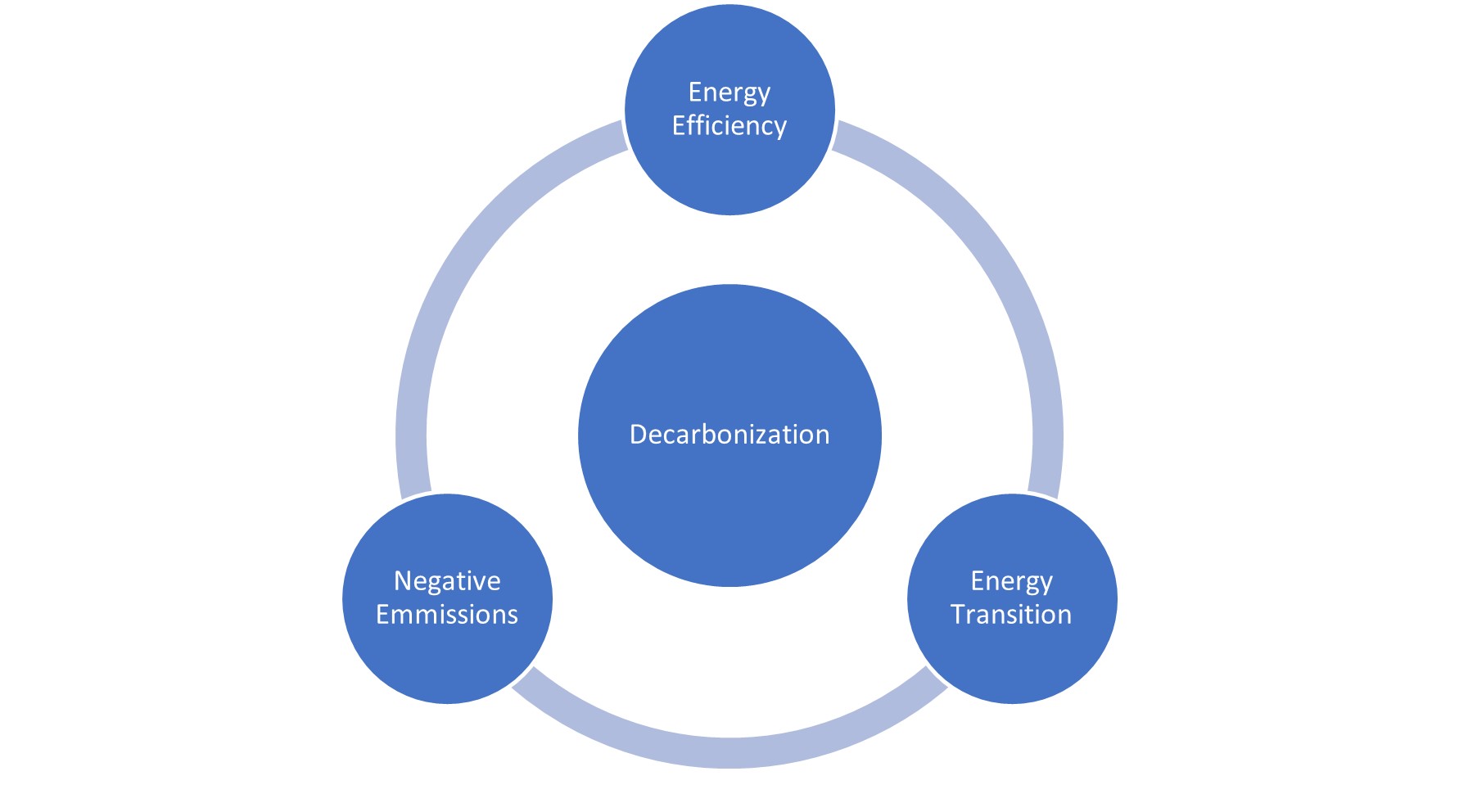

Figure 1. Broad Pathways to Decarbonization

The importance of decarbonization

Decarbonization is important as it helps mitigate climate change by reducing the concentration of greenhouse gases in the atmosphere. The Intergovernmental Panel on Climate Change (IPCC) has estimated that limiting global average temperature increases to 1.5°C requires a reduction of CO2 emissions by 45% from 2010 levels by 2030.[3]

Numerous countries and organizations have taken significant strides towards decarbonization, which has contributed to a reduction in the rate of increase in emissions to approximately 1.3% per year. This rate is about half of what it was in the previous decade.[4]

Globally, different countries and end use segments have identified, implemented or are currently in the process of implementing technologies that can help achieve respective mandates for decarbonization. Some of the more prominent decarbonization technologies and their adoption have been highlighted below:

Prominent technologies

Renewable Energy: Renewable energy sources such as solar, wind, hydro, and geothermal power are naturally replenished and have a low carbon footprint. Countries worldwide are investing in renewable energy to reduce their dependence on fossil fuels and mitigate climate change.

- India – Plans to triple its installed renewable energy capacity by 2030 i.e., from 163 GW in 2022 to 500 GW by 2030

- USA – Plans to have 100% carbon pollution-free electricity by 2030[5]

- Germany – Plans to generate at least 80% of its electricity from renewables by 2050; up from 50% in 2020.

- The United Arab Emirates (UAE) has also targeted to generate 50% of its electricity from renewable sources by 2050.

Green hydrogen: Produced by using renewable electricity to split water into hydrogen and oxygen through a process called electrolysis. It is a promising alternative to fossil fuels as it can be used in various sectors such as transportation, industry, and power generation.

- Saudi Arabia – The NEOM Green Hydrogen Project is the world’s largest utility-scale, commercially-based hydrogen facility powered entirely by renewable energy. The mega-plant will integrate up to 4GW of solar and wind energy to produce up to 1.2 million tonnes of green ammonia, which translates to up to 600 tonnes per day of carbon-free hydrogen. The total investment value for this project is $8.4 billion[6]

- UAE – The new national hydrogen strategy aims to produce 1.4 million tonnes of green hydrogen per year by 2031, 7.5 million tonnes by 2040 and 15 million tonnes by 2050. The goal is to establish the UAE as one of the world’s top green hydrogen producers[7]

- Germany – The FFI and TES green hydrogen project is a joint initiative between Fortescue Future Industries (FFI) and Tree Energy Solutions (TES) to develop the world’s largest integrated green hydrogen project in Wilhelmshaven, northern Germany. The project aims to supply 300 kt of green hydrogen from 2026, which will increase to 5.5 million tonnes per year by 2045. The project will integrate up to 4GW of solar and wind energy to produce up to 1.2 million tonnes of green ammonia, which translates to up to 600 tonnes per day of carbon-free hydrogen. The total investment value for this project is $8.4 billion[8].

Energy storage: Energy storage technologies such as batteries, pumped hydro storage, and thermal storage can help balance the supply and demand of electricity from renewable sources. Storage technologies are critical for the integration of large-scale renewable electricity in the grid, which would be critical to achieving decarbonization of the power industry.

- USA – aims to accelerate the development, commercialization, and utilization of next-generation energy storage technologies, with a goal to meet all U.S. market demands by 2030. From 2023 to 2025, the USA expects to add another 20.8 GW of battery storage capacity.[9]

- UAE –has set a target of installing 10 GW of energy storage capacity by 2030.

CCUS: CCUS (Carbon Capture, Utilization, and Storage) encompasses methods and technologies to remove CO2 from the flue gas and from the atmosphere, followed by recycling the CO2 for utilization and determining safe and permanent storage options.

- USA – IRA 45Q tax credit is incentivizing all new projects, with a baseline amount of $17.0 per tonne of CO2 stored and $17.0 per tonne of CO2 used for EOR[10]. There is also a bonus amount with 5 times more credit ($85 for storing and $60 for EOR)

- Japan – Japan has included CCUS as a part of its long-term strategy to cut emissions and is developing technology for domestic use and export.

- UAE – The Abu Dhabi National Oil Company (ADNOC) has reached a final investment decision to develop the Habshan carbon capture project in the UAE. The project aims to capture and permanently store 1.5 million metric tons of carbon dioxide per year and will have the capacity to capture and store up to 5 million metric tons of CO2 per year by 2030[11]. The project is part of ADNOC’s efforts to reduce its carbon intensity by 25% by 2030 and achieve its Net Zero by 2050 ambition

Top countries driving decarbonization investment

Globally, investments in the energy sector in 2022 have been driven towards addressing the rising costs of energy, increased cost of products such as cement, steel etc., which require high amounts of energy for production, concerns around energy security and imperatives around climate change and the Nationally Determined Contributions (NDCs).

Global clean energy spending has been ramping up and these investments have increased from an estimated USD 1.0 trillion in 2017 to USD 1.3 trillion in 2021, registering a growth of 5.0% CAGR during the same period. IEA has estimated the clean energy investments across global economies to exceed USD 1.4 trillion in 2022[12] driven strongly by investments in renewable energy, energy efficiency and other end users, grids and energy storage, nuclear, electric vehicles, low carbon fuels and CCUS.

The highest clean energy investments in 2022 have been led by China, the European Union and the USA and these are not expected to change drastically for 2023 as well.[13] Analysis of countries across these regions and also globally has revealed trends and top areas of investment, which have been summarized below:

- focus on maintaining and improving energy efficiency

- circular economy and resource efficiency

- emissions reduction for coal-based power generation

- energy transition through renewable energy projects

- integration of renewable energy in district heating applications

- electrification of transport and building sector energy requirements

- improved public transportation and optimized logistics

- production and utilization of green sustainable hydrogen and hydrogen derivatives

- centralized and distributed energy storage solutions with a specific focus on electrochemical storage

- energy efficiency improvements across transport, industry, buildings and agriculture

- digitalization/ digital solutions to optimize performance of key equipment and processes that would reduce overall demand for energy and associated emissions

In addition to decarbonization trends and technologies being adopted by different regions globally, there is also a growing focus by energy-intensive end users on reducing carbon emissions and aligning with mandates that have been defined by respective countries.

An analysis of key energy end use segments provides an indication of technologies and solutions that are being adopted to decarbonize the respective sectors. Insights and analysis of these can be leveraged by UAE and other countries in the GCC and wider Middle East region to define their own decarbonization strategies and action plans.

| Sr. No | End User | Decarbonization modalities |

| 1. | Oil & Gas | · Sensor and AI enabled monitoring and product management for methane emissions

· Carbon capture, utilization & storage (CCUS) · Biofuels · Hydrogen |

| 2. | Power | · Solar (PV and thermal) and wind (onshore and offshore) based renewable power

· Hydrogen based power generation · Carbon capture and storage · Energy efficiency and energy management · Digital solutions – spread across generation, transmission and distribution to optimize equipment performance and reduce energy/ electricity losses |

| 3. | Petrochemicals | · Sustainable and energy-efficient equipment (e.g. cracker units)

· Sustainable fuel sources like hydrogen · Electrification of key processes (e.g. steam cracking) · Utilization of alternative feedstock (e.g. bio-naphtha) |

| 4 | Water & Wastewater | · Digitalization – optimize processes and operations to reduce energy consumption

· Optimizing aeration energy requirements · Remote and real time monitoring · Intelligent pump stations · Renewable power from waste · Renewable energy-based desalination |

| 5 | Cement | · Use of automation, robotics, AI, predictive maintenance, and digital twins to make cement production less carbon intensive

· Additives for reducing clinker factor while improving cement output · Use of sustainable fuel alternatives |

| 6 | Iron & Steel | · Green steel – through the use of renewable electricity and hydrogen-based DRI

· Steel recycling and scrap steel utilization in steel manufacturing processes · Electrification of critical processes (e.g. reheating furnaces) · Carbon capture, utilization & storage (CCUS) |

| 7 | Aluminum | · Technology upgrades

· Green aluminum – through the use of renewable electricity in aluminum processing and production · Electrification of key processes |

| 8 | Automotive & Transportation | · Focus on battery-operated (BEV), fuel cell electric vehicles (FCEV) and hybrids

· Alternative fuels for heavy and long haul transportation, including cargo ships and airlines · Sustainable sourcing to reduce emissions impact on the value chain · Improved air traffic management systems to improve operational efficiency |

While decarbonization is critical to ensure environmental sustainability, several solutions currently being considered for achieving emissions reductions are capital intensive. With growing demand and improved adoption, technology costs are expected to reduce further improving the viability of decarbonization initiatives.

However, decarbonization and emissions reduction is a continuous process. It is important for the UAE and wider GCC region to consider opportunities based on technology availability and maturity. Energy efficiency improvements and process optimization are low-hanging opportunities that can be immediately addressed to achieve substantial emissions reduction. In the medium to long term, green hydrogen, energy storage and CCUS are expected to be more viable, which can be leveraged by the UAE and other regional economies to not only achieve their individual mandates but also play a key role in enabling global economies in achieving their targets through trading and other partnerships.

References:

[1] Cambridge Dictionary

[2] Columbia Climate School

[3] UNFCCC

[4] World Economic Forum

[5] FACT SHEET: President Biden Signs Executive Order Catalyzing America’s Clean Energy Economy Through Federal Sustainability | The White House

[6] https://www.neom.com/en-us/newsroom/neom-green-hydrogen-investment#:~:text=NEOM%20Green%20Hydrogen%20Company%20completes,carbon%2Dfree%20green%20hydrogen%20plant

[7] https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/environment-and-energy/national-hydrogen-strategy

[9] U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

[10] Enhanced Oil Recovery

[11] UAE’s ADNOC to proceed with developing Habshan carbon capture project | Al Arabiya English

[12] International Energy Association (IEA) – https://www.iea.org/reports/world-energy-investment-2022/overview-and-key-findings

[13] International Energy Association (IEA) – https://www.iea.org/reports/world-energy-investment-2022/overview-and-key-findings