The automotive industry has undergone a significant transformation over the past decade. The initial wave of innovation was driven by isolated concepts such as connected cars and self-driving vehicles. This led OEMs (Original Equipment Manufacturers) to partner with third-party vendors to integrate multiple software and hardware stacks to enhance their customer experience (CX).

Despite the initial success, OEMs eventually realized the limitations of this approach. Managing and integrating multiple software stacks and hardware components from different vendors resulted in compatibility issues, increased complexity, and higher costs. This fragmented method also hindered the ability to deliver seamless and consistent updates across all vehicle systems. Additionally, key challenges such as supply chain shortages and scalability issues further complicated this approach, ultimately impacting their branding efforts where big tech companies began to dominate the CX space.

Upon recognizing these challenges, OEMs have prioritized owning and developing their own software stacks, contributing to the rise of Software Defined Vehicles (SDVs). Relatively newer entrants like Tesla recognized the importance of an in-house strategy early on. By embracing this approach, Tesla has come to be viewed as a big tech company, akin to Apple. This strategy has driven Tesla’s mass adoption through superior customer experience (CX).

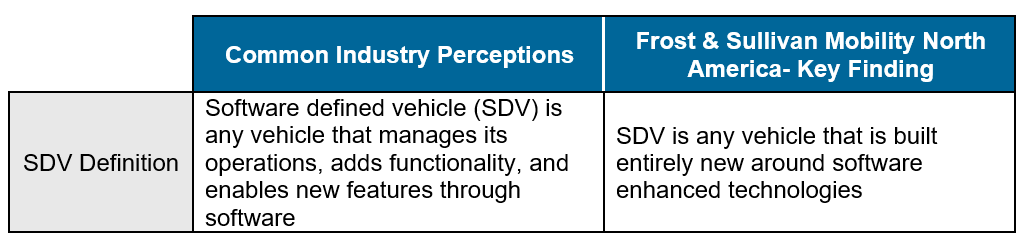

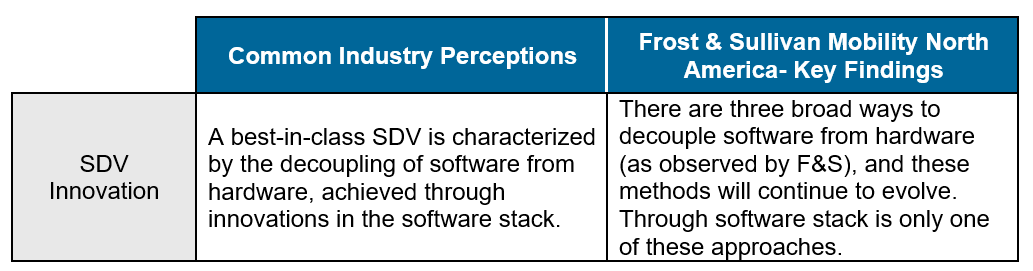

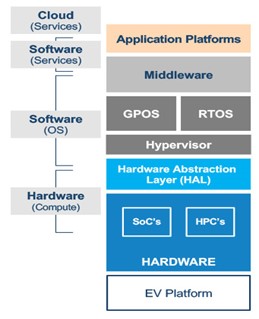

Unlike traditional vehicles that rely on numerous hardware components and software stacks, software-defined vehicles (SDVs) centralize control through advanced computing hardware and a unified software platform. This centralization enables greater agility, scalability, and the seamless introduction of new features and updates. Achieving this requires innovation and investment to decouple software from hardware throughout the vehicle’s lifecycle, along with a realignment towards a software-centric approach at the OEM level.

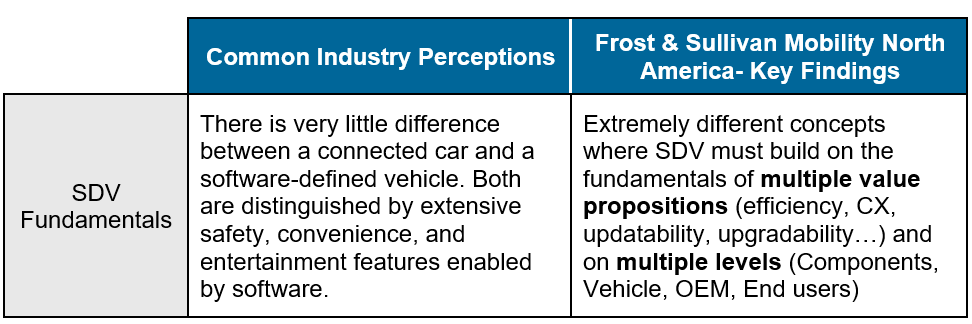

Definition of SDV

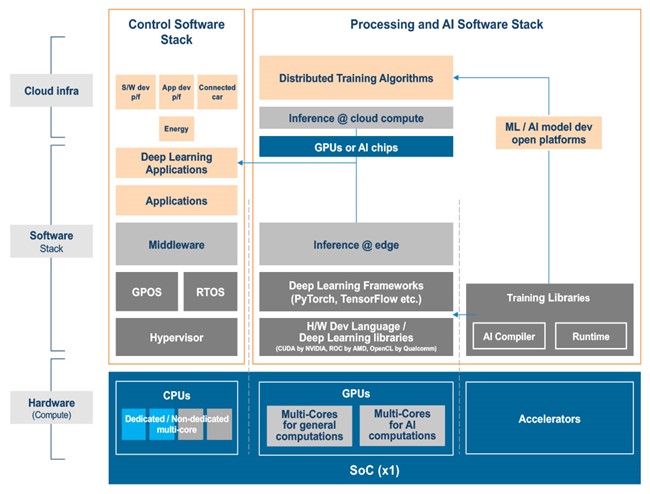

(Figure 1: Basic outline of ‘Control software stack’)

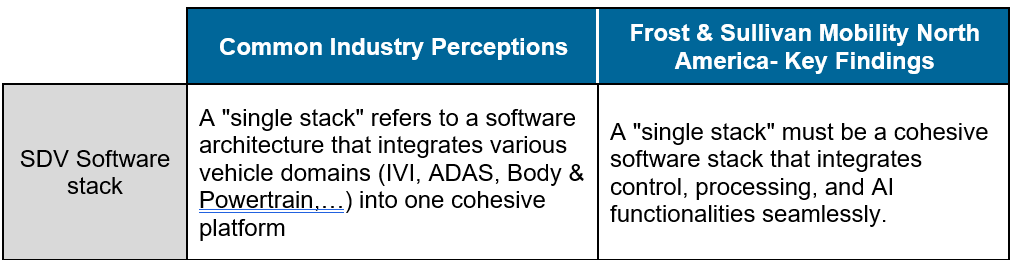

To elaborate, Figure 1 presents a basic outline of control software decoupling from hardware, an area where OEMs are investing heavily to bring in-house. However, many overlook the importance of a unified software stack. In a domain-based SDV architecture, all functions are integrated by domain-based software stacks for each domain controller. Alternatively, a zonal-based SDV architecture unifies these domains into a single software stack, forming a cohesive and efficient system. Further on in the article, we will discuss how this itself is only part of the problem that OEMs need to address.

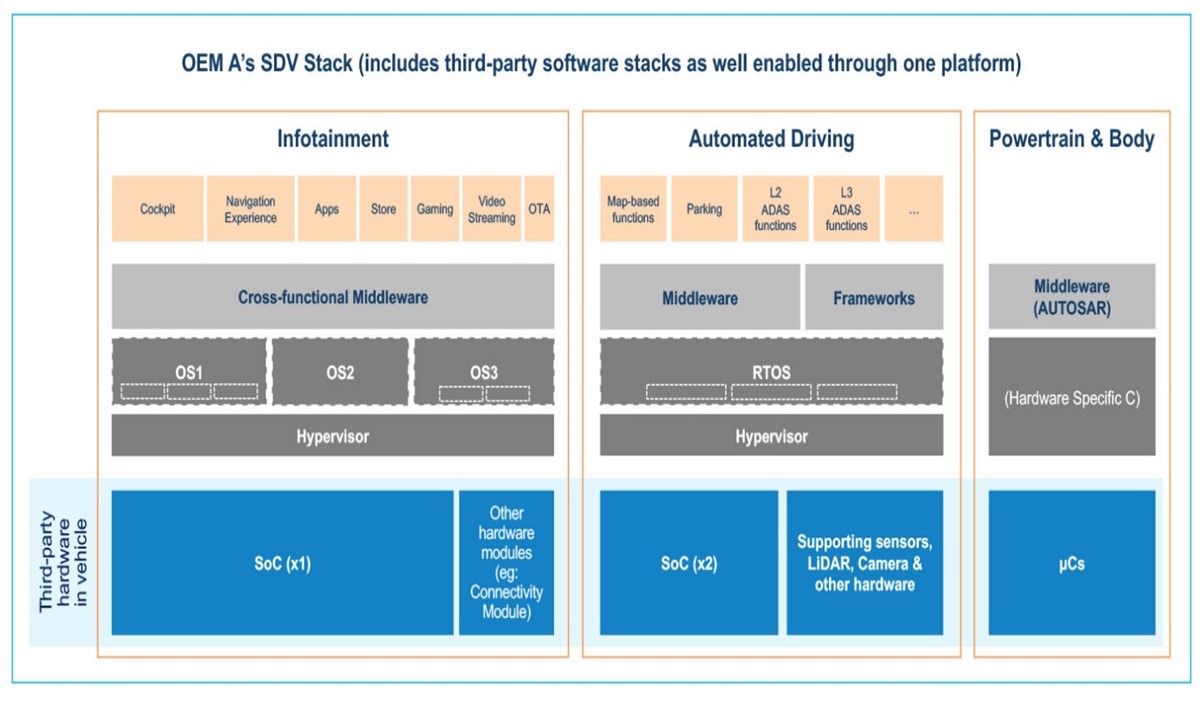

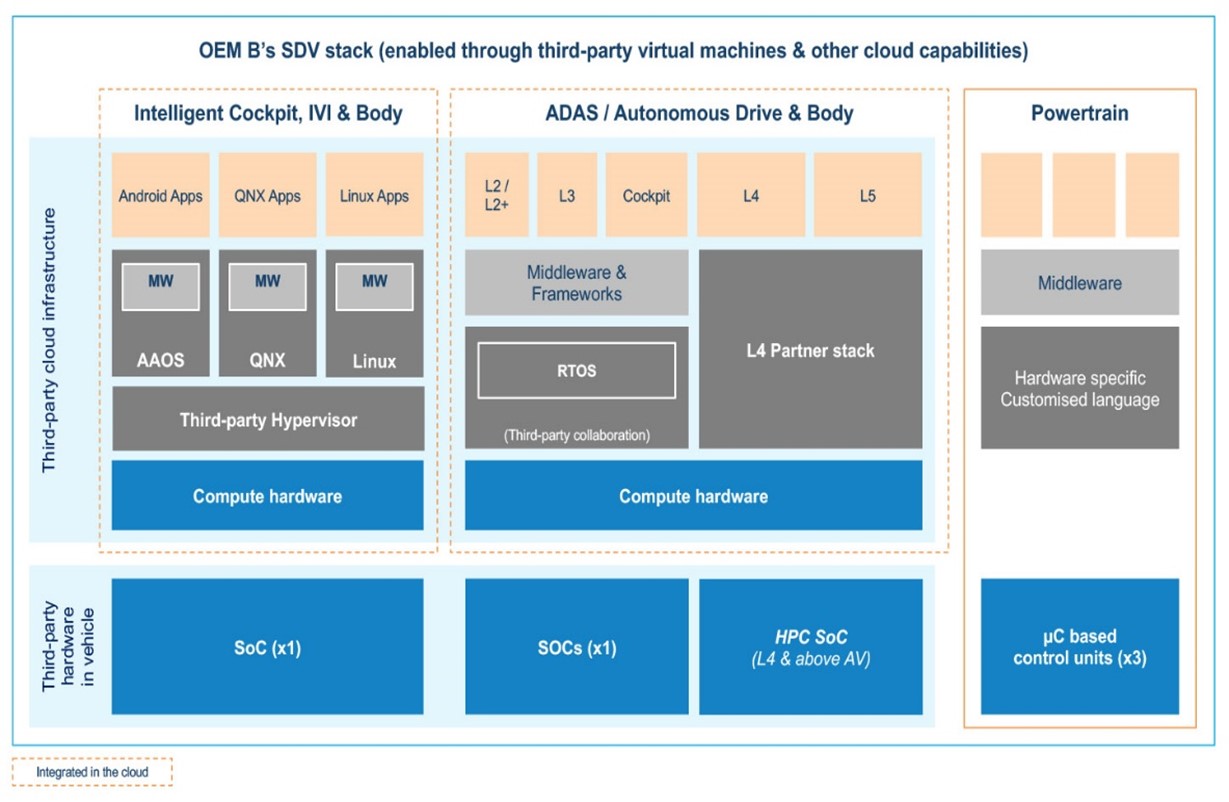

Figure 2 and figure 3 depicts of how OEMs are planning their path towards SDVs

Figure 2: General overview of domain controller- based SDV architecture planned by a few OEMs

Figure 3: General overview of cloud- based SDV architecture planned by an OEM

Catching up from the industry perspective on SDV fundamentals, many OEMs are announcing their software development roadmaps. When an OEM states they are developing software in-house and calling it an “OS,” it often does not mean they are creating a core operating system from scratch. Instead, some OEMs focus on the application layer, ensuring software containers are formed based on specific functions without delving into the core software layers. Others, like Toyota with its Arene OS, create a platform of tools that primarily improves coordination over multiple third-party software stacks. Only a few companies, such as Xiaomi’s HyperOS and NIO’s SkyOS, actually develop a core OS that unifies the control stack, providing a fully integrated, high-performance software environment tailored to the vehicle and its ecosystem.

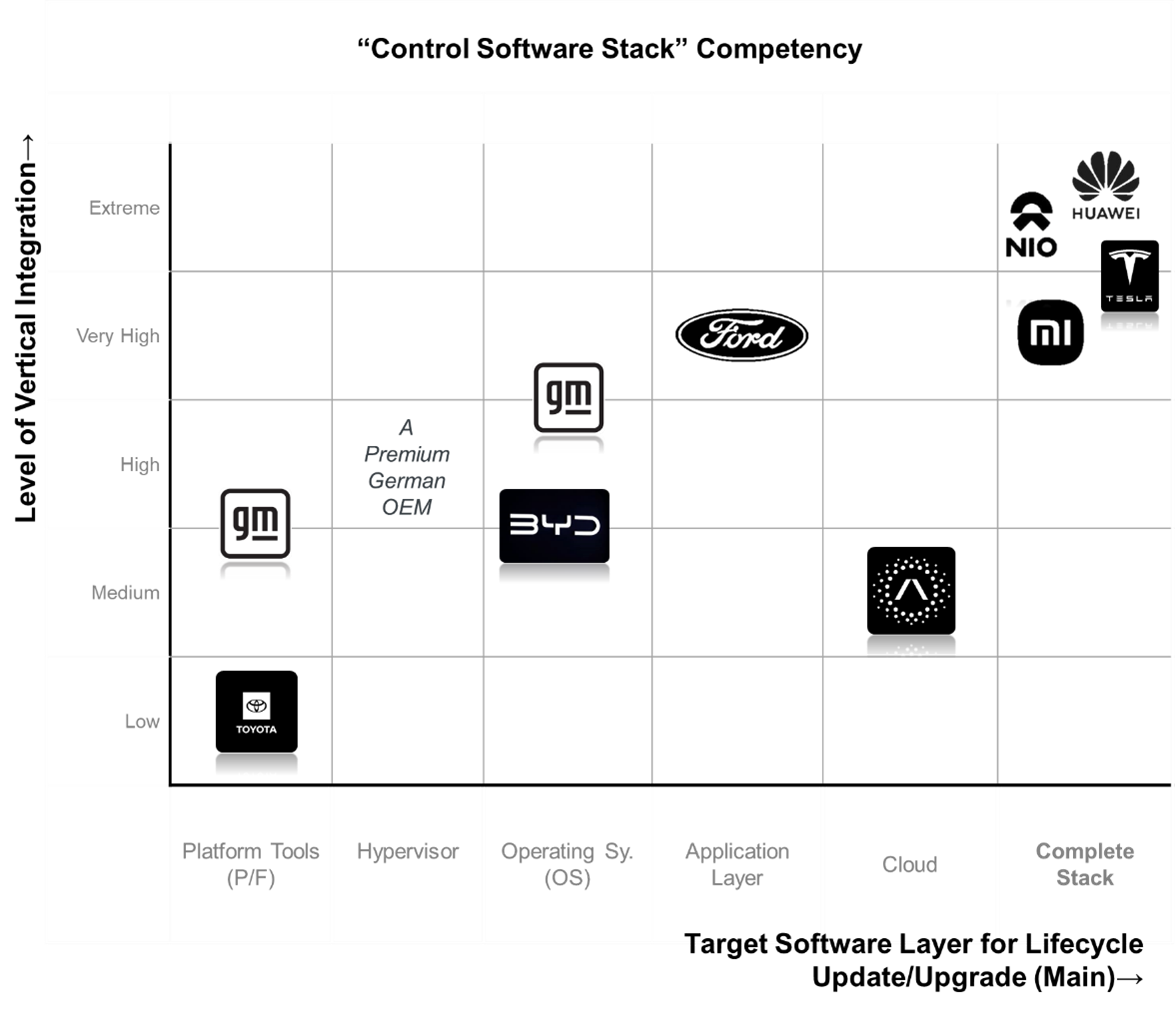

Figure 4: Frost & Sullivan Mobility Benchmarking of selected OEMs on their key focus layers of ‘control software stack’

As shown in Figure 4, a recent analysis by Frost & Sullivan on selected OEMs’ SDV architecture (current and planned roadmap) reveals that apart from Tesla and a few Chinese tech companies, others opt to focus on some specific layers of the stack while relying third-party collaborations for other layers.

But as the industry embraces SDVs, a new question arises: Are we truly in the era of the SDV, or are we on the brink of an AI-defined vehicle era?

AI-defined Vehicle is the true-core of SDV: Ignoring this fact is not bliss.

Originally used for real-time graphics, GPUs have recently taken on a central role in vehicles’ infotainment/intelligent cockpit and ADAS/AV domains due to their parallel computing capabilities. GPUs, along with added accelerated processing units, can handle big data analytics, massive deep learning, and AI capabilities.

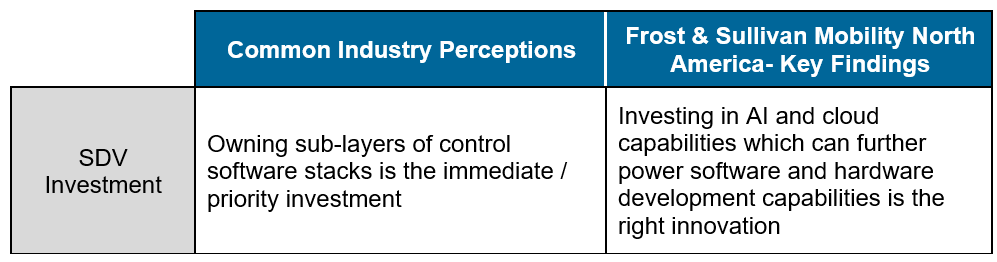

Figure 5: General overview of actual software stacks in SoCs for Infotainment/Cockpit & ADAS/AV domains)

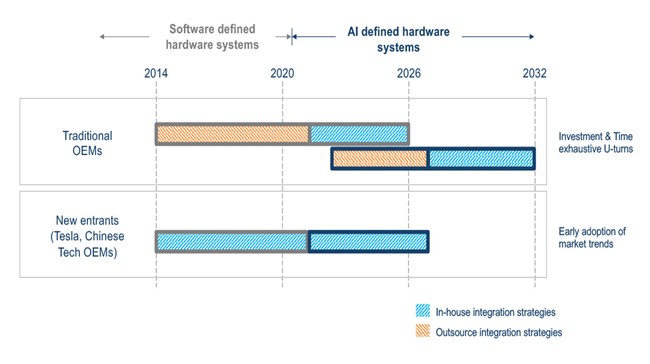

As shown in figure 6, investing heavily now to achieve a unified software stack that feeds into the CPU of a vehicle system’s SoC (F&S term: control software stack; refer fig.5) while outsourcing computing and AI capabilities (F&S term: Processing software stack and AI stack; refer fig 5) is repeating the same mistake OEMs made with their CASE (connected-autonomous-shared-EV) strategy 10 years ago. This is evident from big tech companies redirecting their investments and restructuring their organizations to lead the AI space.

Figure 6: CASE and AI-defined Vehicle Strategies over timeline: traditional OEMs vs new entrants

F&S believes that there is true method to the madness in Tesla’s (Elon Musk’s) sudden shift to prioritize itself as an ‘AI company’.

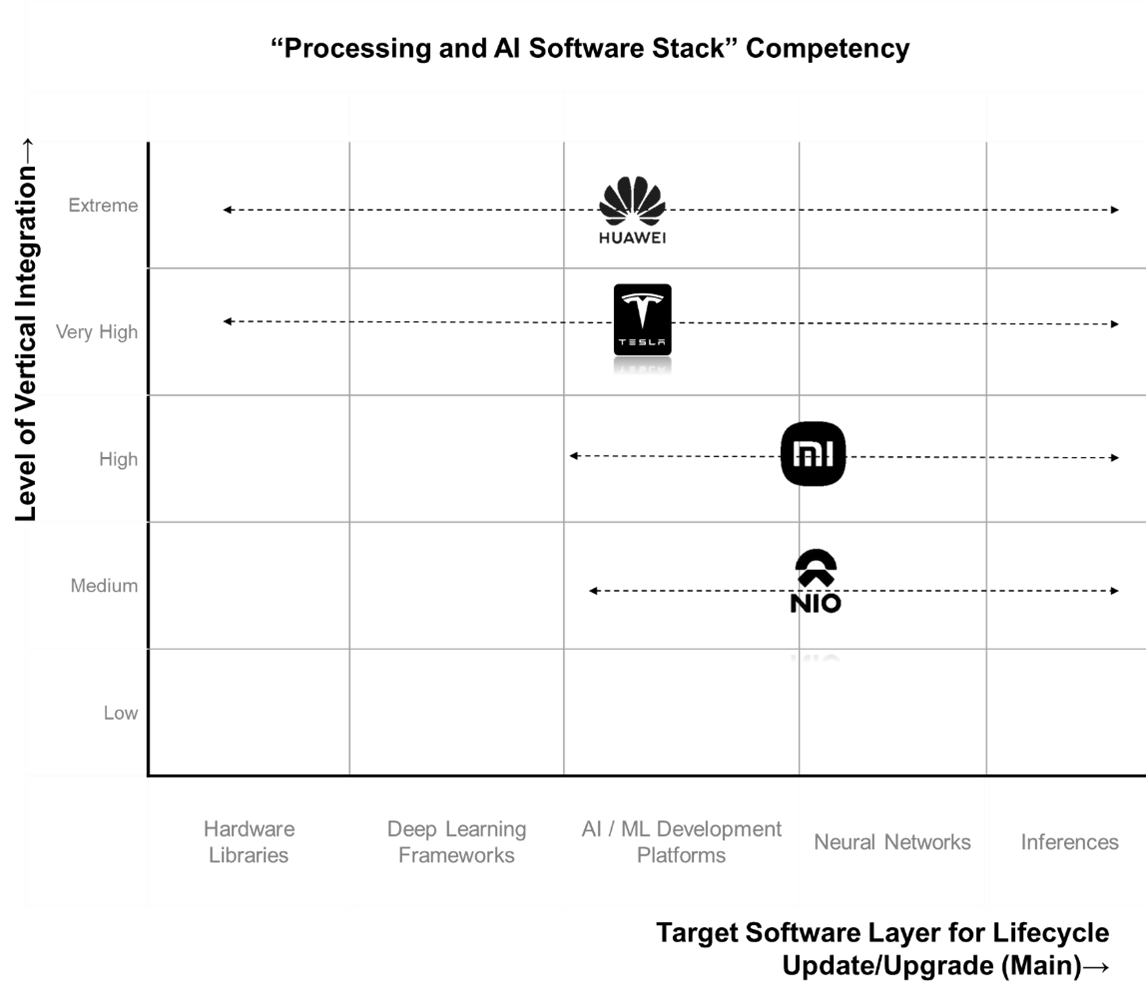

As shown in Figure 7, Frost & Sullivan’s detailed analysis of each OEMs’ SDV architecture (current and planned roadmap) (contact authors for more information) reveals that apart from Tesla and a few Chinese tech companies, most of the other are trying to bring the control stack in-house, while completely relying on suppliers for their hardware and processing/AI software stacks. It is these suppliers that in turn gain the lead in the SDV space (or let’s say – the AI-defined vehicle space).

Figure 7: Frost & Sullivan Mobility Benchmarking of selected OEMs on their key focus layers of ‘Processing and AI software stack’

CASE STUDY: Tesla & Huawei

Tesla developed its own chips and hardware, moved to a vision based ADAS/AV domain in 2020, and building its own neural networks. These networks have a multi-task neural network architecture that shares a common backbone or base network but diverges into several branches, each handling different tasks, enabling full deep learning.

Currently, for other OEMs using third-party solutions like the NVIDIA Drive platform, the software stacks for L2 or L3 ADAS functions differ significantly. Some are programmed by engineers, some are generated from in-house machine learning models, and others leverage third-party neural networks. This often results in modular or fragmented software stacks. In contrast, Tesla’s Full Self-Driving (FSD) system is now the outcome of full deep learning, creating neural network codes for all functions.

So, if we examine Tesla’s ADAS/AV domain, the entire control and processing stack forms a unified or single AI stack running on customized computing hardware, ensuring maximum performance and energy efficiency.

Chinese tech companies like Huawei take a similar approach and may even be one step ahead of Tesla with their AI and cloud infrastructure capabilities. By controlling both hardware and software development, Huawei optimizes performance, and ensures tighter integration. This results in faster innovation cycles and a more responsive vehicle development environment. We will share a detailed analysis of how Tesla and Huawei are going to set new standards for AI-defined vehicles, in the coming articles.

At this point, it is crucial to comprehend what truly constitutes a unified software stack and how it can reduce redundancy, optimize resource utilization, and simplify the overall architecture, leading to more reliable and maintainable systems.

Frost & Sullivan strongly believes that OEMs should not just invest in the industry-perceived SDV but should focus on developing in-house capable AI-defined vehicles. This approach will prevent the need for a U-turn in the next 5-10 years towards becoming AI companies.

Stay tuned for our next article, where we will delve into the innovations beyond software, focusing on hardware and infrastructure advancements that enable software decoupling from hardware and drive SDV innovation.