Companies that proactively embrace electrification by leveraging technological innovation, forming strategic alliances, and adopting sustainable business models will be well-positioned for long-term success.

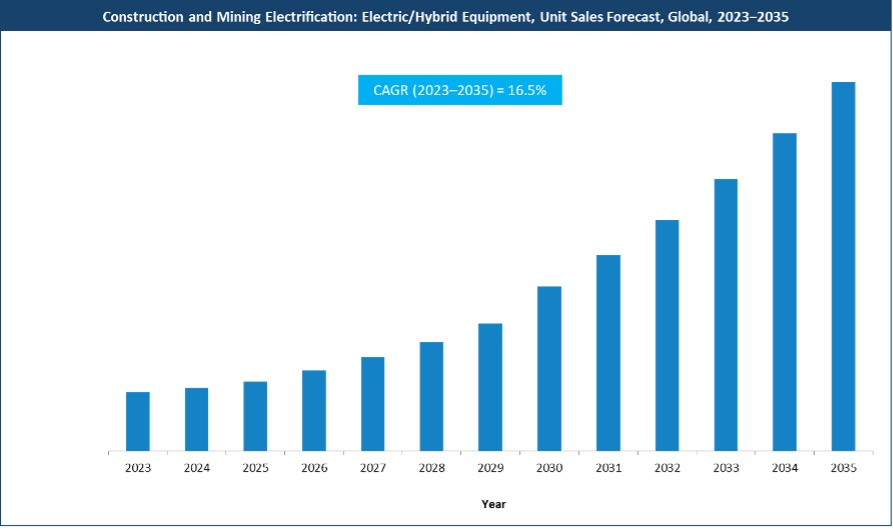

The electrification of construction and mining equipment is rapidly reshaping the global heavy machinery landscape. As industries seek to reduce carbon footprints and enhance operational efficiency, electrified equipment is emerging as a cornerstone of sustainable development. In 2023, the original equipment manufacturer (OEM) market for construction and mining machinery reached $241.2 billion, with electric and hybrid equipment sales totaling 59,909 units. With a projected compound annual growth rate (CAGR) of 16.5%, sales are expected to surge to 376,142 units by 2035. This transition will be propelled by government incentives, declining battery costs, and emissions mandates in construction and mining operations.

To learn more, please access: Construction and Mining Equipment Electrification Industry, Global, 2024-2035, Electric Components Market in Off-highway Vehicles, Global, 2024-2035, Global Forklift Growth Opportunities, Forecast to 2030, or contact [email protected] for information on a private briefing.

Electrification and Automation take Centerstage

The industry is witnessing an unprecedented shift toward sustainability and efficiency, with electrification and automation taking centerstage. Innovations in battery storage, energy management, charging infrastructure, and powertrain design are improving operational performance, while accelerating the adoption of electric machinery across diverse worksite environments. Such trends are being reinforced by government-led incentives, subsidies, and regulatory frameworks that are encouraging the transition to electrified fleets.

Additionally, the rise of digitalization and smart features is transforming fleet management and predictive maintenance. Advanced telematics, AI-driven monitoring systems, and autonomous functionalities are changing the way in which construction and mining equipment is being used. These advanced technologies are, moreover, enhancing safety and reducing downtime. Concurrently, business models are evolving to accommodate new financing strategies, including equipment-as-a-service (EaaS) and pay-as-you-go models. Such trends indicate a broader transformation that is occurring in the market, compelling manufacturers to invest in R&D, collaborate with technology providers, and develop integrated solutions that align with the evolving market needs.

Escalating Competition and a Raft of Strategic Initiatives

Competition among leading equipment manufacturers—Caterpillar, Komatsu, Volvo Construction Equipment (CE), John Deere, XCMG, and Liebherr, among others—is escalating as a result of electrification trends.

Caterpillar is spearheading electrification through its Pathway to Sustainability program, focusing on integrating alternative power solutions and reducing carbon emissions. The company has forged strategic partnerships with major players such as CRH and Vale to accelerate the adoption of electrified mining equipment. Flagship products like the Cat R2900 XE Loader highlight advancements in fuel efficiency and productivity, underlining the company’s emphasis on next-generation powertrains.

Komatsu is driving innovation with fully electric excavators, wheel loaders, and haul trucks, while exploring hydrogen fuel cell concepts. The company is committed to multiple powertrain solutions, including tethered electric, battery-electric, hydrogen-powered, and fuel cell systems. These initiatives align with its broader sustainability objectives, which include reducing carbon emissions and integrating renewable energy into its operations.

John Deere is embracing a long-term approach to electrification, aiming to introduce fully autonomous electric vehicles (EVs) by 2030. While primarily targeting the agricultural sector, this initiative extends to construction machinery, incorporating sustainability principles through its Leap Ambitions framework. The strategy prioritizes reducing greenhouse gas emissions, expanding remanufacturing capabilities, and incorporating sustainable materials to support circular economy models.

XCMG is advancing toward carbon neutrality by 2049, investing in electric and hydrogen-powered machinery. A dedicated electric wheel loader production line capable of manufacturing a unit every 25 minutes, the company highlights its large-scale production capabilities. Innovations in waste heat recovery and renewable energy applications are bolstering XCMG’s competitive positioning in sustainable heavy equipment manufacturing.

Volvo CE continues to push forward on its sustainability and electrification agenda. The company’s emphasis on energy-efficient designs, extensive EV portfolio, and modular production strategies ensure scalability in electrification. Volvo CE’s strong presence in the European market further reinforces its role in advancing sustainable construction solutions.

Our Perspective

Frost & Sullivan anticipates regional variations in electrification adoption across the construction and mining sectors between 2023 and 2035. North America, Europe, and Asia-Pacific are poised for significant growth, driven by regulatory mandates, infrastructure investments, and intensifying market competition. However, widespread adoption will depend on advances in powertrain technology, cost efficiencies, and expansion of charging infrastructure.

Key opportunities are emerging for industry players. Battery technology, hybrid powertrains, and hydrogen fuel cells are expected to drive substantial advancements, with projected growth rates of 24.7%, 9.2%, and 32.6%, respectively. OEMs will need to forge strategic partnerships with battery suppliers, digital technology providers, and mining and construction operators to develop integrated solutions that can compete with internal combustion engine (ICE) models in terms of efficiency and reliability.

Meanwhile, the shift from traditional equipment ownership to service-based models is gaining traction. EaaS and flexible financing options will lower entry barriers and accelerate adoption by reducing upfront capital expenditures. Additionally, aftermarket services, battery lifecycle management, and adherence to environmental, social, and governance (ESG) standards will support long-term profitability and regulatory compliance.

The integration of artificial intelligence (AI), machine learning, and autonomous control systems will boost productivity, safety, and cost-effectiveness. Smart solutions such as 360-degree camera systems, 5G-enabled remote diagnostics, and predictive maintenance will optimize fleet management and streamline operations. Collaboration between OEMs and technology firms will help fast-track the development and deployment of these advanced technologies.

In parallel, mass adoption will receive a fillip from investments in charging infrastructure, battery-swapping facilities, and energy-efficient power grids. Collaboration among key stakeholders will be critical to building a cohesive electrification ecosystem that ensures accessibility and reliability for varied worksite environments.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility