After two years of empty offices and no travel, many businesses are eager to have their employees return to their desks. However, that desire is tempered by the harsh reality of the job market underscoring the need to allow flexible schedules and a choice of in-office and remote work options. With many variations of hybrid work still evolving, one thing is clear – employees want better experiences no matter where they work. Keeping employees happy and engaged is top of mind for business leaders.

Remote work throughout the pandemic years has made employees comfortable with modern video and team collaboration tools. The move to hybrid work is based on the great revelation that employees can be equally, if not more productive, working from home. Many employees are simply unwilling to go back to the office.

So what can businesses do to draw employees back to the office where they can benefit from the in-person energy, creativity, and serendipitous conversations? Among the many ways in which forward-thinking businesses are enticing people back is the push to create more modern, vibrant, and engaging office spaces. Add other benefits and perks to that and more and more employees will want to show up in the office at least some days of the week. Investing in a technology-driven hybrid work environment is a must.

As businesses up the ante, meeting spaces are getting a makeover as well, turning from plain technology-devoid rooms to new vibrant, collaboration spaces equipped for fast and easy video collaboration and ideation. The old meeting room concept is indeed dead. There is a long ways to go, however. Our research shows that at present, less than 10% of the meeting rooms worldwide are enabled for video conferencing. This number will grow nearly three times by 2025. Adding modern audio-video and content collaboration technologies into meeting rooms is a multi-billion dollar opportunity that’s encouraging enterprise communications vendors to expand their product portfolios. Recent news of HP’s intent to acquire Poly and Crestron’s planned acquisition of 1 Beyond is just the beginning of many market developments we expect to see in 2022.

HP and Poly

Last week HP Inc. announced a definitive agreement to acquire Poly in an all-cash transaction for $40 per share, at a total enterprise value of $3.3 billion, inclusive of Poly’s net debt. Although it’s been a few years since the split of HP Inc. (HPI) and Hewlett Packard Enterprise (HPE), there continues to be confusion around the difference between the two. HPE focuses on servers, storage, and networking software and services. HP Inc., the company acquiring Poly, sells personal computing devices and peripherals including printers.

On the surface, the synergies between Poly and HP are not immediately clear. However, a deeper look reveals that the combined entity will have a comprehensive line of collaboration solutions which will position it well to address the growth opportunities that span both personal communication devices and meeting room solutions.

- Technology synergies – In late 2021, HP launched a comprehensive line of meeting devices designed to position the company front and center in the fast-growing video conferencing space. Branded as HP Presence, the portfolio includes meeting space bundles, PCs, 4K cameras, audio-video bars, all-in-one systems, and microphones, as well as room controllers that are designed to work with leading cloud services including Microsoft Teams Rooms and Zoom Rooms. While there is some overlap, Poly’s comprehensive line of audio-video devices complements the HP Presence line to fill the gaps. Specifically, Poly’s market-leading headsets and audio-video devices will position HP as an end-to-end personal and meeting room communication provider. Moreover, HP’s approach to security will bolster Poly’s products. HP’s Wolf Security provides hardware-enforced and application-level protection and is built into all HP devices including notebooks, desktops, and collaboration devices.

- Product portfolio expansion – In video conferencing, Poly (previously Polycom) has long been known for its meeting room endpoints. However, in recent years it has lost significant market share to its rival Logitech which offers an extensive line of easy-to-use, affordable personal webcams and conference room cameras. The connection between PC in the meeting room and cameras running over a cloud platform software is well established. Designed for the meeting room, Logitech’s USB conference cams have seen rapid growth leading to a large installed base of Windows-PC based rooms, an area where Poly has missed significant growth opportunities. HP’s line of PCs, all-in-one desktops, and cameras, will bolster Poly’s products to create a comprehensive lineup of personal and meeting room solution.

- Channel expansion – The acquisition extends HP’s reach into Poly’s AV channel, which is foundational to selling meeting room solutions. Similarly, it allows Poly to tap into HP’s extensive global network channel partner program, particularly for online/digital sales. The combined company is expected to have the channel prowess that will surpass many of its competitors in audio-video devices.

- Tackling supply chain pressures – While the demand for Poly’s products remained strong in 2021, sales took a hit as a result of supply chain pressures. In Q3 2021 Poly reported that its sales backlog increased by $60 million sequentially. During Q4 2021, it grew an additional $59 million with increases across each of its main product categories. HP’s global presence and reach will help mitigate these supply chain challenges.

- Joint engineering – In recent months, Poly has faced a growing void in its technology leadership team. The departure of key executives in product management and engineering has slowed down its pace of innovation. This is another area where Poly can benefit from HP’s bigger pockets and engineering resources. Since taking over the CEO role in August 2020, Poly CEO Dave Shull has taken an approach of incremental innovation and has largely pursued a strategy that is focused on driving higher sales with incremental investments in Poly’s most successful products. HP’s recent foray into meeting devices and the engineering sophistication of the HP Presence line shows that it has invested significant resources in capturing the meeting room opportunity. The two teams combined will put Poly back on the path of rapid innovation.

While the marriage of Poly and HP is not of two like-minded companies, the acquisition is a smart move on part of HP to capture opportunities in a market that is set to grow exponentially. As video devices become more and more commoditized and a must-have for the post-pandemic enterprise, HP’s move is indicative that PC makers are not going to be satisfied with sitting on the periphery. They are ready to jump in to fully capture the opportunities in hybrid work.

Crestron and 1 Beyond

Crestron’s upcoming acquisition of 1 Beyond brings the fast-emerging technology of adaptive, intelligent video into the Crestron ecosystem. Creating equitable meeting experiences for hybrid collaboration is an area that’s getting a lot of attention and is clearly going to drive a lot of new investments into meeting rooms. The notion that remote participants in a hybrid meeting must have a leveled playing field for inclusive audio video is firmly established now. Enabling the best video experience for both in-room and remote attendees is critical going forward.

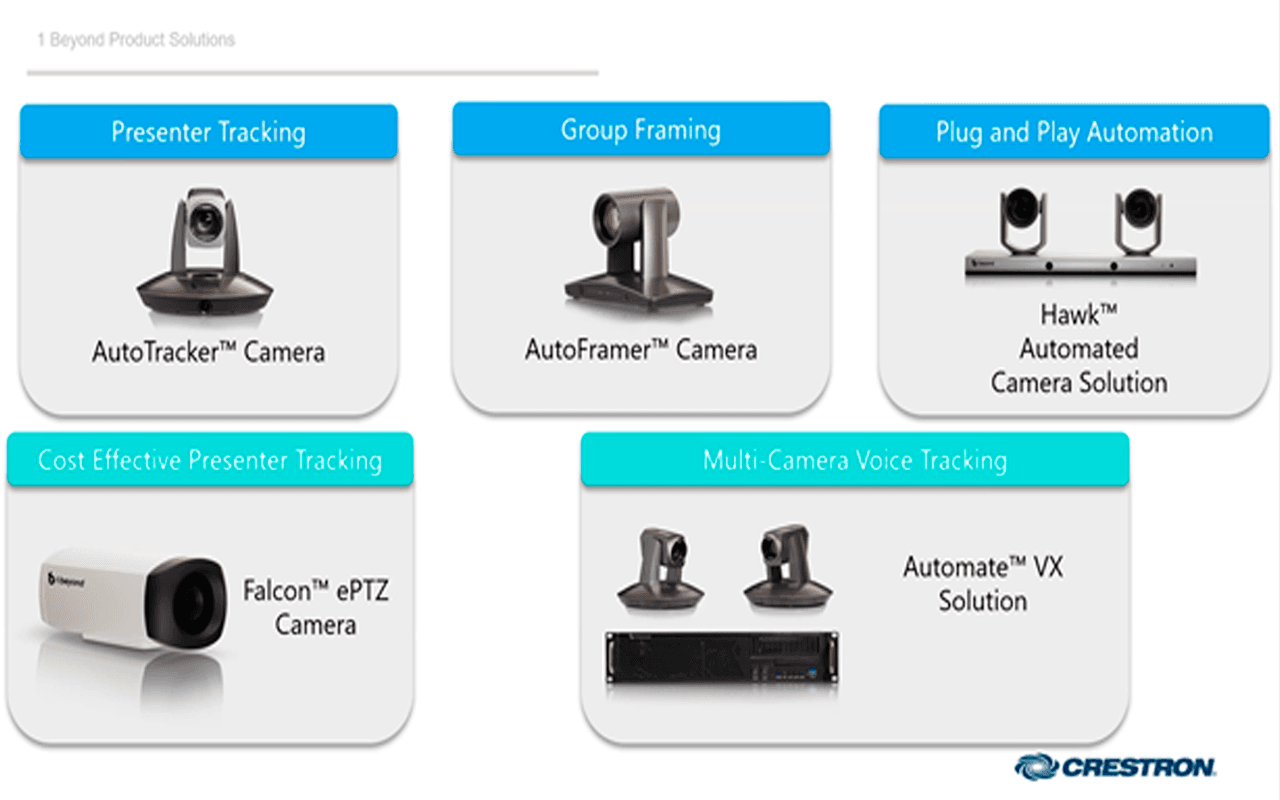

Since the introduction of its Flex video conferencing systems, Crestron has been a leading provider of high-end audio-video technologies. Like Crestron, 1 Beyond technology was built by an engineering-led team of innovators. 1 Beyond products offer:

- Presenter tracking that follows the presenter through the room to ensure that they can be seen and heard no matter where they are in the room.

- Auto framing ensures that the people are the focal point of the room by automatically adjusting the camera to frame the people in the room.

- The multi-camera experience provides automatic switching between cameras based on feedback from the microphone.

1 Beyond Products: Adaptive, Intelligent Video Camera Solutions

Source: Crestron

This acquisition is strategic to Crestron for a host of reasons.

- Portfolio expansion – Crestron does not make its own cameras and leverages its partnerships with Huddly and the recently added Jabra. With 1 Beyond, Crestron will add a new line of intelligent cameras that complement its current portfolio. The acquisition is additive and positions Crestron as an end-to-end provider. It remains to be seen how the addition of Jabra and now 1 Beyond impacts Huddly’s business which relies overwhelmingly on Crestron as an OEM partner.

- A seasoned engineering team – Headquartered in Boston, 1 Beyond has been in business for over 20 years. 1 Beyond co-founders, current CEO Terry Cullen and CTO Rony Sebok, developed an engineering-driven company primarily known for its automated camera tracking technologies. Co-founder Rony Sebok began her career as a software developer at Apple and has been plugged into the world of innovative technologies for some time. 1 Beyond has a small but growing customer base mostly in Government and Education, with some overlap with Crestron.

- Intelligent and inclusive video – With its extensive line of automated camera tracking solutions, 1 Beyond is unique. Meeting equity in the future will be a hotbed of innovation. Remote participants in a hybrid meeting want better inclusive audio-video and can no longer feel left out. This acquisition positions Crestron to take a lead in the market by using 1 Beyond’s automatic multi-camera solution and its intelligent optical zoom cameras. By tying together multiple cameras in a room (up to 12 can be supported currently) and by using automated video switching, which relies not only on the mics built into the cameras but also on external microphones like Shure, 1 Beyond delivers better coverage of the room and its presenters. The Auto Tracker picks up audio first and then leverages machine learning to pinpoint objects based on movement using a 15-degree view. Between optical and digital zoom camera technology, this is the best of both worlds allowing not only flexibility from a camera tracking perspective but also enabling better quality. So from a technology point of view, 1 Beyond is truly differentiated i.e. no one in the market is doing it the way they are doing it.

- Integration and services – 1 Beyond technology is particularly relevant in larger rooms such as lecture halls, high-value meeting spaces, multi-use spaces, and divisible rooms. Crestron’s extensive network of channel partners including AV partners and ISPs are excited about the opportunity to build customized rooms and will see value in this right away.

- Broader positioning – Interestingly, this is Crestron’s first company acquisition (they have made technology acquisitions before). Crestron has been perceived predominantly as an AV-centric company and has been targeting to be recognized as a broader UC provider. If it can continue to position its growing line of intelligent devices with the leading cloud partners and add intelligent software and services, it will gain broader visibility as a collaboration vendor.

Crestron and 1 Beyond are like-minded engineering-led firms that have the potential to bring innovative technologies to market for inclusive and equitable video meetings. However, much fine-tuning of the software and camera switching will be needed to provide a seamless user experience. In addition, 1 Beyond’s media processing system is a Windows-based server today. So taking that software and making it an appliance will be a priority. There is significant potential for Crestron to make the 1 Beyond products more integrated and elegant as well as affordable for broader market adoption.