Spotlight on electric, fully autonomous, automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and new business models like equipment-as-a-service, flexible leasing, and pay-as-you-go.

Electrification, automation, and innovative business models are galvanizing the global forklift market. Over the past few years, the market has experienced steady growth in both revenue and unit sales, fueled by increasing demand from the transportation and warehouse sectors, advances in battery technology, stringent emissions regulations, and more cost-effective electric vehicles (EVs).

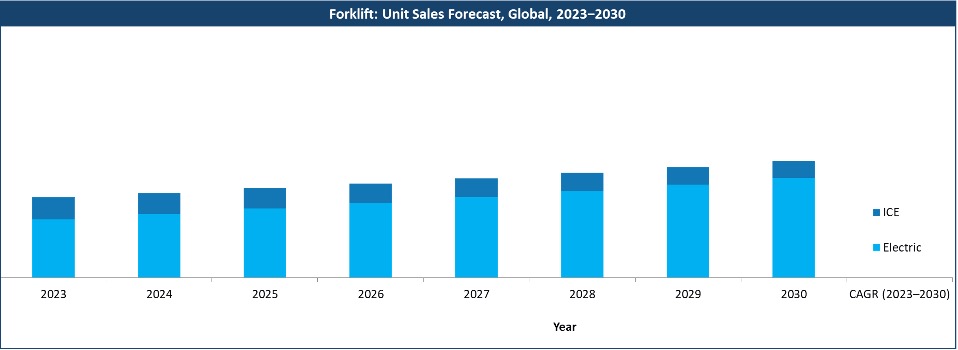

A critical factor in this growth will be the rising adoption of electric variants, underscored by an estimated compound annual growth rate (CAGR) of 8% in electric forklift unit sales over 2023-2030. This shift will be driven by operational advantages such as lower emissions, cost savings, and improved efficiency. In contrast, the appeal of internal combustion engine (ICE) forklifts is expected to decline as businesses move toward cleaner alternatives.

To learn more, please access: Global Forklift Growth Opportunities, Forecast to 2030, Growth Opportunities in the Excavators and Loaders Industry, 2024-2030, or contact sathyanarayanak@frost.com for information on a private briefing.

Sustainability Initiatives, Automation, and Business Model Transformations to Shape Market Dynamics

Supply chain efficiency and sustainability imperatives are motivating businesses and original equipment manufacturers (OEMs) to prioritize energy-efficient and low-emission forklifts. Such trends are providing a fillip to the uptake of electric forklifts. In parallel, battery and powertrain innovations, including advancements in lithium-ion (Li-ion) battery technology, motor efficiency, and powertrain design, are improving total cost of ownership (TCO) and operational efficiency, making electric forklifts a more attractive investment. Moreover, demand – particularly for electric models that offer lower maintenance costs and compliance with environmental regulations – is rising from the warehousing and logistics sectors.

Meanwhile, technological advancements in automation are resulting in the integration of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) that significantly enhance warehouse operations. A shrinking workforce in manufacturing and logistics is further accelerating the shift toward autonomous material-handling solutions.

Business models are also evolving with alternative ownership structures such as rental and leasing programs, battery financing, and remanufacturing services becoming more prevalent. These approaches are allowing businesses to optimize costs while maintaining operational flexibility.

Despite these positive trends, obstacles to widespread adoption remain. Among them are high initial investment costs for electrified and autonomous forklifts, infrastructure limitations for EV charging, and the complexity of transitioning from traditional ICE models.

APAC to Offer Strong Growth Potential

Developed markets such as North America and Europe are poised to experience moderate growth, primarily driven by the expansion of the warehouse and transportation sectors. The adoption of electric forklifts will gain momentum, with Europe leading the way with innovations in electrification, Li-ion battery applications, autonomous forklift operations, and integrated fleet management.

Rapid market growth is anticipated in the emerging Asia Pacific (APAC) region due to industrial expansion in key economies such as China and India. Surging e-commerce, coupled with the evolving warehouse and logistics infrastructure, is set to spur demand for forklifts. APAC will present high growth potential for electric forklifts, particularly in the latter part of the decade, as businesses increasingly adopt sustainable solutions to meet regulatory and operational demands.

Technology is Emerging as a Key Competitive Differentiator

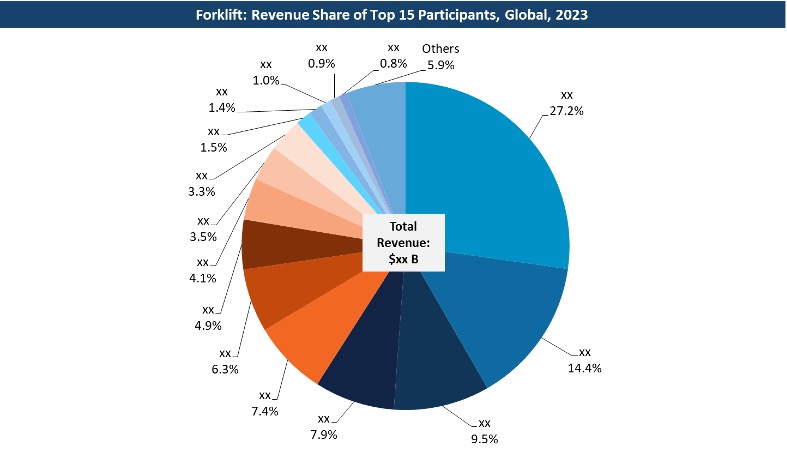

Overall, the forklift industry is highly competitive, with numerous global players investing in electrification, automation, and digital solutions. Leading companies such as Toyota, Kion, Jungheinrich, Mitsubishi Logisnext, Crown, Hyster-Yale, and Anhui Heli dominate. Strategic approaches embracing product innovation, partnerships, and mergers and acquisitions (M&As) have been aimed at expanding technological capabilities and market reach.

Market leaders have been integrating electrification and autonomous capabilities into their portfolios. Moreover, technologies like AI telematics and algorithms, automated monitoring, and digital twins are facilitating fleet utilization and productivity, equipment tracking, real-time inventory forecasting, operational efficiency and safety, predictive maintenance, as well as improved warehouse management and decision-making.

Our Perspective

The global forklift market is at a pivotal stage, driven by technological advancements, sustainability imperatives, and evolving customer expectations.

Electrification is becoming the industry standard, with electric forklifts emerging as the preferred choice due to lower operating costs, reduced emissions, greater efficiency, and regulatory compliance benefits. Accordingly, OEMs will need to target electric portfolio expansion. Simultaneously, stakeholders will need to focus on integrating smart charging stations, energy management systems, and real-time data analytics to maximize the efficiency of electric fleets.

Additionally, businesses will need to focus on aftermarket services such as battery recycling, remanufacturing, and predictive maintenance to extend equipment life cycles and optimize return on investment (ROI).

As businesses seek to optimize operations through automation, fully autonomous forklifts, AGVs, and AMRs will gain increasing traction. Here, strategic partnerships and ecosystem collaborations between OEMs and technology providers will accelerate innovation, with early adopters standing to gain a competitive advantage.

Business model innovation is reshaping the industry with traditional sales models giving way to comprehensive service-oriented approaches, including equipment-as-a-service, flexible leasing, and pay-as-you-go solutions. Leveraging these new models will enhance customer engagement by providing long-term value beyond product sales.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility