By Thirumalai Narasimhan, Industry Analyst – Mobility

Software-defined vehicles (SDVs) are revolutionizing the automotive industry, shifting the focus from mechanical features to software-driven innovations like driver assistance, connectivity, and convenience services. As electrification, autonomous driving (AD), shared mobility, and connectivity converge, OEMs are transitioning from traditional vehicle architectures to software-centric designs. This transformation mirrors the mobile phone industry’s evolution, with vehicles now offering continuous updates and upgrades throughout their lifecycle. Over-the-air (OTA) updates enable real-time enhancements, from safety features to infotainment, creating new revenue streams through feature-on-demand (FoD) services and fostering stronger, ongoing relationships between automakers and customers.

To learn more, please access: Benchmarking of European OEM Software-defined Vehicle Strategies, 2024, Benchmarking of North American OEM Software-defined Vehicle Strategies, 2024, Benchmarking Asian OEMs Software-defined Vehicle Strategies, 2024, Passenger Vehicle Feature on Demand (FoD) Market, Global, 2024-2030, or contact [email protected] for information on a private briefing.

The Innovators

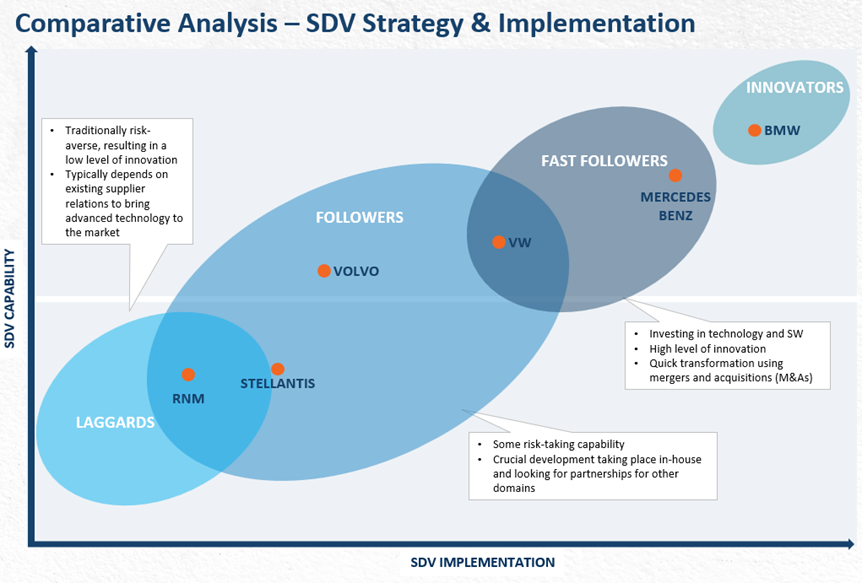

BMW stands as an industry pioneer in SDVs, shaping the future with cutting-edge technological advancements. The company’s strategic focus on both hardware and software innovation underscores its leadership role in the evolving electric vehicle (EV) space. A prime example of BMW’s innovation is its Neue Klasse platform, set for deployment in 2025. This platform will feature a zonal electrical/electronic (E/E) architecture designed to optimize vehicle performance and meet the increasing demands of electric mobility.

BMW’s hardware strategy revolves around developing this zonal architecture to support new battery technologies and enhance vehicle capabilities. Notably, BMW integrates in-house expertise with select partners for the development process, ensuring a seamless collaboration for high-quality outcomes. The Neue Klasse platform will be instrumental in accommodating a range of EVs, including sedans and SUVs, with an ambitious rollout of multiple models between 2025 and 2027. These innovations will cover a spectrum of vehicles from the BMW iX3 to high-performance models under the M brand.

On the software side, BMW has long been a trailblazer, with in-house software development dating back nearly two decades. This experience positions the company as a leader in integrating software with hardware for optimized vehicle performance. BMW’s commitment to a software-defined future is evident in its collaborations with major players like Qualcomm and Arriver. Together, they are advancing AD software functions, leveraging BMW’s comprehensive software toolkit. By 2025, the Neue Klasse platform will also offer OTA software and firmware updates, ensuring vehicles remain at the forefront of technological advancements throughout their lifecycle.

The Fast Followers

Mercedes-Benz, along with Volkswagen, falls into the category of fast followers, demonstrating rapid progress in both hardware and software development for SDVs. While not as pioneering as BMW, Mercedes-Benz has shown a clear commitment to catching up with industry leaders. The company’s hardware strategy focuses on launching new-generation platforms like the MMA, MB.EA, and AMG.EA, all of which will feature domain controller architecture by 2025. Mercedes-Benz has opted for a “clean slate” approach to its architecture, collaborating closely with Tier 1 suppliers for the hardware while developing software capabilities in-house.

At the core of Mercedes-Benz’s SDV initiative is MB.OS, a software platform designed to offer the company full control over the user experience, data privacy, and vehicle function integration. By building MB.OS in-house, Mercedes-Benz ensures it can deliver a consistent brand experience across its vehicle lineup while maintaining the flexibility to integrate third-party applications. The group’s strategic partnerships with NVIDIA, Luminar, and Google illustrate its reliance on external expertise to supplement its in-house capabilities, particularly in the field of AD and advanced driver assistance systems (ADAS).

Mercedes-Benz has committed over $2.8 billion to software research and development, demonstrating the company’s determination to be at the forefront of vehicle software innovation. By focusing on critical systems like AD, the company is positioning itself to monetize its vehicle platforms while leaving less essential systems in the hands of its suppliers. This strategy allows Mercedes-Benz to rapidly innovate while managing costs and risks associated with full-scale in-house development.

The Followers

Stellantis, together with other automakers like Renault-Nissan-Mitsubishi (RNM) and Volvo, falls into the “followers” category when it comes to SDV capabilities. While not at the cutting edge of innovation, these automakers are, nevertheless, taking significant steps to catch up with leaders like BMW and Mercedes-Benz. Stellantis’ strategy involves developing domain controller architecture, scheduled for deployment across all its brands starting in 2024. Although this hardware architecture is still under development, the company is laying the groundwork to scale its SDV capabilities across its diverse vehicle portfolio.

Unlike the innovators and fast followers, Stellantis relies heavily on partnerships to advance its SDV initiatives. Its collaborations with Foxconn, Amazon Web Services (AWS), and Qualcomm illustrate a strategy of leveraging external expertise to build robust software solutions and backend infrastructures. Stellantis is also co-developing its hardware and software using available toolkits and selectively sourced components for its STLA Brain platform. This selective sourcing allows Stellantis to retain control over critical aspects of the operating system while benefiting from plug-and-play solutions that accelerate the development process.

With a $1 billion investment earmarked for software development, Stellantis aims to extend its SDV capabilities across all its brands. The company’s long-term goal is to achieve economies of scale, utilizing partnerships to gradually develop a fully integrated SDV platform. Stellantis’ focus on collaboration and incremental development ensures that it will remain competitive in the evolving SDV landscape even as the company’s strategic partnerships and long-term planning suggest that it is positioning itself to be a formidable player in the SDV market over the next decade.

Our Perspective

As SDVs become the norm, the automotive industry must adopt a collaborative approach to meet the rising demands for advanced electronic components and systems. Partnerships with semiconductor companies and tier suppliers will help OEMs develop optimized components and control units that address the growing computing power requirements of modern vehicles.

The FoD business model represents a promising growth area. As telematics becomes standard, automakers can capitalize on new revenue streams through subscription-based services and aftersales offerings. Creative packaging and intelligent pricing models will enable OEMs to generate recurring income, transforming them from vehicle sellers into content providers. Both premium and mass-market automakers will need to prioritize FoD to cater to evolving consumer needs and secure long-term revenue.

Cross-industry collaboration will be critical. OEMs should work closely with tech companies to develop cutting-edge solutions, reducing the cost, time, and complexity of product development. While the automotive industry has long product cycles, tech companies operate with agility and rapid innovation. This collaboration can bridge the gap between these industries, allowing OEMs to tap into external expertise and build an ecosystem that fosters innovation.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility