Global Trade by 2035: a Thorny Path to $71 Trillion or a Transformational Leap to $105 Trillion?

Trade wars, pandemic and war-induced supply chain disruptions, and inward-looking policies are catalyzing a transformation is global trade patterns. While the trade rebound has been sizable between 2021 and 2023, following COVID-19 driven contraction, the future trajectory of global trade – exports and imports combined – will be a complex equation of highly interconnected variables of macroeconomy, geopolitics, supply chain strategies, trade policies, technological advancements, as well as services trade.

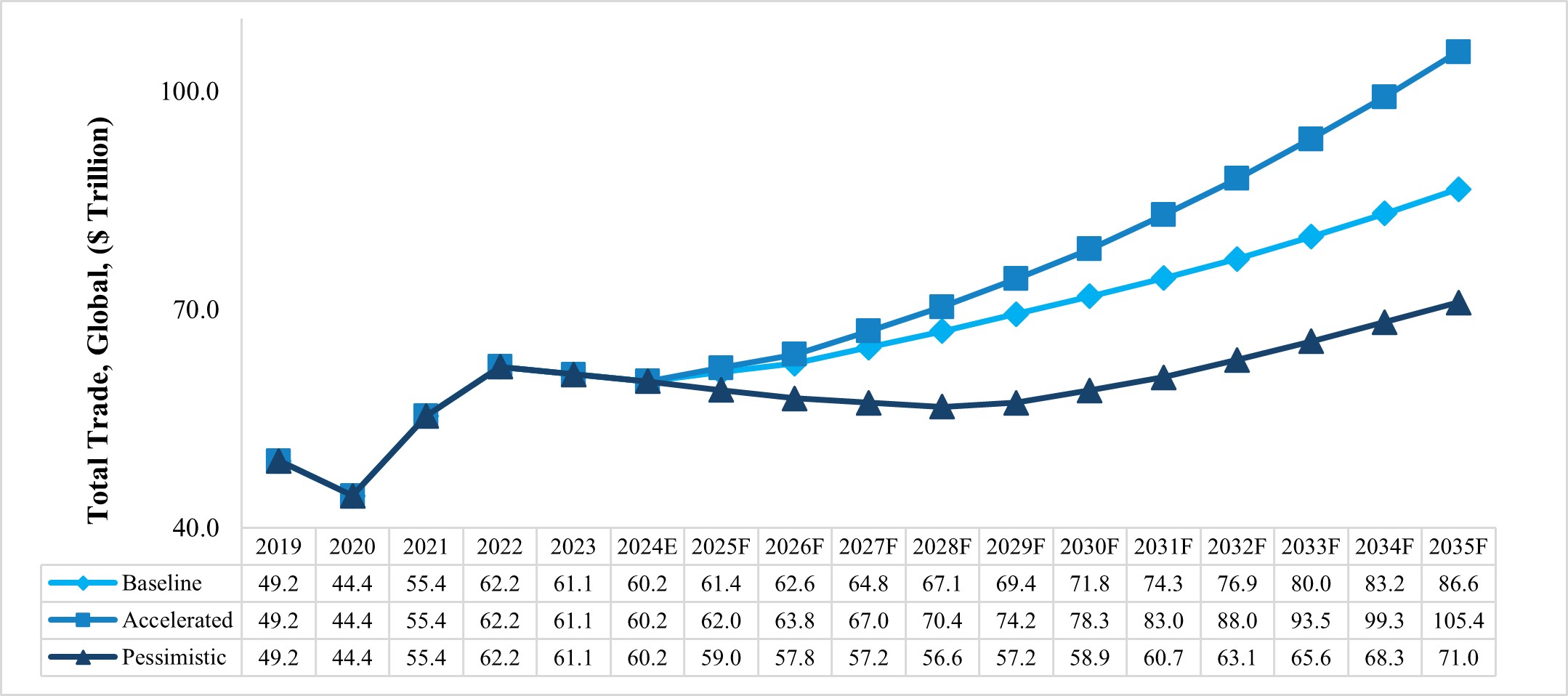

Baseline shows a US$ 87 trillion global trade potential over the next decade

Fost & Sullivan’s scenario-based global total trade forecasts show that in the baseline scenario, total trade will reach US$ 86.6 trillion, rising at a compounded annual growth rate (CAGR) of 2.9% between 2023 and 2035, whereas in an accelerated case, it would surpass the US$ 105.4 trillion mark. In a pessimistic scenario, where global trade fragmentation exacerbates due to persistent trade wars and geopolitical frictions, global trade CAGR will be a meager 1.3% between 2023 and 2035, reaching US$ 71.0 trillion.

Chart 1: Total Trade1 by Scenario, Global, 2019-2035 (in $ Trillion)

- Total trade = Total exports+ Total imports. Data stands updated as of 11th September 2024. E: Estimates; F: Forecasts; Sources: World Bank; Frost & Sullivan

Below are the scenario-wise assumption highlights underpinning our forecasts:

| Baseline | Accelerated | Pessimistic |

| Global GDP growth ranges between 3.0%-3.2% per year between 2024 and 2035. | Global GDP growth ranges between 3.6%-4.0% per year between 2024 and 2035. | Global GDP growth slows to 2.2% to 2.5% range between 2024 and 2035. |

| Muted impacts of geopolitical frictions. | Ongoing wars/ tensions ease and global co-operation accelerates as trade relations normalize. | Rifts deepen and deep economic and trade fragmentation occurs, with numerous inter-country / regional war breakouts. |

| Supply chain diversification continues at the current pace. | Accelerated diversification, with regional sourcing and production ecosystems in place between 2027 and 2030. | Wars across geographies leads to massive supply chain disruptions; further exacerbated with low cross-country co-operation. |

| Bilateral trade agreements continue, with current FTAs/RTAs continuing without disruptions. | BRICS+[1] establish an FTA; EU-Mercosur[2]; China/Japan/ South Korea deal; ASEAN[3]-European Union FTA – some of the on-going negotiations close successfully. | Massive escalations in US-China, EU-China tariff wars pushing up production costs and inflation severely. Reversal of trade liberalization. |

* The list assumptions is not exhaustive only indicative.

A well-oiled decision-making machine running on agility, cross-vertical collaboration, continuous feedback loops, and stress testing

A dynamic global environment – politically and economically – will warrant an agile and multi-pronged decision-making approach wherein firms must build flexible and adaptable business and production practices to remain competitive. Responsiveness measures will include:

- Diversifying into emerging markets (e.g., India, UAE, Vietnam) to cushion the downsides during softer growth periods in advanced nations.

- Building diplomatic ties and local partnerships in key revenue generating markets to build policy influence and cement domestic presence.

- Diversifying sourcing and procurement partners to cap the impacts of supply side shocks.

- Conducting quarterly/ bi-annual stress tests across the firm’s production value chain to ascertain readiness.

- Advocating for policy changes by establishing presence in local commerce/trade/ industry associations.

Megatrends transforming global trade need careful consideration to gain first mover’s advantage

Global corporations must account for some of the long-term trends significantly impacting the global trade landscape. For instance, Eastern geographies including Africa, Middle East, and Asia will become export hubs of the future, regionalization focus will see the emergence of highly integrated regional trade corridors, and as local/regional cost-effective manufacturing ecosystems cement themselves, the manufactured goods’ trade routes will be shortened. Multi-sector growth opportunities spanning across regions will emerge from such unprecedented trade dynamism and companies which leverage these transformations to drive real-time decisions are bound to remain ahead of the curve.

You can read more about the global trade transformation over the next decade in Frost & Sullivan’s published thought leadership on ‘Global Trade Transformation, 2024-2035’.

Also take the opportunity to schedule a Growth Pipeline Dialog™ with our economists and growth experts to drive organizational growth priorities: Schedule Your Growth Pipeline Dialog™ with the Frost & Sullivan Team