A raft of government mandates and regulations—the AIS 140, AIS 093, GPS based toll tax, Automated Testing Station Fitness Testing, and Goods AIS 140, among them—will propel India’s connected truck telematics market on the path of strong, sustained, and rapid growth. This will be reinforced by the emergence of aggressive telematics and mobility start-ups backed by sizeable war chests. Such trends will receive a fillip from increasing customer demand resulting from greater awareness about the RoI benefits linked to telematics-enabled fleet management solutions. In combination, this will spur revenue expansion from an estimated $51.6 million in 2022 to $205.6 million in 2027, with the market set to hit top gear from 2025 onwards.

To learn more, please see: Growth Opportunities in the Indian Connected Truck Telematics Market, Global Connected Truck Telematics Outlook, 2023, Growth Opportunities in the Global Video Telematics Market, Growth Opportunities in the European Digital Tachograph Market, 2023, or contact [email protected] for information on a private briefing.

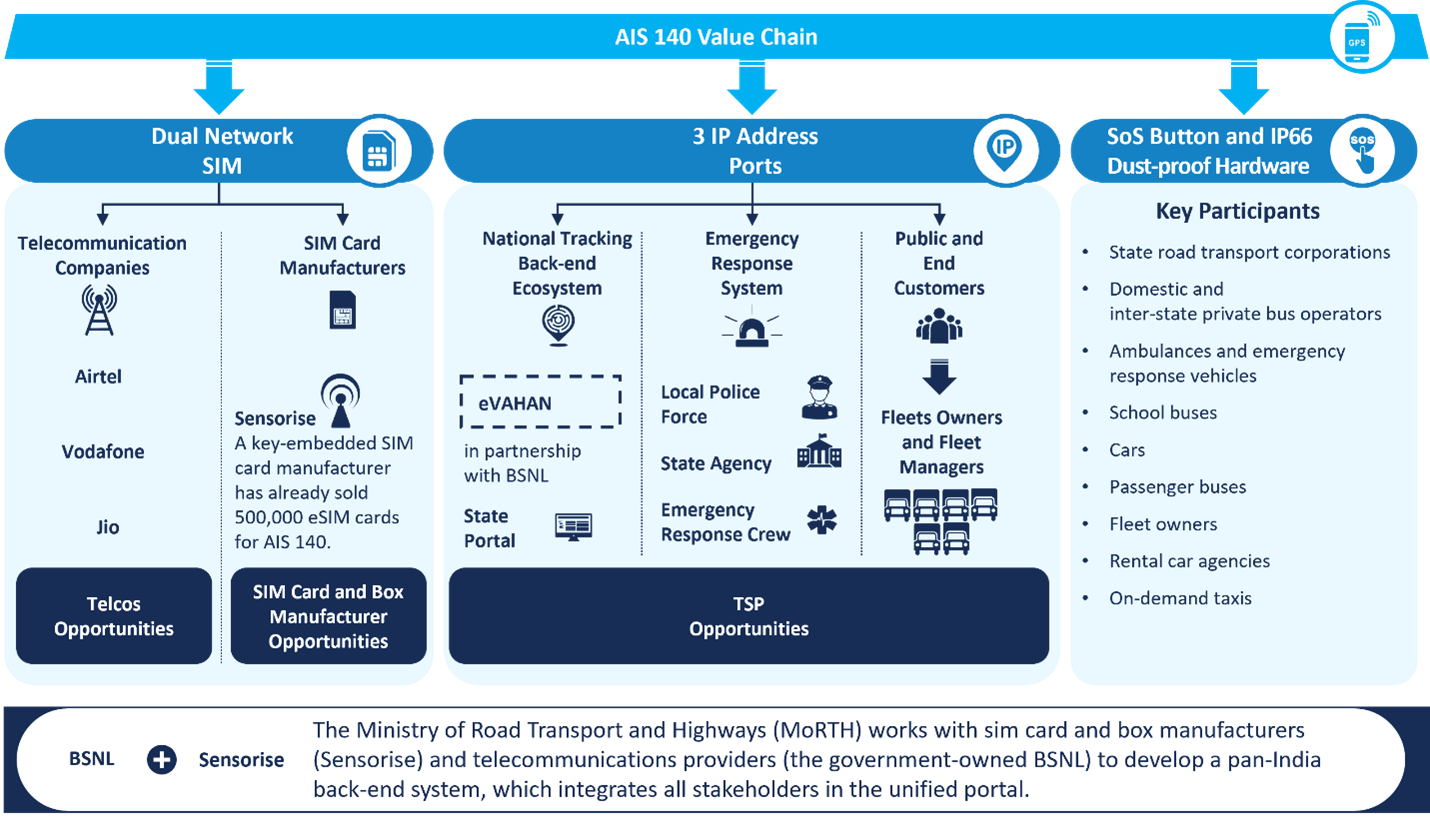

Figure 1: AIS 140 Value Chain, India, 2023

New Road Toll Collection System to Widen Adoption of AIS 140 by Fleets

One of the key government regulations that will push volume growth is the Automotive Research Association of India (ARAI) published AIS 140. Since April 1, 2019, this set of standards has made it mandatory for all existing and new public buses and commercial vehicles (CVs) to install a vehicle-tracking device and an emergency button. While considered relatively successful – the AIS 140 mandate has pushed annual growth rates in India’s CV telematics market to above the 20% mark over the past couple of years – it has not been as impactful as was initially envisioned. Enforcement has varied by state, with CV parc still not under a single, uniform system.

Patchy implementation notwithstanding, our research indicates that the AIS 140 regulation will continue to drive adoption rates in CVs and public buses over the next 2-3 years. The government’s new GPS-based, road toll collection system, aimed at facilitating toll tax collection, is set for launch at the end of 2023. This will support wider adoption of AIS 140 devices by fleets. Slated to work in tandem with the eVAHAN portal and AIS 140 GPS trackers, it will aid market prospects as will standard factory fitments of AIS 140 devices into new BSVI vehicles.

Start-ups Heat Up the Market

The competitive landscape is heating up with well-funded telematics and mobility start-ups engaged in price wars to win over India’s highly price-sensitive customers. Such disruptive price strategies are hurting traditional OEM and international participants, who are struggling to keep pace with similar offers and are steadily losing customers to newer technology incumbents.

The ecosystem currently has several telematics service providers (TSP) like Arya Omnitalk, Loconav, Intangles, Minda (KPIT), Microlise, FleetX, iTriangle, Omnicomm, Pricol, and Uffizio. Other stakeholders include OEMs like Ashok Leyland, Tata Motors, Mahindra, Daimler and Volvo Eicher as well as important value chain providers like WheelsEye, Blackbuck, SAP, Oracle, and Bosch.

TSPs are expanding their R&D network and partnering with hardware and solution providers in a bid to bolster their product portfolios. To grow their business, some TSPs are targeting larger fleets by retrofitting their existing vehicles, while others are turning to competitive pricing and focusing on small, local fleet businesses. Several OEMs, meanwhile, are attempting to build their own telematics capabilities – either organically or through partnerships with TSPs and large fleet owners.

Customer service is a major consideration for fleets in selecting vendors. Therefore, in addition to strengthening their expertise in telematics solutions, traditional OEMs are looking to offer higher value-added services and flexible, cost-effective payment options.