As focus shifts from business expansion to profitability, collaboration and innovative partnerships will emerge as key to capitalizing on emerging opportunities.

By Albert Geraldine Priya, Research Manager – Mobility

The global shared mobility market, encompassing traditional carsharing, peer-to-peer (P2P) carsharing, corporate carsharing, bikesharing, kick scooter sharing, ridehailing, demand responsive transit (DRT), Mobility as a Service (MaaS), and autonomous shared mobility, is poised for substantial growth. With an estimated revenue opportunity exceeding $900 billion this year, the industry is highly dynamic and ripe for transformation. What are the key trends that will shape the competitive landscape in 2024? What growth opportunities can stakeholders leverage to drive revenues?

To learn more, please access: Global Shared Mobility Predictions and Outlook, 2024, European and North American Mobility-as-a-Service Growth Opportunities, Growth Opportunities in the Evolving Public Transport Landscape, 2030, and Evolution of Shared Mobility Infrastructure in Top 20 Smart Cities, or contact [email protected] for information on a private briefing.

Major Trends Shaping the Shared Mobility Landscape in 2024

- Profit or Perish: The New Mantra

While most segments of shared mobility have been around for over a decade, the focus is shifting from business expansion to profitability. In 2023, numerous companies scaled back or shut down due to funding shortages. Moving forward, operators will need to enhance service utilization and reduce operational costs to achieve sustainable revenue growth. For this, collaboration among operators, cities, and consumers will become essential, with local authorities playing a pivotal role in integrating shared mobility with public transport.

- Technology: The Catalyst for Profitability

As shared mobility services reach maturity, the next phase will be to achieve profitability through technological advancements. Operators will need to leverage safety technologies, predictive maintenance, and fleet optimization to enhance efficiency and reduce costs. The integration of advanced tech solutions will be critical in driving this shift.

- Legislative Boost for Corporate Mobility

With many companies mandating partial office returns, the demand for flexible commuting solutions is rising. To ease employee commutes and encourage hybrid work models, regulatory change will be accompanied by initiatives like job tickets and mobility budgets. Employers will look move beyond traditional company cars to more holistic, corporate mobility models.

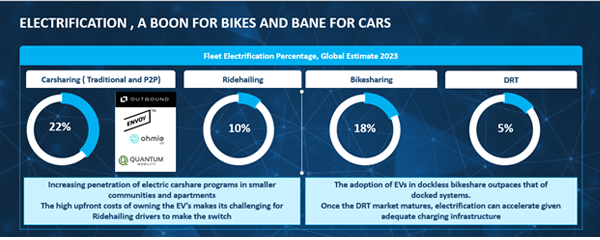

- Electrification: A Double-Edged Sword

The push towards electrification continues, particularly for bikes, while car electrification faces challenges due to high costs and lower residual values. Successful electrification will depend on seamless integration among stakeholders, including shared mobility operators, cities, and technology providers. Strategic partnerships and robust EV infrastructure, facilitated by simulation software that can optimize the number and location of charging stations, will be vital for the sector’s growth.

- Micromobility: The Mainstream Solution

Micromobility sharing surged during the COVID-19 pandemic and continues to offer numerous benefits, including reduced personal car usage, health advantages, and improved first- and last-mile connectivity. Cities are expected to integrate micromobility more deeply into their transportation systems, supported by government subsidies and financial incentives.

- Digital Transformation for Urban Mobility

As mobility modes proliferate, effective management is becoming increasingly crucial. Advanced data intelligence systems will help cities optimize fleet utilization and parking, enhancing safety and efficiency. These systems will also support the growing trend of car-free and 20-minute cities by managing green spaces and curbside usage effectively.

- Regulatory Support for Autonomous Mobility

Autonomous vehicle (AV) regulations are evolving, addressing safety drivers, remote operations, and liability issues. In 2024, key regulations will enable AV developers to commence driverless testing and launch robotaxi operations in new regions..

Stabilizing Growth and Emerging Segments

While carsharing, ridehailing and bikesharing growth rates will stabilize by 2030, segments like autonomous shared mobility, MaaS, DRT, and kick scooter sharing are set for significant growth in the next few years. Kick scooters will dominate the micromobility fleet in North America and Europe, and niche market segment like carsharing for apartment and residential communities are likely to see an increased uptake

Fleet management and optimization technology will enhance utilization rates, potentially increasing fleet efficiency by over 30%. Corporate mobility projects will likely grow by 20-30%, driven by EU regulations and widespread fleet adoption. MaaS will shift towards hyper-localized models, offering customized solutions for specific regions and communities.

Our Perspective

Stakeholders, including cities, will need to leverage government regulations promoting sustainable mobility. Extensive collaboration among the automotive, technology, and public sectors will be critical to disrupting the evolving landscape with new business models and MaaS solutions. The focus will need to be on urban redevelopment in order to effectively integrate new shared mobility modes into urban transport networks.

Future growth will hinge on partnerships, and technological advancements. Shared mobility providers will need to continuously build on their core technological strengths or partner with relevant operators to fill capability gaps. Merging data from public and private mobility operators will enhance MaaS solutions, providing comprehensive and efficient services.

Clear regulations will be the foundation from which autonomous shared vehicles can take-off. OEMs will need to partner with fleet management companies and cities to gain insights into ridership demand and promote autonomous shuttles alongside other shared mobility modes. This collaboration will drive the successful deployment of autonomous technologies in urban environments.

The shared mobility market is on the cusp of significant transformation in 2024. Achieving profitability, leveraging technology, adapting to legislative changes, and embracing electrification will be crucial for operators. As micromobility becomes mainstream and digital transformation enhances urban mobility management, the industry is set for robust growth. Collaboration and innovative partnerships will be the key drivers, enabling cities and operators to navigate the evolving landscape and capitalize on emerging opportunities.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility