By Benson Augustine, Program Manager – Mobility

The global automotive aftermarket is witnessing a paradigm shift as circular economy initiatives gain momentum. Remanufacturing—the process of restoring used parts to like-new condition with affiliated warranty—is an integral element of circular economy models and offers substantial growth opportunities. Revenues of the global remanufactured automotive components market are projected to rise from $27 billion in 2022 to $42 billion by 2030.

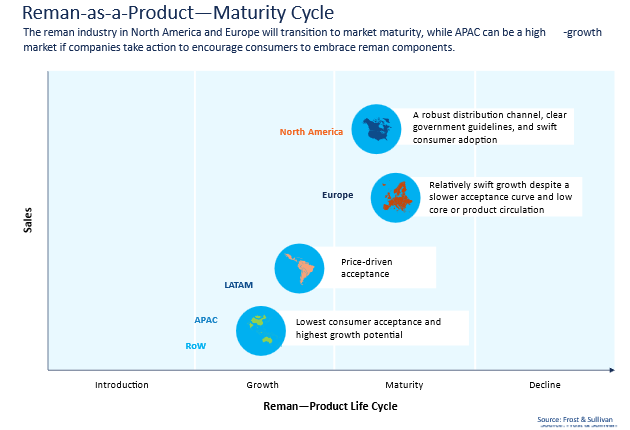

Currently, North America and Europe have the most mature remanufacturing markets. Revenue growth in these markets is underpinned by robust distribution channels, clear government guidelines, and increasing consumer adoption. The Asia-Pacific (APAC) region, with China in particular, is poised to become a high-growth market. China’s expanding role in global remanufacturing logistics and domestic adoption positions it as a significant player in the future. Growth in Latin America will be more price-driven, with proximity to North America enhancing the region’s potential as an alternative sourcing hub.

To learn more, please access: Circular Economy Initiatives and Growth Opportunities from Remanufacturing in the Automotive Aftermarket or contact [email protected] for information on a private briefing.

Focus on Reverse Logistics, Consistent Regulatory Frameworks, and Component Modularization

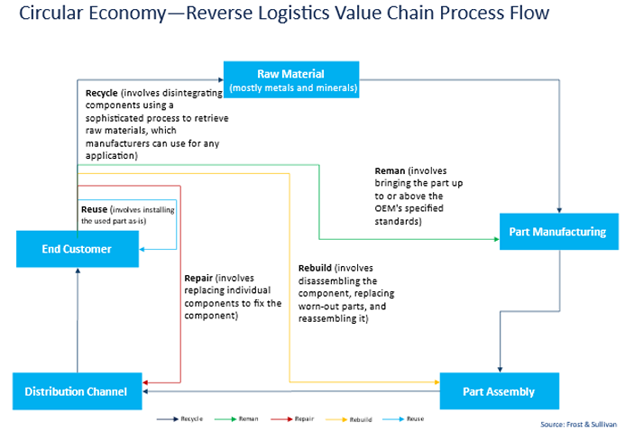

The increasing momentum of green components in the circular economy is a crucial factor driving the remanufacturing market’s growth. As supply chains and reverse logistics strengthen, more parts are being identified for inclusion in the remanufacturing process, creating a compelling business case for remanufacturing. This trend is particularly evident in legacy components like engines and transmissions, which remain significant revenue generators.

Another critical trend is the growing importance of core acquisition and investment in reverse logistics. Establishing sustainable, long-term core acquisition strategies through backward integration programs is essential as the circular economy concept takes center stage. Developing and implementing a consistent regulatory framework will also be crucial for OEMs and Tier I suppliers to standardize reusability and remanufactured parts throughout the value chain, aligning with environmental goals.

The concept of component modularization is gaining traction to ensure easy serviceability and maintenance globally. This modularization, combined with the right to repair, aims to democratize the aftermarket, making it more accessible and sustainable. Additionally, traceability and lifecycle management are becoming increasingly important, with Tier I suppliers investing in core authentication protocols. These protocols facilitate recall, warranty, and lifecycle management of remanufactured components, enhancing their reliability and value.

The rise of connected, autonomous, shared, and electric (CASE) vehicles presents a unique opportunity for remanufacturing. Repurposing electronic components, batteries, and associated embedded algorithms can significantly reduce the overall cost of ownership, as service and maintenance costs decrease over time. This shift is particularly relevant as the adoption of electric vehicles (EVs) accelerates globally, with North America, Europe, and China leading the charge.

Our Perspective

The conventional components aftermarket, particularly engines and related components like transmissions and engine control units (ECUs), remain a dominant OEM category. By the end of 2030, this segment is expected to generate close to $17.2 billion. To maintain momentum, Original Equipment Suppliers (OES) must focus on acquiring more engines and engine-related cores from the aftermarket to ensure consistent channel activity. Tier I suppliers can also benefit by launching programs that increase the visibility of remanufacturing in conventional application categories.

The remanufacturing of eComponents and batteries is in its nascent stage but is poised for rapid growth as EV adoption increases. By 2030, the global remanufacturing opportunity for eComponents and batteries is expected to reach $1.2 billion. Suppliers in North America and Europe need to develop intellectual property (IP) for eComponent technology and battery cell chemistries to stay competitive. Additionally, forming partnerships with retailers, wholesalers, and OES channels will be crucial for establishing a network for storing, transporting, repairing, and servicing eComponents and batteries.

Reverse logistics is critical for the sustainability of remanufacturing programs. Suppliers must invest in developing B2B partnerships to source cores from salvage yards and establish closed-loop feedback mechanisms in the supply chain. This approach will ensure a consistent supply of remanufactured components to meet growing demand. Private labeling in the Independent Aftermarket (IAM) offers another significant opportunity. By outsourcing private labeling, regional suppliers can access global markets, distribute products domestically, and pass on cost savings to value chain partners and end consumers.

Core buyback programs present an efficient and environmentally friendly approach to sourcing remanufactured components. By engaging directly with end consumers, suppliers and distributors can reduce core acquisition costs, logistics, and operational overheads. Developing robust core buyback programs that source directly from customers will be essential for OEMs, Tier I suppliers, retailers, and distributors. Additionally, implementing rewarding incentives will encourage long-term participation in these programs, ensuring a steady supply of cores.

Last Word

The future of the automotive aftermarket lies in the successful integration of circular economy principles, with remanufacturing playing a pivotal role. The industry can unlock significant growth opportunities by capitalizing on emerging trends, such as green components, component modularization, and CASE vehicle adoption. Strategic investments in core acquisition, reverse logistics, and private labeling will be essential for suppliers, OEMs, and distributors to remain competitive in this evolving landscape. As global regulatory bodies continue to champion the circular economy, the automotive aftermarket must adapt to these changes, ensuring long-term sustainability and profitability.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility