Favorable outlook notwithstanding, key challenges such as financing, infrastructure development, and innovative business models will require strategic intervention.

By Shraddha Manjrekar, Industry Analyst – Mobility

Hero MotoCorp recently announced a phased investment of around Rs 525 crore in Euler Motors as part of its long-term strategy to strengthen its position in India’s electric three-wheeler (E3W) market. The decision underscores the tremendous growth potential of the country’s booming E3W market, driven by the convergence of environmental consciousness, fluctuating fuel prices, and robust government support. Encompassing passenger rickshaws, autorickshaws, and cargo vehicles, E3Ws offer an affordable and eco-friendly alternative for urban commuting and last-mile delivery.

Stakeholders are focusing on affordability, sustainability, and scalability, even as advances in battery technology continuously boost vehicle efficiency and lower operational costs. Simultaneously, the transition from lead-acid to lithium-ion batteries has significantly improved energy storage capacity, reducing downtime and increasing profitability for operators.

However, several challenges persist, including inadequate charging infrastructure, high initial investment costs, and insufficient battery recycling facilities. Addressing these barriers will be critical to unlocking the market’s full growth potential.

To learn more, please access: Electric Three-wheeler Market, India, FY2024–FY2030, Voice of Consumer – Buyer Profiles of Electric Two-wheelers in India, Indian Electric Two-Wheeler (e2W) Market, Forecast and Growth Opportunities, 2024–2030, or contact [email protected] for information on a private briefing.

Enabling Policy, Technology Advances, and New Finance Models Boost Market Prospects

The Indian E3W market grew 57.2% in FY2024 over the previous year, highlighting its upward trajectory. The government’s ambitious target of achieving an 80% E3W market share by 2030, reinforced by schemes such as the Electric Mobility Promotion Scheme (EMPS), the Production-Linked Incentive (PLI) program, and various state-level subsidies and tax benefits, is set to solidify the role of E3Ws in India’s sustainable transportation landscape.

A crucial factor in market expansion will be the development of charging infrastructure. As of FY2024, India has over 16,000 public charging stations, supported by initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) I and II. Additionally, the government is finalizing battery swapping policies to enhance convenience and efficiency for commercial fleet operators. Although rural and semi-urban areas face infrastructural challenges, increasing collaboration between private and public stakeholders is expected to bridge this gap, ensuring wider adoption.

The market is also poised to benefit from technological advancements, such as rapid battery charging and integrated telematics. The rise of fintech-based financing models is further set to facilitate E3W adoption by easing financial barriers, particularly for small-scale buyers. Market prospects will receive a further filip from the growing demand for last-mile passenger and cargo transport, particularly in eCommerce and food delivery.

A Fragmented Market Marked by Increasing Competition

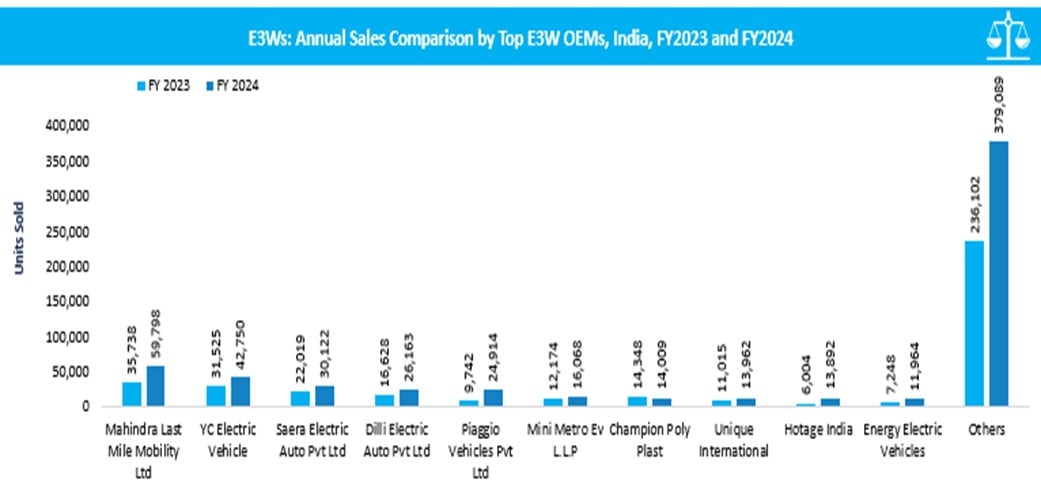

The Indian E3W market is highly fragmented, with a mix of established manufacturers and new entrants. Companies such as Mahindra, YC Electric, Saera Electric, and Piaggio compete with startups like Altigreen Propulsion and Omega Seiki Mobility.

With over 60 active players, market differentiation is largely driven by affordability, brand reputation, and advancements in battery technology. Mahindra Last Mile Mobility (LMM) leads the market with strong brand equity, an extensive service network, and innovative models like the Mahindra Treo. YC Electric focuses on providing economical, passenger-centric rickshaws, particularly in Tier 2 and Tier 3 cities, while Saera Electric is positioned as a mid-market player balancing affordability with quality and export potential.

The E3W sector is also attracting interest from legacy two-wheeler manufacturers as illustrated by Hero MotoCorp’s investment in Euler Motors. As competition intensifies, partnerships, technological advancements, and strategic market positioning will be key differentiators for sustained success.

Our Perspective

Several critical factors will shape the future of India’s E3W market. Government policies, particularly incentives and subsidies under FAME II, will play a pivotal role in accelerating adoption. Financial assistance for vehicle purchases will directly stimulate demand, making E3Ws an attractive investment for fleet operators and independent drivers. Additionally, the increasing importance of last-mile connectivity in urban areas will position E3Ws as a cost-effective, practical solution for congested urban environments.

Rising fuel prices will further reinforce the economic viability of E3Ws, spurring uptake for commercial and short-distance applications. Market expansion will also be propelled by technological breakthroughs such as rapid battery charging, smart telematics, and the transition to lithium-ion batteries. Battery swapping solutions, in particular, are expected to mitigate range anxiety and enhance operational efficiency, making E3Ws an even more compelling choice for consumers and businesses alike.

While the outlook remains highly favorable, key challenges such as financing, infrastructure development, and innovative business models will require strategic intervention. Strengthening partnerships with financial institutions, expanding battery swapping networks, and promoting shared ownership or leasing models will boost adoption rates. As the market evolves, fostering collaboration between policymakers, manufacturers, and technology providers will be essential to ensuring the rapid, sustainable growth of India’s E3W market.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility