Leading Asian automakers like BYD, Nio, Toyota, Honda, and Hyundai look to partnerships, platforms, and new business models to align with evolving software-driven automotive industry.

The concept of software-defined vehicles (SDVs) has gained considerable traction in the automotive industry, fundamentally reshaping how vehicles are designed and developed. Unlike traditional platform-based approaches, SDVs rely heavily on software to control the vehicle’s systems, features, and updates, enabling rapid advancements in autonomous driving, in-vehicle connectivity, and more. As SDV strategies evolve, automotive original equipment manufacturers (OEMs) are shifting their architectural and developmental approaches. This transformation has led to the emergence of new ecosystems, with Asian OEMs taking center stage, though they have tended to be “followers” rather than pioneers in this field.

To learn more, please access: Benchmarking Asian OEMs Software-defined Vehicle Strategies, 2024, Benchmarking of European OEM Software-defined Vehicle Strategies, 2024, Benchmarking of North American OEM Software-defined Vehicle Strategies, 2024, and Passenger Vehicle Feature on Demand (FoD) Market, Global, 2024-2030, or contact [email protected] for information on a private briefing.

A Cautious Approach

Asian OEMs, such as BYD, Toyota, Hyundai, Nio, and Honda, typically adopt a cautious approach to innovation, positioning themselves as “followers.” These manufacturers invest in internal development while selectively partnering with external suppliers to manage risk and enhance their technological capabilities. Their strategy involves in-house development for core systems, supplemented by collaborations where expertise is lacking. This blend allows them to gradually introduce new SDV technologies without taking the same risks as early innovators.

That said, hardware and software strategies are rapidly transforming to accommodate the transition towards SDVs. Chinese automaker BYD introduced its e3.0 domain controller platform in 2024, setting the stage for a shift towards a more centralized/zonal architecture with its next-generation e4.0 platform. By 2030, BYD aims to handle most of its development in-house, although the company currently relies heavily on suppliers. Chinese OEM Nio is working on a centralized electrical/electronic (E/E) architecture, with a clear focus on in-house development for most of its vehicle systems. The next generation of Nio vehicles will feature this new architecture, giving the company greater flexibility and control over its product evolution.

Japanese automakers are also realigning their SDV development and deployment strategies. Toyota is advancing towards a centralized/zonal architecture with its upcoming battery electric vehicle (BEV) platform, expected to launch between 2025 and 2026. The company is known for its predominantly in-house development approach but leverages key suppliers to address areas where it lacks specific expertise. Meanwhile, Honda plans to roll out its fully domain-based architecture by 2026, specifically for its electric vehicle (EV) models. The company balances in-house development with strategic supplier partnerships, ensuring it maintains control over core competencies while leveraging external expertise where needed.

Honda’s SDV journey revolves around its eM platform, which adopts a zonal architecture. The platform is expected to be deployed in 2025. Like Honda, Hyundai relies on in-house development alongside close collaborations with its affiliated companies within the Hyundai Group.

Software Development Strategies Across Asia’s OEMs

Each Asia OEM’s approach to software development varies, reflecting differences in their business models, R&D capacities, and financial strategies.

BYD is actively developing its software capabilities in-house, though it still depends on suppliers for certain areas. The company collaborates with other BYD Group subsidiaries to cover gaps in expertise. Nio emphasizes in-house software development, with full control over major systems like autonomous driving (AD), the digital cockpit, and intelligent chassis. While Nio does engage external partners for non-core areas, it aims to minimize dependency on outside solutions.

Toyota is using its in-house Woven platform to drive its SDV ambitions, while CARIAD, a partner in software development, plays a role in certain areas. Toyota also taps into its network of suppliers to address any software gaps. Honda’s strategy focuses on a partnership-driven approach, with core development handled internally. Honda aims to expand its network of collaborators to strengthen its SDV portfolio.

Hyundai adopts a consortium-based model, where in-house teams lead development efforts but partner with other companies for specific software solutions. The goal is to standardize SDV development through these collaborations.

Building the SDV Ecosystem

A robust ecosystem is essential for SDV development, and OEMs are forging strategic partnerships to enhance their capabilities.

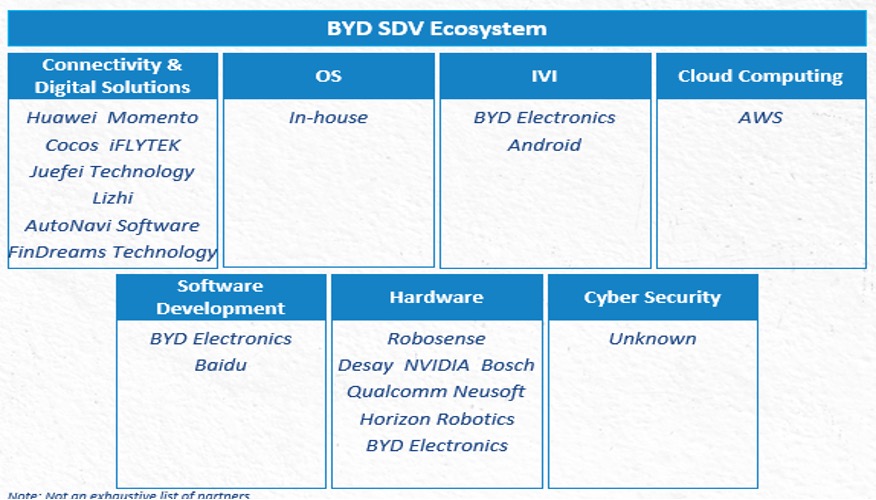

In this context, BYD has established an intelligent driving research division, enhancing its in-house capabilities. The company is also partnering with industry giants like NVIDIA and Qualcomm for advanced software and chip development, though it continues to rely on external collaborations for complex software functions. Nio’s approach emphasizes control over critical SDV technologies, with in-house teams managing major systems. The company collaborates with Tier I suppliers for non-core functions, such as drive-by-wire systems, but aims to reduce this reliance over time.

Toyota focuses on developing key SDV components like E/E architecture and operating systems (OS) in-house, while using suppliers for specialized expertise. Toyota Arene and Woven, its two-pronged software platform, form the foundation of its SDV strategy. Honda has committed $12.66 billion to develop software-defined mobility. This investment will accelerate its in-house capabilities, particularly for powertrain and infotainment systems, while forming partnerships in areas like next-gen E/E architecture, electrified powertrains, and ADAS.

Under its “Unlock the Software Age” initiative, Hyundai is preparing for a full SDV transition by 2025. The company relies on a consortium of 19 affiliated companies to support hardware and software development, aiming to create an open development ecosystem.

Our Perspective

The rise of SDVs marks a shift from hardware-focused to software-centric business models in the automotive industry. Automakers, suppliers, and technology providers must collaborate to develop vehicles with software-oriented architectures. Partnerships, particularly with start-ups and non-traditional automotive players, will be key to driving innovation in this space. As SDVs become more common, cloud-based architectures will offer new revenue streams, particularly through over-the-air (OTA) updates and foreign object damage solutions.

By consolidating functions in high-performance computing (HPC) systems and enhancing cybersecurity measures, OEMs can better manage the complexity of SDVs. Collaboration among regulatory authorities, telecom operators, and security companies will be essential to developing secure vehicle-to-everything (V2X) communication systems.

The future of SDVs also presents opportunities for cloud computing providers, particularly in functional virtualization. OEMs will increasingly need cloud infrastructure support as they shift to software-based models, opening up avenues for growth across the supply chain.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility