Trends to pivot around video safety solutions integrated with advanced AI and ML technologies, increasing installation of telematics hardware by OEMs into their commercial vehicles (CVs) at the production stage, and a host of telematics solutions promoting driver well-being and retention.

By Mugundhan Deenadayalan, Industry Principal – Mobility

Three major trends are transforming the global connected medium and heavy commercial vehicles (M&HCV) space: video telematics, OEM telematics proliferation, and driver-centric services. Video safety solutions integrated with advanced technologies such as AI and ML will experience high adoption, OEMs will increasingly factory-fit telematics hardware into their commercial vehicles (CVs), and a host of telematics solutions promoting driver well-being and retention will emerge. In conjunction, these trends will create growth opportunities, both in terms of volume and revenues, for stakeholders across the value chain.

To learn more, please see: Global Connected Medium & Heavy Commercial Vehicles Growth Opportunities, Growth Opportunities in European Heavy-duty Electric Trucks, or contact [email protected] for information on a private briefing.

Integration of AI and ML technologies with video safety solutions offers tremendous growth potential

The global M&HCV segment is likely to be among the early adopters of telematics. With the number of M&HCVs forecast to nearly double by the end of 2028, the associated telematics market is also set to expand from an installed base of 15.8 million in 2023 to around 26.7 million in 2028.

With its range of use cases, video safety solutions generated an estimated $800 million in 2023. Already, OEMs are starting to add not just telematics gateway units but video dashcam systems as well into their CVs as standardized factory fitments. Meanwhile, fleet operators are increasingly turning to video telematics to enable better performance, safety, visibility, and control. The integration of AI and ML technologies with video safety solutions is further enhancing such benefits and represents tremendous growth potential.

The factory fitment of telematics devices across the M&HCV segment is gathering momentum. For instance, Class 7 and Class 8 trucks in North America and Europe already have factory-fitted telematics as a standard feature with this trend set to extend in time to Class 3 to Class 6 CVs and other regions as well. For OEMs, factory-installed telematics hardware translates to control over vehicle data and, therefore, the ability to deliver a superior value proposition to customers. This is resulting in more partnerships between third-party vendors and OEMs, such as the recent one between Daimler and video telematics solutions provider, Lytx.

Acute driver shortages, the need for continuous driver training across multiple functions such as vehicle inspection, and the demand for in-vehicle driver health monitoring solutions has spurred a shift from vehicle-oriented to driver-focused telematics solutions. This is underlining the appeal of targeted telematics solutions that alleviate the burden of more peripheral tasks like order and workflow management or of driver health dashboards that can monitor a driver’s health or that automatically alert first responders in case of an emergency.

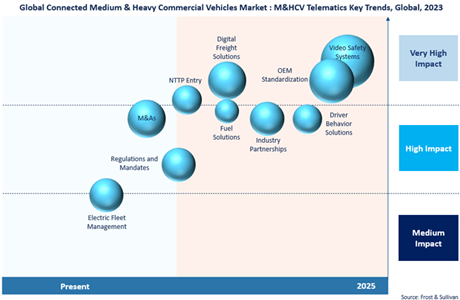

Key Trends in M&HCV Telematics, Global, 2023

Increasing competition will trigger mergers & acquisitions and partnerships

Large, well-established companies dominate the M&HCV telematics market, although there has been an increasing influx of technology companies whose expertise can be effectively leveraged in the connected CV space.

Currently, TSPs like Geotab, Verizon Connect, Solera Omnitracs, Solera, Webfleet Solutions, Samsara, Lytx, and Michelin Connected Solutions are battling it out with OEMs like Daimler, Volvo, Paccar, Traton, Scania, and Navistar for a share of M&HCV telematics revenues. As competition heats up, mergers & acquisitions and partnership strategies will become common. TSPs will partner with technology start-ups to build on complementary capabilities. Automotive insurance, data and application service providers will partner with OEMs in an attempt to capture telematics revenues. OEMs will acquire TSPs, such as Michelin’s acquisition of European fleet telematics leader Masternaut, and its subsequently rebrand as Michelin Connected Solutions. The use of innovative AI applications will impel partnerships between OEMs and TSPs with software-as-a-service (SaaS) providers and AI companies.

Meanwhile, aftermarket players will bank on their technological expertise and comprehensive, end-to-end solutions continue to retain their prominence in the M&HCV telematics market.

Our Perspective

OEMs and telematics vendors will need to collaborate on innovative solutions that support driver health, safety, and performance. This could take the form of driver-centric gamification features aimed at improving driving behavior, providing incentives to reward safe and efficient driving patterns, incorporating voice-based, in-vehicle services, or offering health monitoring solutions that track driver fatigue or stress.

OEMs across North America and Europe will increasingly install video dashcam systems in their production lines. This will open new opportunities for dashcam and video solutions providers. Cost-effective AI and ML dashcams and video telematics systems will see rapid adoption. To leverage expanding growth potential in the automotive video telematics arena, partnerships, investments and M&A will become crucial.

Finally, telematics proliferation will highlight the need for ecosystem collaboration. OEMs will need to partner with TSPs and other stakeholders to design data-driven fleet management solutions that deliver added value for fleet owners and operators.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility