While fuel cell electric vehicles (FCEVs) and battery electric vehicles (BEVs) are long-term solutions, H2ICE technology offers fleet operators an immediate, practical solution to balancing economic and emissions considerations.

The trucking industry in North America and Europe is at a crossroads, balancing the imperative for lower emissions with the economic realities of transitioning from traditional diesel-powered engines. While battery electric vehicles (BEVs) have dominated the discourse on zero-emission transport, hydrogen-powered alternatives are emerging as viable solutions, particularly in the heavy-duty trucking segment. Hydrogen Internal Combustion Engine (H2ICE) trucks offer the global freight industry a path to transition to low emissions, while avoiding the infrastructural challenges associated with BEVs.

Recent developments highlight this shift. In March 2024, Tata Motors launched India’s first hydrogen-powered truck trials, deploying 16 H2ICE and fuel cell electric vehicles (H2FCEVs) on key freight routes. This is reflective of a larger, global trend of growing interest in hydrogen-powered solutions. Moreover, challenges with electric truck adoption, ranging from high costs to limited infrastructure, have increased the appeal of hydrogen-powered alternatives.

Hydrogen vs. Diesel vs. Electric: The Battle for the Future

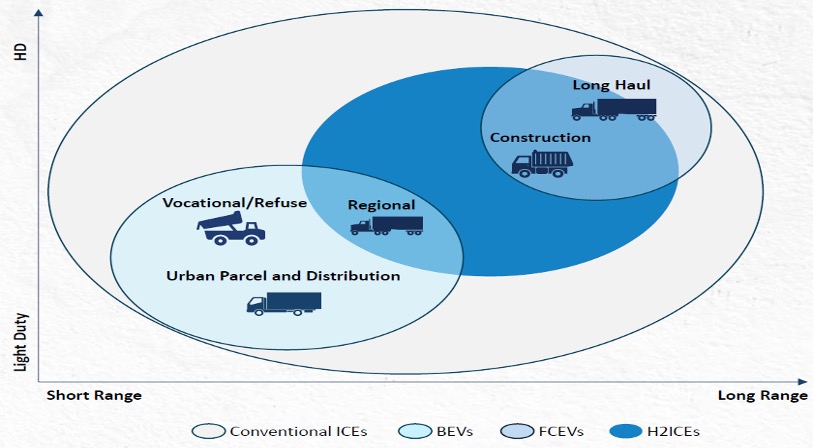

Source: Frost & Sullivan

H2ICE trucks occupy a unique position between traditional diesel trucks and electric trucks. While diesel trucks remain the most cost-effective in terms of upfront expenses, they are increasingly being phased out due to stringent emissions regulations. Electric trucks, on the other hand, offer zero emissions but face challenges in range, payload capacity, and charging infrastructure. H2ICE trucks present a middle ground by leveraging hydrogen as a clean fuel while maintaining many operational similarities with conventional ICEs.

In terms of environmental impact, H2ICE trucks offer near-zero carbon emissions, significantly reducing nitrogen oxide (NOx) pollution compared to diesel trucks. While electric trucks provide the cleanest solution, they require substantial investments in grid infrastructure and charging stations. Furthermore, hydrogen refueling stations can be integrated into existing fuel distribution networks, making H2ICE trucks more adaptable to current logistics operations. In terms of cost, H2ICE trucks demand a lower price premium than BEVs, making them an attractive short-to-medium-term alternative as the industry transitions toward a greener future.

Long-term viability remains a critical consideration. Diesel trucks are in decline, with regulations gradually forcing them out of the market. H2ICE trucks are expected to gain traction over the next decade before tapering off in favor of FCEVs and BEVs. Meanwhile, BEVs will continue to grow steadily as technology advances support lower costs and improved efficiency.

To learn more, please see: Hydrogen Internal Combustion Engine Truck Market, North America and Europe, 2024–2034, or contact sathyanarayanak@frost.com for information on a private briefing.

Wide Range of Use Cases

Source: Frost & Sullivan

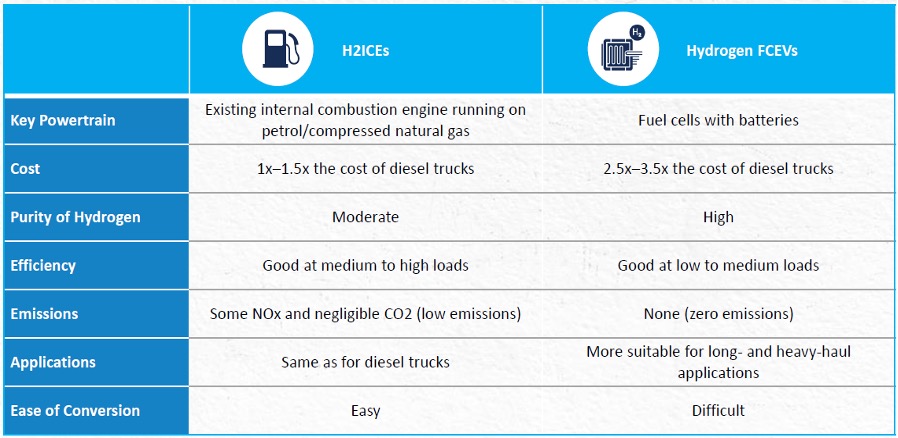

Unlike electric trucks, which are most effective in urban and short-haul operations, H2ICE trucks offer extended range and quicker refueling times, making them ideal for long-haul and regional transportation.

Industries that require continuous operation and heavy payload capacities—such as construction, cargo transport, and cold-chain logistics—stand to benefit from H2ICE technology. Long-haul applications include transportation between warehouses, port-to-hub logistics, and large-scale distribution networks. In regional haul, H2ICE trucks can effectively support supermarket supply chains, white goods transportation, and parcel delivery services. Furthermore, municipal applications such as refuse collection and vocational transport present promising opportunities for early adoption.

A key factor in widespread deployment is the availability of hydrogen refueling infrastructure. While current refueling networks are limited, ongoing investment in hydrogen production and distribution, especially in Europe, indicate that accessibility will improve. The success of H2ICE trucks will largely depend on coordinated efforts among OEMs, policymakers, and fuel suppliers to create an efficient hydrogen ecosystem.

Heavy-Duty Applications to Dominate

The H2ICE truck market is poised for exponential growth between 2025 and 2034, with sales projected to increase more than 61-fold, reaching over 23,600 units across North America and Europe. North America is expected to account for 53% of these sales, primarily due to the region’s existing fuel infrastructure and a cautionary approach toward immediate electrification.

Heavy-duty applications will dominate H2ICE truck adoption, representing over 96% of total sales. Major OEMs, including Mercedes-Benz Trucks, Cummins, Volvo Trucks, Kenworth, Peterbilt, Ashok Leyland, and MAN Trucks, are investing in H2ICE technology as regulatory support for low-emission alternatives strengthens.

In North America, growth will be driven by the relative ease of converting existing natural gas and diesel engines to hydrogen combustion, providing fleet operators with a cost-effective solution amid increasing emissions regulations. Meanwhile, in Europe, adoption will be accelerated by stringent low-emission mandates and aggressive hydrogen infrastructure expansion. The European Union’s push toward green hydrogen production, as part of its transport decarbonization efforts, will further support H2ICE viability.

Our Perspective

H2ICEs represent a strategic bridge in the transition toward zero-emission trucking. While FCEVs and BEVs are long-term solutions, H2ICE technology offers an immediate, practical alternative by leveraging existing infrastructure and minimizing transition costs for fleet operators.

In the short-to-medium term, H2ICE trucks will play a crucial role in expanding hydrogen adoption, stimulating demand for refueling stations, and strengthening the broader hydrogen economy. The competitive advantages of H2ICE—affordable price premiums, operational familiarity, and flexible fueling—position it as a viable alternative for fleets hesitant to commit fully to BEVs or FCEVs. However, long-term competitiveness will depend on hydrogen fuel costs and refueling infrastructure expansion. As BEV and FCEV prices decline and energy efficiency improves, H2ICE trucks may eventually cede ground to fully zero-emission alternatives.

For OEMs, the next decade presents a window of opportunity to capitalize on H2ICE while laying the groundwork for future FCEV and BEV integration. Strategic partnerships in hydrogen production, distribution, and refueling infrastructure development will be key to ensuring long-term success. By balancing investments across H2ICE, FCEVs, and BEVs, manufacturers can navigate industry shifts while maintaining technological leadership.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility