Establishing a stronger domestic production base could not only reduce dependence on imports but also position the GCC as a regional export hub.

By Gnanaprakash Shanmugam, Industry Analyst – Mobility

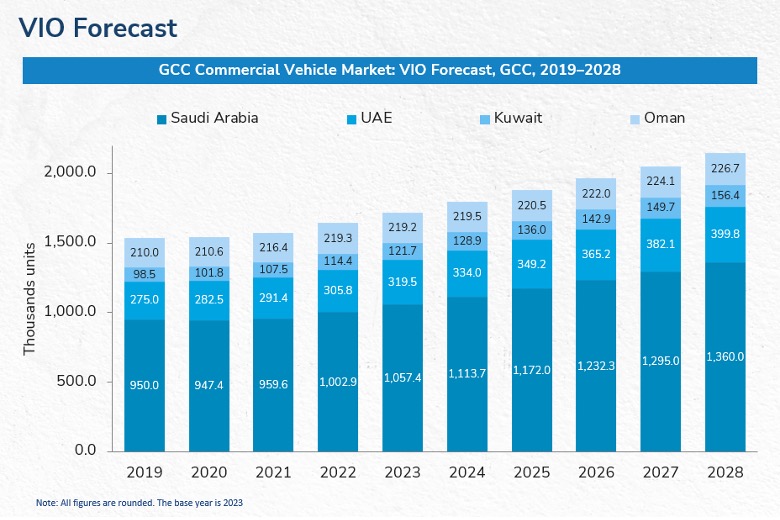

The Gulf Cooperation Council (GCC) commercial vehicle (CV) market has witnessed steady growth in recent years, driven primarily by rising demand for light commercial vehicles (LCVs) and the increasing need for medium commercial vehicles (MCVs) and heavy commercial vehicles (HCVs) in freight transport and large-scale infrastructure projects. The market is heavily reliant on vehicle imports, but opportunities for local manufacturing are gaining traction. Establishing a stronger domestic production base could not only reduce dependence on imports but also position the GCC as a regional export hub, leveraging its strategic location and advanced logistics infrastructure.

Market expansion is receiving a fillip from the push for economic diversification. As GCC nations invest heavily in infrastructure, construction, transport networks, and industrialization, CV demand will continue to rise.

Saudi Arabia remains the largest market within the GCC for new and used CVs as well as automotive parts. It is also the leading importer of automotive products from the United States, with a notable portion re-exported to other nations. Meanwhile, Chinese and Indian manufacturers are gaining ground, offering competitively priced alternatives that cater to the region’s evolving market needs.

To learn more, please access: Commercial Vehicle (CV) Market, Gulf Cooperation Council, 2024–2028 or contact sathyanarayanak@frost.com for information on a private briefing.

Chinese Manufacturers Gain Prominence

One of the most notable trends impacting the region’s CV market is the rise of Chinese and Indian manufacturers, who are making significant inroads due to their cost-effective offerings and product innovation. Chinese CVs, in particular, are gaining popularity due to their adaptability to the region’s challenging climatic conditions and affordability, compelling traditional market leaders to adjust their pricing and product strategies. Indian manufacturers, such as Ashok Leyland, have also expanded their footprint, with nearly 40% of the company’s exports now directed to the GCC.

Another crucial trend is the region’s increasing emphasis on local manufacturing and supply chain optimization. Global CV brands such as Isuzu and Dongfeng are expanding their regional distribution networks to enhance delivery efficiency and reduce costs. The GCC’s reliance on vehicle imports has long been a challenge, but domestic assembly and manufacturing initiatives are set to change this landscape. Saudi Arabia, which already has 160 local automotive manufacturers producing parts, accessories, and trailers, is leading this effort. As local production scales up, reliance on imports is expected to decline, fostering a more self-sufficient automotive ecosystem.

Meanwhile, the region’s economic diversification strategies are stimulating CV demand. With governments investing heavily in transport and logistics infrastructure, the market is set for sustained expansion. Such trends are being accelerated by mega projects such as Saudi Arabia’s Neom Project, Jeddah Central, the GCC Railway, Red Sea Project, Sultan Haitham City, and Mohammed Bin Rashid City.

Competitive Pricing and Improved Quality Underpin Dominance of Asian Manufacturers in LCV Segment

The GCC CV market is dominated by well-established Japanese and European brands, particularly in the heavy commercial vehicle (HCV) segment. Companies such as Daimler, Mitsubishi Fuso, Hino, Isuzu, Scania, and SinoTruk hold strong market positions, with European manufacturers favored in the premium HCV category. However, in the LCV segment, Asian brands—especially from China, Japan, and India—are steadily gaining dominance, driven by competitive pricing and improved vehicle quality.

Saudi Arabia continues to be the region’s automotive hub, accounting for the largest share of commercial vehicle sales, parts imports, and re-exports. Meanwhile, rising diesel prices—such as the 53% increase in Saudi Arabia—are affecting truck demand, as businesses reassess the total cost of ownership. This has led to growing interest in alternative powertrains, including electric and hybrid, which are expected to play a larger role in fleet operations in the near future.

Furthermore, government policies supporting local manufacturing are reshaping the competitive landscape. Both Saudi Arabia and the UAE are implementing initiatives to encourage domestic production, reducing import duties and transportation costs. This shift is expected to make locally assembled CVs more cost-competitive, prompting international OEMs to collaborate with local manufacturers to streamline supply chains and optimize distribution networks.

Our Perspective

Source: Frost & Sullivan

One of the most significant growth drivers of the GCC CV market will be the increasing number of giga projects across the region. Large-scale infrastructure initiatives, including new bridges, roads, airports, and ports, will generate strong demand for HCVs.

Local manufacturing will present another key opportunity. GCC governments, keen to establish a robust domestic automotive industry, will reduce their reliance on imports while leveraging the region’s strategic location as a global logistics hub. Accordingly, companies that invest in local production will benefit from lower import costs, reduced supply chain risks, and enhanced market competitiveness. This will be particularly advantageous for OEMs that collaborate with regional suppliers to strengthen their value chain.

Technological advancements will also play a crucial role in determining market trajectory. The adoption of telematics and fleet management solutions is growing, with government mandates in Dubai and Abu Dhabi requiring their installation in HCVs. Leading OEMs such as Isuzu, Nissan, and Volvo have already integrated telematics into their fleets, optimizing route planning, reducing fuel consumption, and improving operational efficiency. Looking ahead, the ability to offer customizable telematics solutions tailored to specific industries—such as logistics, construction, and oil and gas—will provide OEMs with a competitive edge.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility