Stakeholders seek to navigate market volatility and changing customer behaviors

The $340 billion off-highway equipment industry, comprising key segments such as construction, mining, and agricultural equipment, plays a crucial role in global infrastructure, food production, manufacturing, and mineral extraction. Over the past two years, economic uncertainty fueled by supply chain disruptions, inflation, and geopolitical tensions has significantly altered customer behaviors. Rising input costs and shrinking profit margins have resulted in more cautious equipment purchases across all three crucial end-user sectors. The agricultural sector has been particularly hard hit, as reflected in a sharp decline in tractor sales.

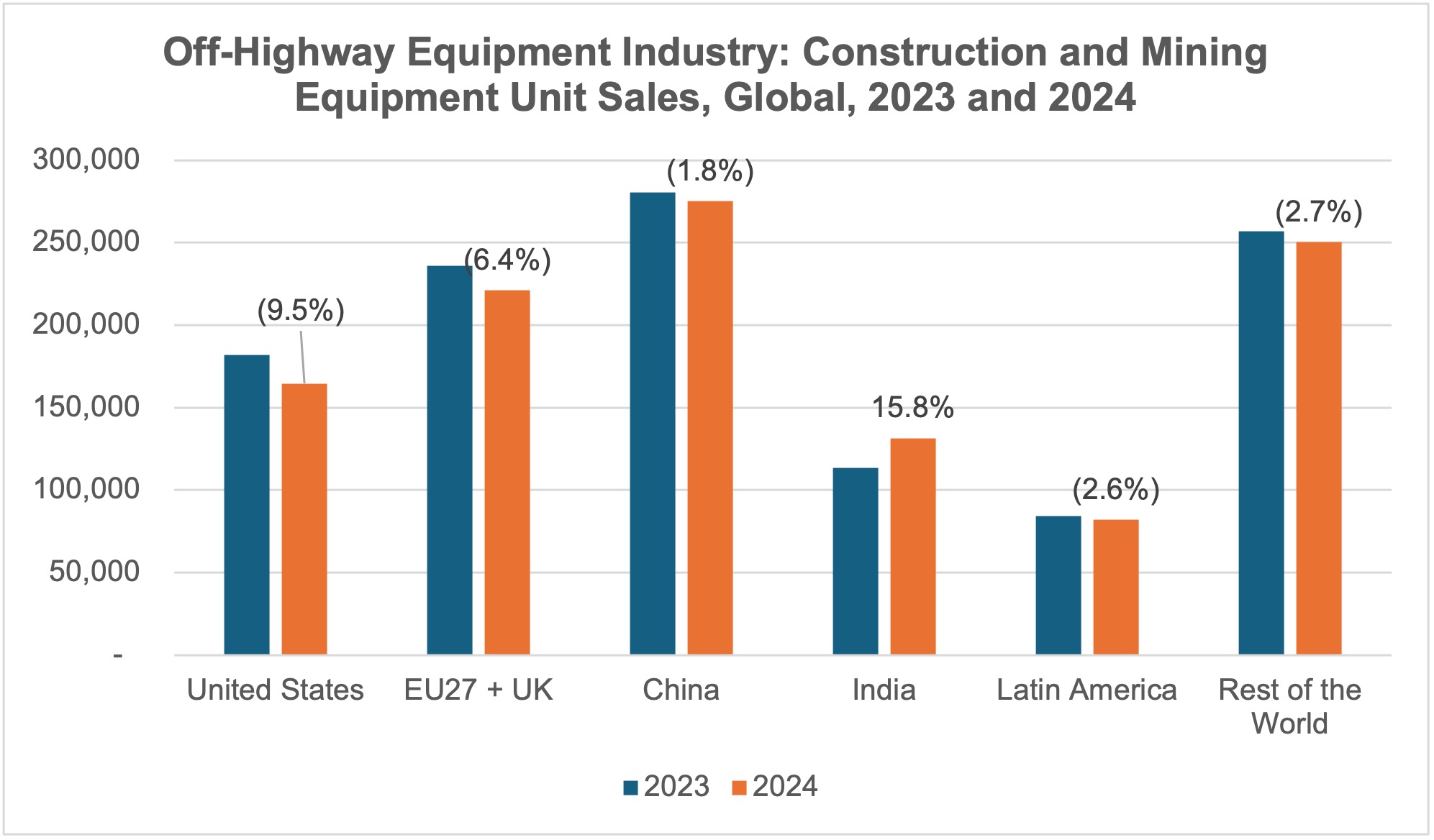

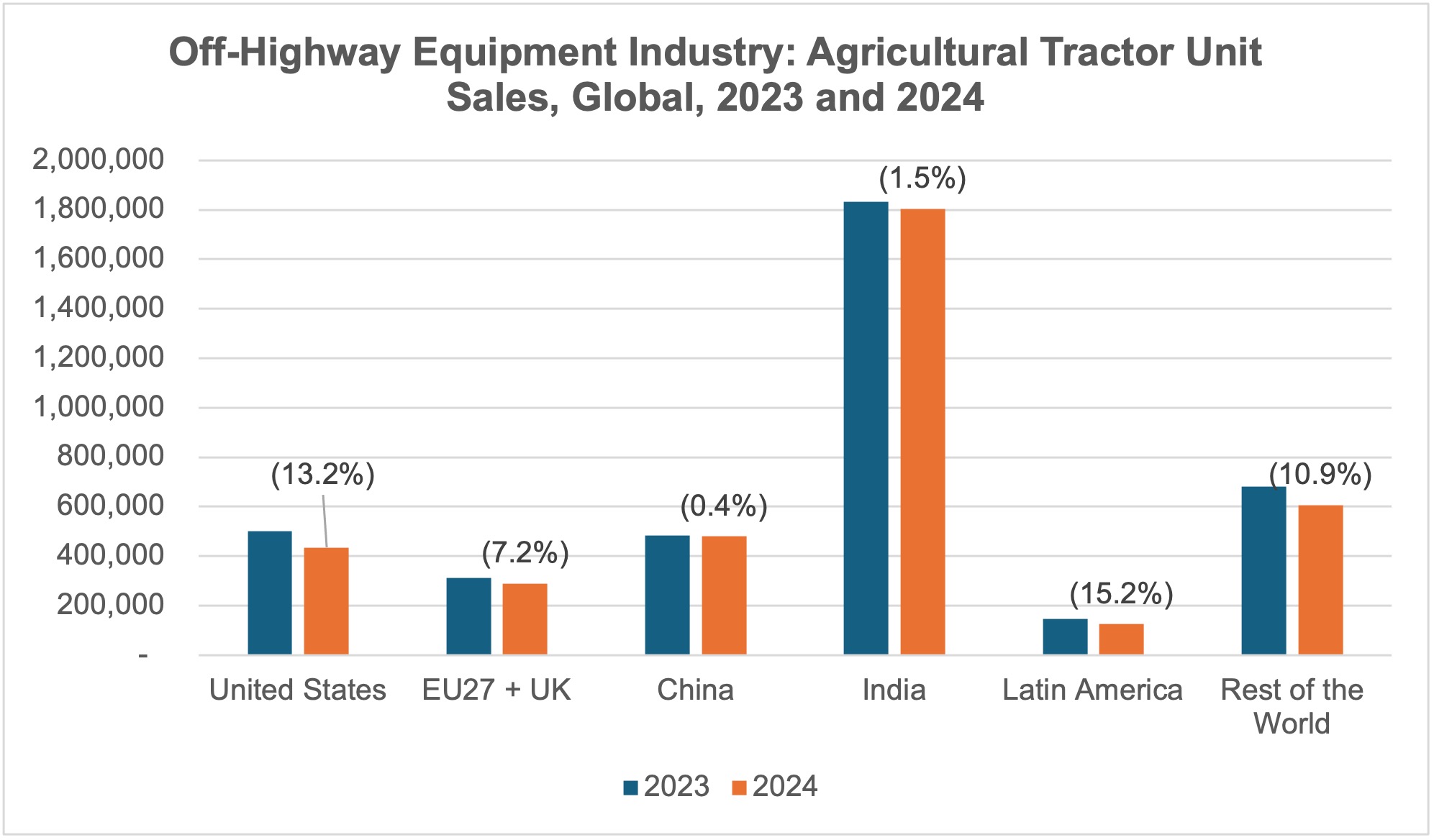

Note: Numbers in the chart’s parenthesis indicate 2023-2024 year-on-year growth / decline.

Agricultural Equipment: Demand Revival in Europe to Offset Subdued Sales in the U.S.

Agricultural tractors, which account for approximately 87% of total agricultural equipment in operation, saw a 5.4% drop in global unit sales in 2024. This decline stemmed from falling demand in major markets, including Latin America, the U.S., and Europe. Ongoing trade challenges and economic uncertainties are expected to further impact sales, with the U.S. being the most affected. The delayed passage of the Farm Bill has already led to a 15.8% decline in total agricultural tractor sales in January 2025 (compared to January 2024). This trend is likely to be exacerbated by new tariff regimes under the Trump administration, set to take effect in April, which will influence equipment prices, investment decisions, and company profitability in the short term. Additionally, tariffs imposed by the U.S. government on Canada, Mexico, and China would invite retaliatory measures from these countries, further straining the agricultural industry, leading to increased operational costs and suppressed demand.

In Europe, the agricultural industry is expected to recover from its slowdown, with an anticipated uptick in orders in the latter half of 2025. The European Agricultural Machinery Association (CEMA) has reported an increase in industry confidence across nearly all European markets. However, unpredictable weather conditions and persistent economic uncertainty remain obstacles to sustained growth in agricultural equipment sales.

Construction & Mining Equipment: Positive Outlook to be Driven by Technology-led Innovation

The construction sector has similarly experienced a downturn in most markets, except in India where construction and mining machinery sales have surged due to infrastructure investments and order backlogs. While India is likely to see a slowdown in 2025, other global markets are expected to stabilize and return to growth, driven by investments in residential and infrastructure development. Despite ongoing economic volatility, continued investments in construction and greenfield mineral exploration projects are expected to sustain steady demand for equipment.

Note: Numbers in the chart’s parenthesis indicate 2023-2024 year-on-year growth / decline.

In Europe, road and bridge infrastructure initiatives, coupled with residential construction activity, will influence equipment purchasing cycles among contractors. Demand for compact equipment—particularly mini excavators and mini track loaders—is expected to remain strong, as dealers expand their rental fleets to meet contractor needs. The increasing acceptance of rental equipment by owner-operators is projected to be a key driver of construction equipment growth in 2025.

Despite economic headwinds, several positive factors are shaping a bright outlook for the global construction and mining equipment market. The evolution of digital solutions, machine control technologies, and real-time access to critical machine data across the construction sector value chain is expected to boost contractor confidence in equipment investments. A digitally connected marketplace will further accelerate construction and mining equipment sales, reinforcing overall resilience amid ongoing economic fluctuations.

Frost & Sullivan’s team of off-highway experts will be sharing their insights on the latest trends and opportunities in the off-highway equipment industry at bauma 2025, the premier trade event for Construction Machinery, Building Material Machines, Mining Machines, Construction Vehicles, and Construction Equipment. To book an appointment with our experts, please contact: Sven.Thiede@frost.com (Europe) or Ajit.Swaminathan@frost.com (Americas).