While false positives remain a challenge, digital twins, over-the-air (OTA) updates, and ongoing innovations in AI and machine learning (ML) are transforming fleet maintenance by enhancing efficiency, reducing costs, and improving vehicle reliability.

By Nikhil Pradyot Phadke, Industry Analyst – Mobility

The commercial vehicle (CV) predictive maintenance industry is rapidly evolving, driven by advancements in real-time data analytics, artificial intelligence (AI), and machine learning (ML). Prognostics is emerging as a game-changer, enabling fleet operators to predict vehicle component failures and optimize maintenance schedules. This will support significantly reduced operational costs and enhanced vehicle uptime, addressing inefficiencies inherent in traditional maintenance strategies. By 2029, revenues generated from predictive maintenance solutions in North America, Europe, and India are projected to reach $428 million, highlighting the market’s immense growth potential.

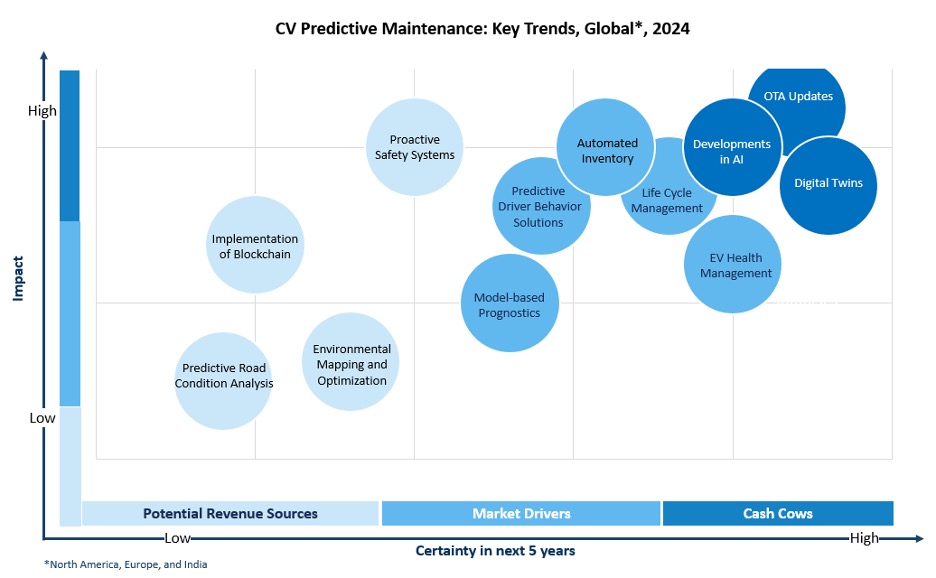

Digital Twins, Over-the-Air Updates, AI Applications to Emerge as Major Revenue Spinners

Trends such as the integration of digital twins with sensor fusion are shaping the CV predictive maintenance landscape. This technology allows real-time data to be incorporated into virtual model simulations, improving decision-making and vehicle performance optimization. Leading original equipment manufacturers (OEMs) such as Volvo, Daimler, and PACCAR have implemented digital twins in the manufacturing phase to enhance vehicle design and efficiency. Companies like TRATON (Scania) and telematics service providers (TSPs) are integrating digital twin technology into predictive maintenance, enabling precise, real-time prognostics. India’s Intangles, a pioneer in this space, has successfully incorporated digital twins into commercial maintenance solutions.

Over-the-air (OTA) updates represent another major advancement, transforming vehicle maintenance by enabling remote diagnostics and software updates without requiring physical workshop visits. Traditionally, trucks require 10–12 software updates annually, and OTA updates facilitate seamless, timely installations, preventing unnecessary downtime. OEMs such as Scania, Volvo Trucks, and Daimler, along with TSPs like Motive, Geotab, and Michelin, are enhancing their offerings with OTA capabilities. This technology is instrumental in minimizing warranty claims and reducing downtime by 2–3%, ensuring higher operational efficiency.

Another major trend is the growing application of deep learning and AI in CV maintenance. The growing technological complexity of modern trucks has resulted in a surge in diagnostic trouble codes (DTCs), creating an urgent need for skilled technicians. However, a shrinking pool of skilled professionals is underlining the importance of automation and standardization. AI-powered prognostic solutions facilitate automated fault code interpretation, enabling accurate diagnosis and predictive health management. Key applications include predictive lifecycle management, automated maintenance scheduling, fault code analytics, parts inventory management, and remote diagnostics. The adoption of such AI-driven systems is expected to accelerate as technological advancements increase their accuracy and reliability.

To learn more, please access, Commercial Vehicle (CV) Predictive Maintenance Industry, North America, Europe, and India, 2024–2029, Connected Off-highway Equipment Market, Global, 2024–2030, or contact sathyanarayanak@frost.com for information on a private briefing.

Strategic Partnerships between TSPs and Specialized Prognostics Firms to Drive Market Expansion

Strategic partnerships between TSPs and specialized prognostics firms are playing a pivotal role in the market’s expansion. While large TSPs dominate the telematics market, they often lack the specialized expertise required for high-accuracy predictive analytics. Conversely, dedicated prognostics firms, despite their expertise in AI-driven diagnostics, struggle with market penetration due to limited distribution networks. Collaborative partnerships between TSPs and analytics firms provide mutual benefits: TSPs can improve their service portfolios with sophisticated predictive solutions, while analytics firms gain wider market access. For instance, Uptake has established partnerships with leading TSPs such as Samsara, Geotab, Platform Science, and Trimble, strengthening its presence in the predictive maintenance ecosystem.

Despite its potential, widespread adoption of prognostics in CVs faces challenges. High false-positive rates in bumper-to-bumper predictive maintenance solutions have slowed adoption among fleet operators and OEMs. Frequent false alarms create inefficiencies, limiting the trust and practicality of these solutions. Addressing this challenge requires further advancements in AI and ML algorithms to enhance diagnostic accuracy. Once false-positive rates decline, fleet owners are expected to embrace full-scale prognostics, unlocking substantial cost savings and operational efficiencies. As predictive technologies improve, an industry-wide inflection point is anticipated, where high-accuracy solutions drive accelerated adoption and market expansion.

Intense Competition, Collaboration, and Specialization Mark Competitive Landscape

The CV predictive maintenance market is characterized by intense competition, with leading players such as Uptake, Pitstop, Preteckt, Daimler, and Volvo holding significant market shares. Advanced predictive analytics capabilities and strategic alliances with TSPs have positioned Uptake ahead of competitors like Pitstop and Preteckt. Other notable players include Intangles, Stratio, AWAKE Mobility, and TWAICE.

In North America, Europe, and India, OEMs have secured approximately 24% of the market, with a stronger presence in Europe, where they account for 40% of the predictive maintenance segment. Volvo and Daimler are at the forefront of OEM-driven prognostic solutions, though their offerings remain relatively basic to mitigate false-positive risks. In India, Intangles dominates with a commanding 60% market share, largely due to its pioneering digital twin technology.

The market is also witnessing increased specialization, with companies like TWAICE focusing on battery prognostics and Michelin advancing connected tire solutions. This trend has led to a fragmented landscape where application-specific solutions cater to targeted maintenance needs. Recent developments underscore the industry’s dynamism. For instance, Uptake has strengthened its market presence through TSP collaborations, while Intangles continues to leverage digital twin technology to refine its predictive capabilities. Meanwhile, tech firms are investing in augmented deep learning algorithms to boost diagnostic accuracy and drive greater adoption.

Our Perspective

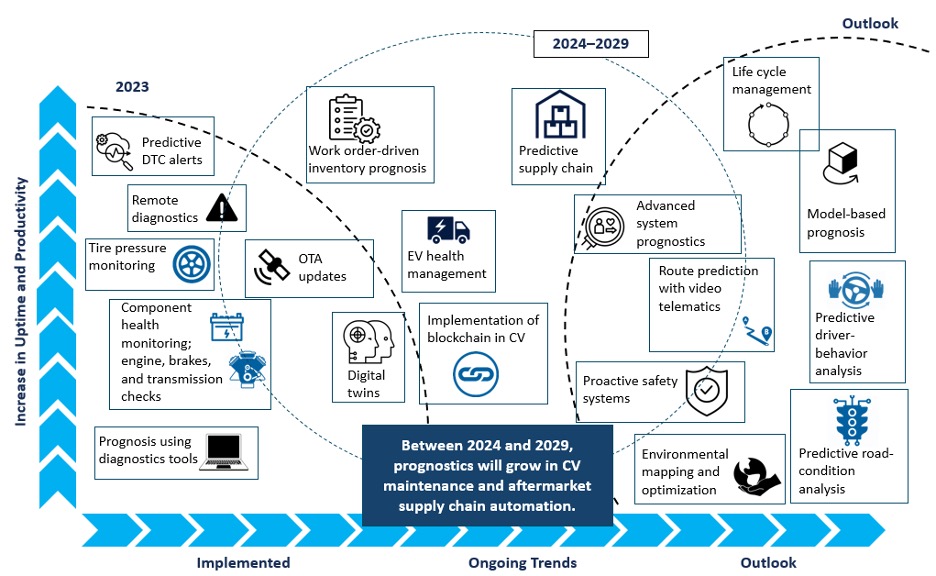

Scope of Prognostics in CVs across the project timeline

The evolution of prognostics in the CV market is set to redefine the maintenance ecosystem with technologies such as digital twins, OTA updates, and advanced component monitoring. Integrating predictive analytics with automated inventory tracking systems, reinforced by automated work order management, will support streamlined workflows. Overall, such innovations will upturn traditional business models while reducing operational downtime, lowering maintenance costs, and improving vehicle lifecycle efficiencies.

The emergence of Prognostics as a Service (PaaS), which enables fleet operators to subscribe to tailored prognostics solutions rather than investing in full-scale implementations, will emerge as a key growth opportunity. Given ongoing challenges with false positives, most fleet owners prefer application-specific monitoring, focusing on critical vehicle components. PaaS will address this by offering flexible, subscription-based plans, reducing upfront costs and expanding accessibility.

Meanwhile, advancements in AI and ML prognostics models will minimize false positives while providing actionable insights, leading to increased confidence among fleet operators. Moreover, the integration of AI-driven chatbots, interactive dashboards, and real-time analytics will improve user experience, enabling fleet managers to make informed decisions more effectively. Additionally, collaborations between software providers, OEMs, TSPs, and prognostics firms will refine predictive maintenance ecosystems, ensuring seamless data integration and technological advancements across the industry.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility