The integration of artificial intelligence (AI) and machine learning (ML) into telematics systems and video safety solutions are set to promote safety, sustainability, and optimized performance.

Connected technologies are set to significantly transform fleet management, particularly within the commercial vehicle sector. The integration of advanced analytics and artificial intelligence (AI) is poised to elevate telematics systems, offering fleet operators real-time insights that drive efficiency and sustainability.

The growth of the global connected truck telematics industry will be further propelled by a combination of regulatory mandates and the pursuit of operational efficiency. In North America, the enforcement of Electronic Logging Device (ELD) regulations has made telematics adoption a necessity for fleet operators. Similarly, the Smart Tachograph mandate in Europe underscores the importance of telematics systems for compliance, while also highlighting the potential return on investment (ROI) through improved efficiency, fuel savings, and environmental benefits.

The demand for greater operational efficiency across industries is a central factor fueling the adoption of telematics solutions. Companies are increasingly focused on optimizing fleet performance, reducing fuel consumption, and minimizing their environmental impact. Telematics systems enable real-time fleet monitoring and management, which translates into substantial cost savings and lower emissions, aligning with global sustainability objectives.

To learn more, please see: Global Connected Truck Telematics Outlook, 2024, Growth Opportunities in the South African Connected Truck Telematics Industry, Global Connected Medium & Heavy Commercial Vehicles Growth Opportunities, Growth Opportunities in European Heavy-duty Electric Trucks, or contact [email protected] for information on a private briefing.

Innovative Technologies to Transform Market Dynamics

Several key trends are expected to influence the connected truck telematics market in 2024 and beyond. A notable development is the convergence of telematics with cutting-edge technologies like edge computing and video telematics. This integration promises to unlock new possibilities for data-driven decision-making and enhance security within the connected truck ecosystem. Additionally, the adoption of AI and machine learning (ML) is becoming increasingly widespread, as companies strive to incorporate these technologies into various applications, such as predictive maintenance, freight matching, and video safety solutions.

The evolution of autonomous vehicles and platooning technologies is another major trend poised to reshape the future of trucking. These innovations require advanced telematics systems for seamless integration and operation, driving demand for more sophisticated and reliable solutions. As a result, Tier 1 suppliers and original equipment manufacturers (OEMs) are expected to dominate the telematics hardware market, with many expanding their focus to include software-as-a-service (SaaS) offerings that complement their hardware products.

Figure 1: Top Connected Truck Telematics Trends in 2024

Focus on Comprehensive Solutions Portfolio and Targeted Regional Growth Strategies

Despite the positive outlook for connected truck telematics, several challenges related to telematics—data privacy, interoperability, and cybersecurity, among them—could hinder widespread adoption. To mitigate these risks, industry stakeholders, policymakers, and technology providers must collaborate to establish robust standards and protocols that protect data while ensuring seamless integration across diverse systems and platforms.

Meanwhile, market participants are expected to implement a variety of strategies to remain competitive. Building a strong brand identity as a comprehensive, one-stop solutions provider will be crucial, as fleets increasingly prefer integrated solutions offering a broad range of capabilities. Collaborations with AI enablers and other technology partners will be essential for expanding AI capabilities and developing innovative applications within the telematics ecosystem. Additionally, companies will need to tailor their strategies to different regions, as market conditions and customer preferences vary significantly across North America, Europe, Asia-Pacific, and other regions.

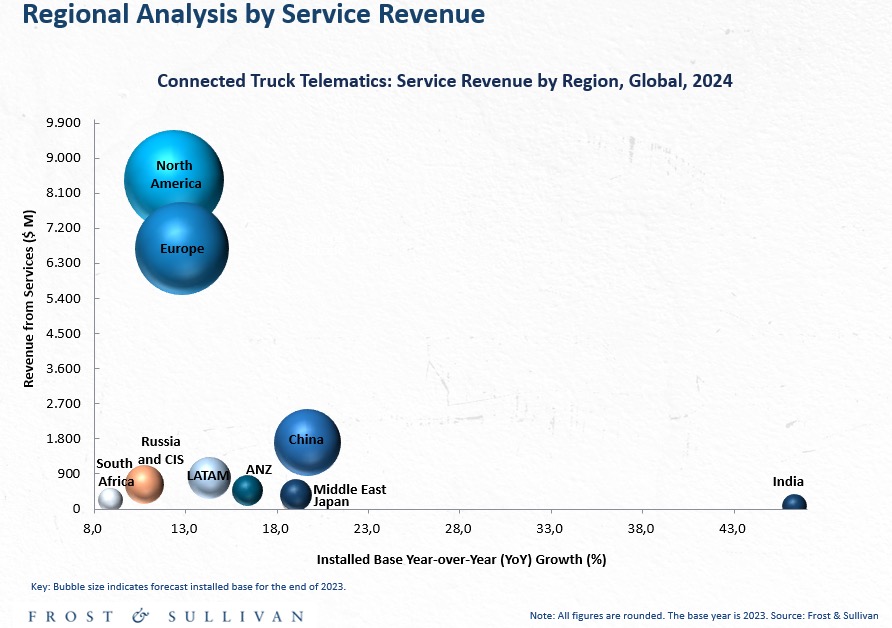

Variations in Regional Outlook

The connected truck telematics market is set to grow at varying rates across different regions. In North America, robust growth is expected, driven by the increasing adoption of video and electric vehicle (EV) telematics. The video telematics sector alone is projected to grow by over 30%, supported by upselling strategies and partnerships with AI vendors.

Figure 2: Service Revenue by Region, Global, 2024

Europe’s market will expand steadily, despite challenges such as slowing GDP growth and declining road freight volumes. Key drivers include stringent emissions mandates, Global Safety Regulations, rising demand for SaaS solutions, and the ongoing electrification of fleets.

India is emerging as a high-growth market due to the disruption caused by new technology companies and start-ups offering low-cost hardware, affordable services, and innovative solutions. The introduction of GPS-based toll systems and AIS-140 regulations will further accelerate growth, particularly in entry-level solutions.

In Latin America, rising fuel prices over the past three years have made fuel management solutions crucial in this cost-sensitive region. As a result, there is growing adoption of AI-controlled hardware and video solutions among large fleets, driven by the need for cost optimization.

Russia’s truck market experienced strong sales in 2023, dominated by local and Chinese OEMs, which is likely to drive increased telematics adoption in 2024.

South Africa presents a challenging environment for foreign companies due to unfavorable regulatory frameworks, infrastructure issues, intense competition, and supplier network problems. These factors are expected to lead to underperformance in the telematics industry.

In the Middle East, the adoption of video and AI dashcams is anticipated to surge. Success will hinge on strong local distributor networks, strategic positioning, and regional reach. OEM digitization efforts and interest from North American and European companies will further contribute to market growth.

The Asia-Pacific region is witnessing a rise in cloud-based SaaS solutions, with OEMs increasingly offering telematics units as standard on heavy commercial vehicles. Australia and New Zealand remain key expansion areas for Western TSPs, benefiting from minimal entry barriers and a favorable business environment, particularly for video solutions.

Our Perspective

The video safety solutions industry is anticipated to exceed $900 million by the end of 2024, driven by its versatile applications and strong ROI. Significant adoption is expected in Europe, Brazil, and Mexico, with North America also gaining momentum. Low-cost video dashcams with essential safety features are poised to thrive in emerging markets like Brazil, Mexico, India, ANZ, and the Middle East.

Sustainability remains a key priority, especially in Europe and North America, as fleets increasingly aim for carbon neutrality. To achieve this, TSPs must incorporate sustainability into their core strategies, enabling fleets to adopt practices that not only reduce emissions but also deliver measurable operational benefits. Leveraging connected vehicle data will be critical in driving these sustainable mobility solutions.

The integration of AI and ML into telematics systems is becoming the industry standard, offering enhanced capabilities such as predictive analytics, video safety assessments, freight matching, and risk prediction. To stay competitive, businesses should actively pursue partnerships with AI vendors or develop in-house teams dedicated to creating AI-driven SaaS platforms. These strategies will ensure that companies remain at the forefront of innovation, providing advanced, data-driven solutions to their clients.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility