As the automotive industry evolves, so is the need for advanced diagnostic solutions that keep pace with increasingly complex vehicles. Diagnostics-as-a-Service (DaaS) has emerged as a groundbreaking business model offering significant benefits for automotive workshops, dealerships, and collision centers worldwide. By leveraging cloud-based diagnostics, remote troubleshooting, and OEM-level access to vehicle data, DaaS is setting new standards for efficiency and accuracy.

Evolving Automotive Diagnostics Landscape

Traditionally, automotive diagnostics relied on handheld tools that technicians used to scan vehicles for diagnostic trouble codes (DTCs). While these tools played a critical role in vehicle repairs, they presented several limitations. Workshops struggled to find the right tools for specific vehicle models, and investing in new devices for every update was costly. Moreover, the reliability of scanned DTC codes was often inconsistent, leading to inefficient repairs.

DaaS addresses these challenges by offering comprehensive, cloud-based diagnostic solutions that integrate OEM scan tools, guaranteed accuracy for scanned DTCs, and access to original equipment (OE) repair procedures. Through DaaS, technicians can now perform remote diagnostics, access real-time vehicle data, and utilize troubleshooting guidelines with the support of master technicians. This shift has streamlined the diagnostic process, reducing costs and improving accuracy for automotive service providers.

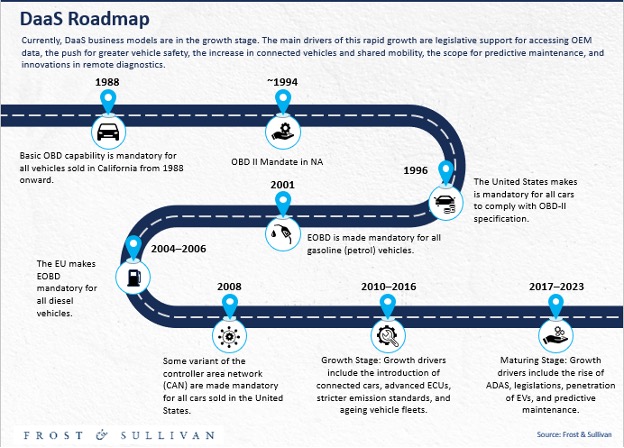

The model is currently in a rapid growth phase, driven by several key factors, including legislative support for accessing OEM data, the growing need for vehicle safety, the rise of connected vehicles, and the expansion of electric vehicle (EV) adoption. As these trends continue, DaaS is poised to become an integral part of the automotive repair industry.

To learn more, please access: DaaS Business Models in the Automotive Sector, NA & EU5, 2023-2030, or contact [email protected] for information on a private briefing.

Opportunities in EV Diagnostics and ADAS Calibration

The DaaS market is expected to generate significant revenue in the coming years, with predictions of reaching $3.28 billion by 2030. Collision centers currently represent the largest segment of DaaS-related revenue, while EV battery diagnostics is projected to experience the highest compound annual growth rate (CAGR) at 27.8%. As the number of used EVs increases, particularly with government incentives for EV purchases, the demand for EV diagnostics will continue to surge.

The State of Health (SoH) of an EV battery is becoming a critical metric, particularly in the used car market, where buyers need assurance regarding battery longevity. DaaS solutions are ideally positioned to address this need by offering robust diagnostics that provide accurate assessments of battery health. Furthermore, the EV30@30 campaign, which aims for 30% of all vehicle sales to be electric by 2030, and the European Union’s ban on ICE vehicles by 2035 are key drivers for the expansion of EV diagnostics within the DaaS framework.

In addition to EV diagnostics, the calibration of advanced driver assistance systems (ADAS) is becoming increasingly essential. As vehicles become more technologically advanced, ADAS systems—which include features like adaptive cruise control, lane-keeping assistance, and collision avoidance—require precise calibration to function correctly. DaaS enables workshops to perform ADAS calibration using OEM-standard procedures and tools, ensuring both safety and compliance. With ADAS penetration on the rise, DaaS services are set to play a pivotal role in maintaining vehicle safety and performance.

Ensuring Fair Access to Vehicle Data

One of the significant challenges facing the automotive repair industry is the growing complexity of vehicles and the need for access to proprietary vehicle data. Historically, independent repair shops have struggled to compete with OEM dealerships because of their limited access to this data. However, recent legislative changes are helping to level the playing field, promoting fair access to vehicle diagnostics for independent workshops and dealers.

Legislation like the Right to Repair Law in the U.S. and the EU’s Data Act ensures that independent repair shops can access OEM-level data, enabling them to provide the same high-quality diagnostics as dealerships. This regulatory framework is a significant driver of the DaaS business model, as it ensures that all service providers, regardless of size, can benefit from advanced diagnostic tools and data access. Additionally, these laws protect consumers by ensuring a competitive repair market, reducing costs, and improving vehicle safety.

Regional Expansion and Revenue Forecasts

As the DaaS market continues to evolve, North America currently leads in revenue generation, driven by widespread adoption among major multi-shop operators (MSOs). However, Europe—in particular, the EU5 of Germany, France, Italy, Spain, and the UK—is expected to experience faster growth due to technological advancements and the rapid expansion of leading DaaS providers in the region. By 2030, EV battery diagnostics revenue in North America and the EU5 is projected to reach $61.6 million, with battery management becoming essential for lease-end inspections, used car sales, and individual vehicle ownership.

The collision repair industry will remain a significant contributor to DaaS revenue, with estimates suggesting it will generate $1.26 billion in North America and $1.15 billion in the EU5 by 2030. The increasing complexity of ADAS calibration services poses challenges for independent repair shops, but with DaaS support, they can overcome these hurdles and capture a larger share of the market. Moreover, the integration of DaaS platforms with value chain providers such as insurance companies and mobility service providers is expected to drive further growth in the coming years.

Our Perspective

The rise of DaaS represents a paradigm shift in the automotive repair industry. By providing workshops, collision centers, and independent dealers with access to OEM data, cloud-based diagnostics, and remote troubleshooting, DaaS is transforming how vehicle repairs are conducted. The growth of EVs, the increased importance of ADAS calibration, and legislative support for fair data access all point to a bright future for the DaaS business model.

As the market continues to evolve, DaaS providers will need to innovate to stay ahead, particularly in areas such as predictive maintenance, real-time telematics, and cybersecurity. With revenue forecasts projecting significant growth, particularly in EV diagnostics and ADAS calibration, DaaS is set to become a cornerstone of the automotive industry, offering unparalleled opportunities for efficiency, accuracy, and customer satisfaction.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility