With new policy incentives set to create a more level playing field, Indian EV automakers will focus on investments, partnerships, and R&D to enhance local production capacity, boost domestic component sourcing, and expand enabling infrastructure.

New policy incentive policies by the Indian Government are set to energize the Indian electric vehicle (EV) market, while intensifying competition between domestic and international players. The market has made consistent gains in the aftermath of the pandemic with Frost & Sullivan estimating a CAGR of 34.45% from 2023 to 2030. Government support for clean mobility alternatives like EVs, technological advances in the form of improved range and battery efficiency, mounting environmental concerns, and volatile fuel prices are all providing a strong springboard for EV market growth in India.

While government incentives and technological improvements are pivotal, the market still faces hurdles such as inadequate charging infrastructure and high initial costs. Currently, EVs are priced on an average 25% higher than internal combustion engine (ICE) vehicles, largely due to expensive components like batteries, motors, and power electronics. Financial and non-financial purchase incentives, supported by progressive policies like FAME, will be essential to driving uptake levels.

To learn more, please access the upcoming Growth Opportunities in Indian Electric Vehicle Market, and Indian Commercial Vehicle Growth Opportunities, or contact sathyanarayanak@frost.com for information on a private briefing.

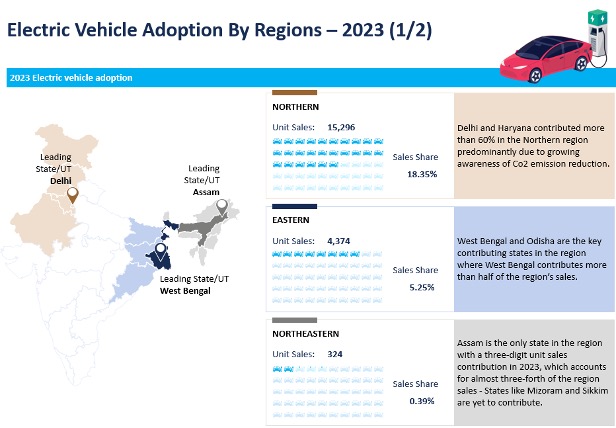

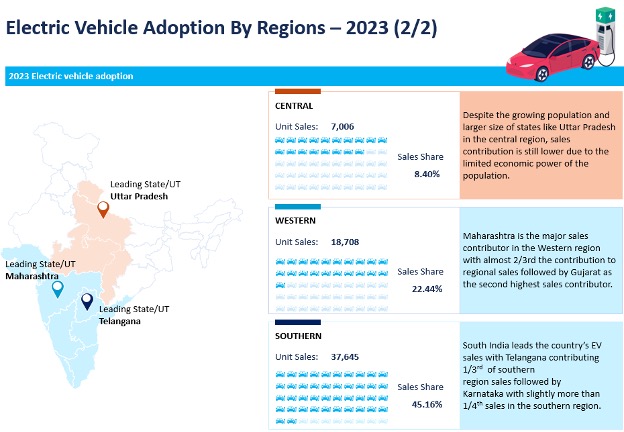

The South Leads

The Southern states of India, due to their robust EV and component manufacturing hubs, account for nearly 45% of the country’s EV sales. Leading states include Telangana, Karnataka, and Kerala, along with Maharashtra and Delhi. By 2030, EV infrastructure investments are expected to further boost sales in the South, potentially contributing close to 47% of national sales.

However, the extent of state-level subsidies varies, the nature of these incentives may evolve based on budgetary considerations and policy priorities. In the long term, market growth will be driven not as much by incentives, which will reduce over time, as by steadily increasing consumer demand for EVs.

Meanwhile, technological advancements have significantly impacted the Indian EV market. For example, improvements in lithium battery technology have reduced battery costs by 90% over the past 15 years, making EVs more affordable. Additionally, advancements in EV chargers and smart grids are expected to enhance accessibility and consumer interest.

Competition Intensifies

The influx of foreign investments indicates a strong interest in India’s EV market. Notably, Tesla is negotiating for tax concessions amidst the government’s “Make in India” initiative. The government’s new EV policy extends a slew of import duty concessions, subject to certain pre-conditions, to foreign OEMs. As part of these concessions is a lower tax rate of 15%, compared to the 70-100% imposed earlier on imported EVs. Such concessions will make international OEMs more cost-competitive, challenging domestic leaders like Tata and Mahindra.

Several international partnerships are also shaping the market. Tesla has partnered with Tata Electronics for semiconductor chips, Citroën has become the first foreign car manufacturer in India to export 500 units of “Made in India” ë-C3 electric cars to Indonesia, and collaborations between Shell and Tata are underway for charging station installations. Moreover, companies like Ford and VinFast are planning significant investments in the Indian EV market.

EV sales are expected to surpass 120,000 units in 2024, with Tata Motors, SAIC, and Mahindra & Mahindra dominating the market, holding a combined market share of 88.83%. Tata Motors, with its early market entry, diverse portfolio, and strategic partnerships, sold over 55,000 EVs in 2023, and is the runaway market leader. The competition is now intensifying with foreign automakers like Stellantis, Hyundai, BMW, BYD, Geely, Mercedes-Benz, and VW in the fray. Automakers like Hyundai, Kia, MG, Toyota, and Maruti Suzuki have plans to strengthen their EV portfolio and support system through joint ventures (JVs) and partnerships. Meanwhile, Renault is considering building a mass-market EV in India.

Our Perspective

Reducing import duties will encourage domestic OEMs to invest in R&D and focus on localizing component sourcing to counter new international competitors. India has the potential to become a hub for cost-effective, high-quality EV manufacturing, leveraging its skilled labor force and extensive lithium reserves. Specialized training and efficient extraction and supply of lithium will be critical to maintaining uninterrupted mass production.

Infrastructure development, including manufacturing facilities, charging stations, and retail infrastructure, will also be key to scaling up EV production and sales. Partnerships and JVs across the value chain will be crucial.

As India’s EV market gains momentum and international competition increases, domestic players will need to focus on investments and partnerships to enhance production capacity and supporting infrastructure. While incentives play a role, EV sales are not solely dependent on the level of subsidies. Building local capacity for critical components will be vital for OEMs to produce affordable EVs for the cost-conscious Indian market and ensure sustainable growth.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility