Market participants to focus on diversifying supply chains, developing user-centric intelligent features, and collaborating with local governments to bridge infrastructure gaps.

China’s electric vehicle (EV) industry is poised for significant expansion, driven by strategic investments in infrastructure, advancements in battery technology, and an increasingly diverse range of EV models. The extension of EV purchase tax exemptions from 2024 to 2027 is expected to further stimulate industry growth. As a result, the EV market is projected to surge from 8.9 million units in 2023 to an estimated 25.2 million units by 2030.

This rapid expansion will heighten competition, particularly in the battery electric vehicles (BEVs) segment, which currently dominates the market, as well as in the smaller plug-in hybrid electric vehicles (PHEVs) segment. As the market evolves, OEMs are anticipated to introduce new models with enhanced compatibility with battery swap solutions. Additionally, strategic collaborations between EV start-ups and traditional international OEMs will likely become more prominent, reflecting the global shift toward electric mobility.

To learn more, please access: Growth Opportunities in China’s Electric Vehicle Industry, 2024-2030, Strategic Profile of BYD, ASEAN Automotive Market Outlook, 2024, or contact [email protected] for information on a private briefing.

Key Industry Trends

China’s accelerated development of the EV ecosystem is prompting significant shifts within the automotive industry. Leading OEMs such as GAC Honda, Haval, and Changan have announced plans to transition to fully electric portfolios. BYD, which discontinued ICE vehicle sales in 2022, has capitalized on this trend, reporting sales of over 3 million EV units in 2023.

As the industry enters a new phase, traditional fuel-based vehicles are gradually being replaced by more intelligent, electric alternatives. The evolving competitive landscape is expected to result in a more differentiated product portfolio, catering to both budget-conscious consumers and those seeking high-end options. This shift underscores the importance of integrating advanced technologies and offering innovative features to meet diverse consumer demands.

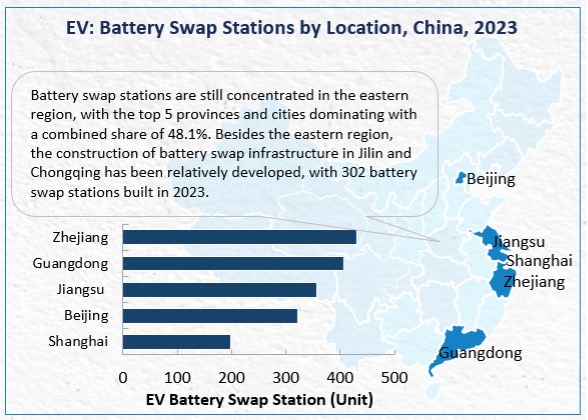

Meanwhile, the battery swapping market in China has seen significant growth and increased competition. In 2022, just three operators—NIO, Aulton, and Botan—dominated the market. By 2023, five new competitors had entered the fray, intensifying the competitive landscape. NIO, a market leader, continues to innovate with its battery swap stations, with its 4.0 version now featuring multi-brand compatibility, 23 battery positions, and a 22% reduction in swap time. NIO’s leadership is reinforced by its innovative Battery-as-a-Service (BaaS) subscription model and the comprehensive digital ecosystem that it has built around its vehicles.

Source: Frost & Sullivan

Despite these positive signs, China’s EV industry faces serious headwinds in the form of global economic and geopolitical instability. Domestically, the country is struggling with slowing economic growth. While government incentives, including consumer vouchers and large-scale automotive shows, have bolstered sales, overall economic recovery remains uncertain, posing risks to sustained growth.

Moreover, geopolitical tensions, such as the Russo-Ukrainian war and escalating US-China relations, have disrupted global supply chains, leading to increased costs for essential raw materials used in EV batteries. In response, Chinese OEMs are seeking to diversify their supply chains by forming partnerships with multiple logistics providers and establishing more localized production bases.

A Concentrated but Dynamic Market

China’s EV market is highly competitive, with over 30 active OEMs, including domestic companies, joint ventures, and international brands. Despite the large number of players, the market is concentrated, with the top three OEMs—BYD, Tesla, and GAC Aion—accounting for over 50% of the market share in 2023.

Tesla remains the dominant foreign player, particularly in the BEV segment, while several domestic start-ups, such as Aito, Zeekr, Livan, and IM Motors, have emerged as strong competitors. The BEV segment continues to outpace PHEVs both in size and growth rates, with BYD, Tesla, and GAC Aion leading this segment. In the PHEV segment, BYD, Li Auto, and Changan control nearly three-quarters of the market.

Our Perspective

Source: Frost & Sullivan

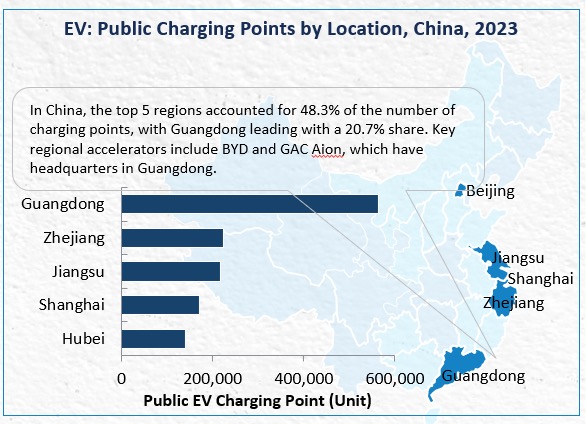

Despite significant advancements, there is a noticeable gap in EV infrastructure development in China’s second-tier and third-tier cities. Also, while Guangdong, Zhejiang, Jiangsu, Shanghai, and Hubei in the east have well-established charging ecosystems, other areas, particularly in the western and northern regions, lag. To address this disparity, public EV charging operators and automakers should collaborate with local governments to accelerate the deployment of charging stations and supporting infrastructure.

As intelligent technologies become increasingly vital for competitive differentiation, it is crucial for industry players to promote the adoption of these technologies across all market segments, not just in premium models. Developing user-centric intelligent features and prioritizing data security through advanced encryption and robust protection measures will be key to gaining a competitive edge in the evolving EV landscape.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility