Focus is on electrification, connectivity, compactness, and design refresh of recreational vehicles as market participants set out to woo a younger generation of customers.

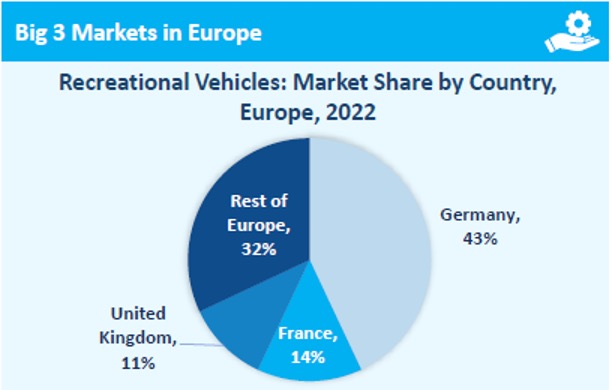

From motorhomes to camper vans and caravans, camping and adventure activities to commercial applications in the form of food trucks, mobile office spaces, and emergency vehicles, from individual ownership to rentals, the European recreational vehicles (RV) market is on a growth trajectory. As of 2022, the total number of new RV registrations in Europe was estimated at 183,509 units, with Germany, France, and the UK collectively accounting for 68% of market share. Interestingly, close to 70% of major RV builders in Europe manufacture their vehicles in Germany due to advantages like the availability of RV base models and that of critical components like chassis and engines.

Rising demand both for personal ownership as well as rental services, technology advances, and electrification are set to spur growth prospects, even as participants move to address a range of challenges related to cost, regulations and stagnant design sensibilities.

Surging camping and outdoor activities across Europe are driving demand for RVs. Simultaneously, RV rental service providers are targeting newer customer segments, including the mass market. Market participants are turning to digital technology to lure millennials and Gen Z customers. For instance, offering connected motorhomes equipped with apps and in-vehicle convenience features like theft alarms, cameras, and infotainment that make the camping experience safer and more convenient. Moreover, the development of online configurator offerings over the next 3‒5 years is aimed at enabling customers to customize RV models according to their needs prior to vehicle purchase, thereby transforming RV sales and services.

At the same time, stringent emissions regulations and customer preferences will provide a fillip to electrification trends in the RV market. By 2025, major automotive OEMs are expected to launch all-electric battery versions of their existing ICE base campervan models, competing with motorhome/RV builders for a share of market revenues.

To learn more, please see: Strategic Analysis of the Recreational Vehicle Market in Europe, Growth Opportunities for Adventure Motorcycles in India, or contact [email protected] for information on a private briefing.

High cost of ownership and design stagnation are major challenges

Europe’s RV market includes traditional automotive OEMs such as Ford, Fiat, Mercedes-Benz, Volkswagen, Citroen, and Iveco; RV builders like Dethleff, Hymer, Swift that assemble RVs after procuring engine and chassis from OEMs; RV modifiers like Westfalia and Possl that buy base model RVs directly from OEMs and carry out interior alterations; and equipment suppliers like Trauma and Al-Ko that supply specific components for the interiors and exteriors.

While growth prospects are promising, major challenges remain. For a start, certain segments such as coach-built and fully integrated large motorhomes are associated with high purchase and maintenance costs linked to their larger size and increased features. In addition, some caravans tend to be large and unwieldy, making them inconvenient to drive and park, particularly in urban settings. Accordingly, the appeal of traditional caravans and motorhomes, especially among younger customers, is likely to decline compared to campervans and motorhomes that are compact, easier to drive, and more economical. This also highlights the need to create a fresh design outlook in motorhomes and caravans to woo a new cohort of younger customers.

Market participants will also need to address increasingly stringent regulations, whether in terms of road safety or emissions. Meanwhile, new product and infrastructural challenges loom. Evolving customer preference for connected features will require renewed focus on ways to incorporate innovative connectivity features, while promoting product differentiation.

The trend towards electric motorhomes underlines the importance of developing EV charging infrastructure, while accounting for the fact that camping grounds are typically located outside urban areas and that demand is likely to be seasonal. Threats from substitutes also threaten market incumbents. This could take two forms: customized and purpose-built vehicles with little to differentiate them from RVs and the entry of new EV platform development companies that support a range of customization options since they are built on a modular flatbed design.

Our Analysis

Over the 2023-2030 period, Frost & Sullivan foresees a range of high growth potential areas for Europe’s RV market linked to trends such as subscription-based sales, connected apps, growth of private campsites/campgrounds, smart monitoring systems, all-electric offerings, rising use of RVs as mobile office spaces, and repurposing of old motor homes. Over the medium and long-term, our research highlights a strategic roadmap that encompasses on-the-go offices using motorhomes/caravans; fully electric motorhomes; rental motorhomes and caravans; purpose-built RVs; RVs for luxury travel; solar powered motorhomes; fully integrated smart homes; and fully autonomous motorhomes.

As the decade unfolds, market participants will need to adopt the latest technology to create a highly functional mobile space that enhances the customer experience. This could include leveraging sustainable power sources such as solar panels for renewable power generation and drawing on smart home technology for integrated control systems that automate climate control.

Another aspect could be improving safety through advanced safety features, such as collision avoidance systems and adaptive cruise control as well as through remote monitoring and control. Boosting occupant health and wellness through the incorporation of air purification systems and moving towards modular design to facilitate customization are also set to resonate with customers. Connectivity will also be a key focus area; on the one hand, it will support seamless operations in rental vehicle businesses and, on the other, enable superior internet connectivity and UX for customers.

We anticipate that vehicle electrification trends will trigger demand for compact RVs for camping. This will underpin the growth of micro-motorhomes and campervans since they are compact, easily integrated, and widely available at rental companies. Further growth impetus in these two segments will come from the ability to quickly and easily manufacture electric versions.

In short, digital technology with a thrust on product differentiation will allow the European RV market to reach a new customer audience, while the RV transitions from being a mode of transport to becoming a mobile living space and lifestyle statement.

With inputs from Amrita Shetty – Senior Manager, Communications & Content, Mobility