Beset by pandemic-related factory shutdowns and border closures, booming e-commerce demands, escalating trade tensions, and production relocations, logistics companies have had a challenging year and a half. Unrelenting disruptions to supply chains have underscored their fragility while highlighting the urgent need to achieve real-time, end-to-end supply chain visibility.

What are the key factors underlying the push towards end-to-end supply chain visibility? Which enabling technologies will help overcome existing challenges and spearhead growth in the logistics industry over the next 4-5 years? What will be the implications of such developments on stakeholders and customers?

To understand more about the opportunities and challenges in fleet & logistics asset tracking and shipment monitoring from a logistics and transportation players’ perspective, Frost & Sullivan and HERE Technologies conducted a voice of customer survey in six key countries in the Asia Pacific and Oceania; namely, Australia, Singapore, Thailand, Indonesia, India, and Japan.

These are some critical findings from the resulting ‘The State of Movement: Asia Pacific, 2021’ study.

Technology-Driven Transformations to Enhance Logistics Asset Tracking and Fleet Visibility

Achieving end-to-end supply chain visibility is difficult at the best of times. Across the Asia Pacific, logistics companies continue to struggle with a range of diverse challenges. Primary among them are the limitations of existing solutions, including a lack of relevant features that will allow full tracking of fleet and assets. This is true for last-mile logistics, the fulcrum of the e-commerce sector, as well.

Other major pain points include:

- Poor infrastructure

- Complex supply chains

- Systems that function in silos

- Shortages of skilled workforce.

This is further exacerbated by issues centered on the lack of solutions integration and data accuracy.

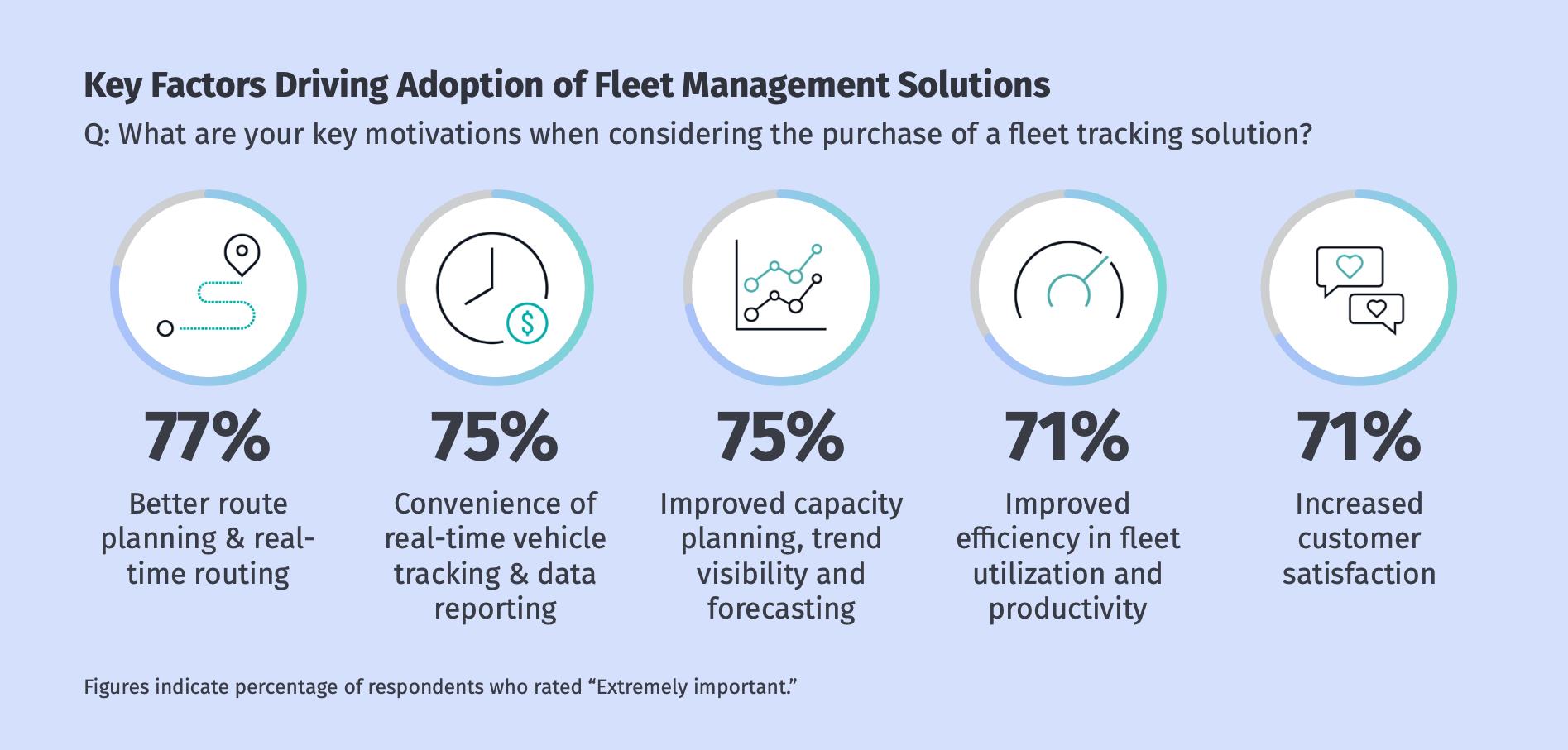

Little surprise then that the industry is stepping up the quest for solutions to address these significant challenges. For instance, dynamic changes in route conditions, on-demand trends, volume spikes, and flexible workforces underline the need for real-time fleet management solutions. Accordingly, respondents emphasized the importance of solutions that enable real-time route planning and optimization.

Real-time asset tracking and data tracking solutions are another vital consideration for logistics companies in response to the need for end-to-end visibility across their heavy, returnable/reusable, and other warehouse assets.

Meanwhile, solutions that improve capacity planning, trend visibility, and forecast planning, increase customer satisfaction, and boost operational efficiency and cost savings are gaining impetus across fleet management and logistics service delivery asset tracking.

Our survey revealed that almost 21% of logistics companies currently leverage IoT for their fleet management solutions. IoT is gathering momentum in fleet tracking and service delivery asset tracking, particularly for returnable and heavy assets.

The ability to transform business operations and services gives a fillip to map-based solutions with real-time location data. Around 51% of logistics companies in our survey stated that they deployed map-based solutions with real-time location data, primarily for fleet tracking.

A key trend that will define the logistics industry in the next two years is the growing prevalence of cloud-based solutions. A whole host of benefits like easy deployment, seamless collaboration among multiple stakeholders across the supply chain, end-to-end supply chain visibility; flexibility; cost efficiency; scalability; and data security will all drive the preference for cloud-based solutions across all assets, particularly for fleets.

Shipment Monitoring to Follow Similar Trajectory

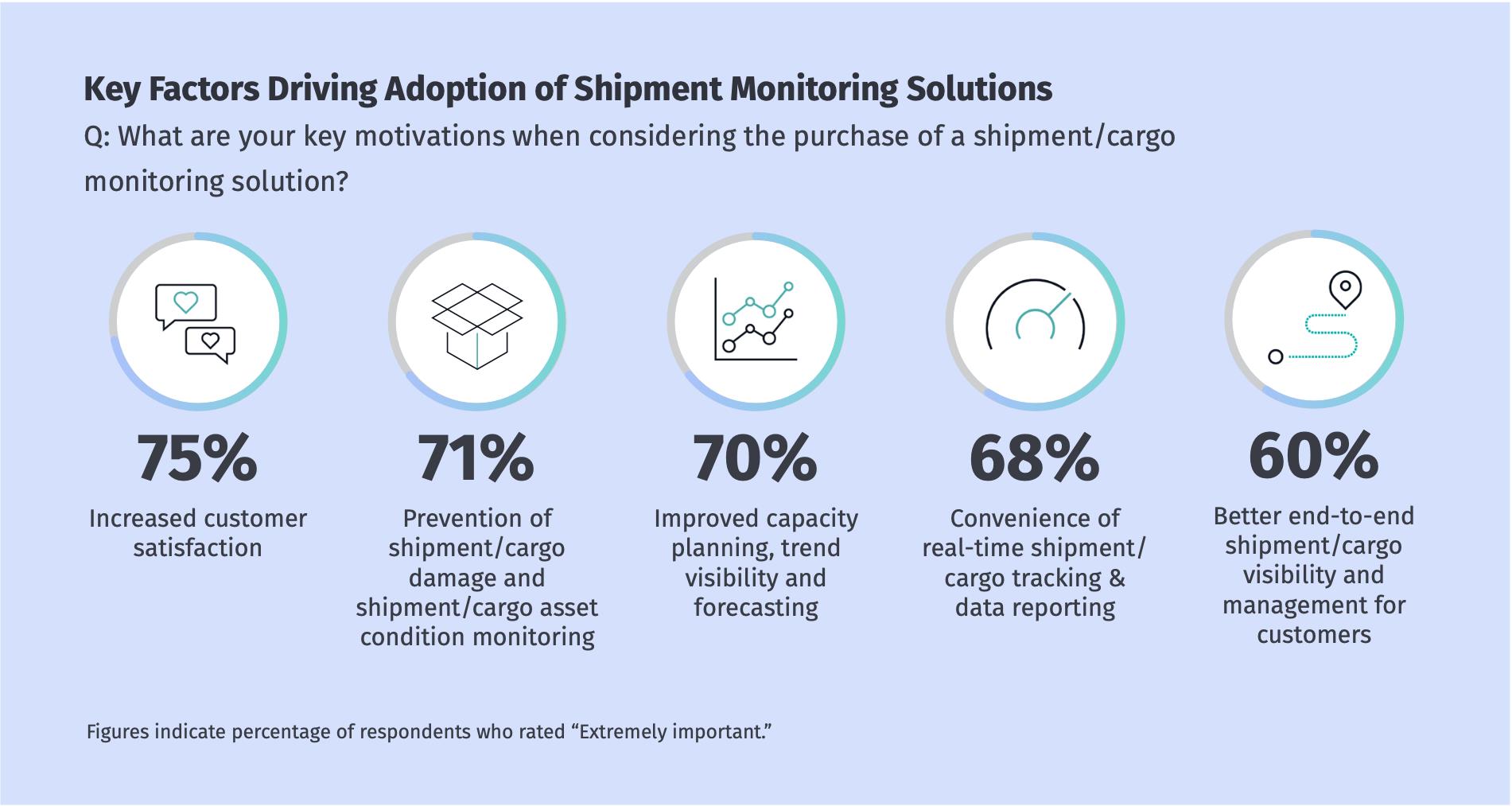

Changing customer expectations, particularly in the aftermath of the e-commerce boom, have centered on the speed and quality of delivery and around demands for complete shipment visibility from start to finish. This, in turn, underscores the interest in and implementation of shipment monitoring solutions focused on asset condition monitoring, improved capacity planning, and real-time tracking. These solutions enable better end-to-end shipment visibility and management for both B2B and B2C customers.

Even as logistics companies in the Asia Pacific stress the importance of real-time shipment condition monitoring and shipment tracking, IoT is experiencing increasing uptake for condition-sensitive shipments such as cold chain items and dangerous goods. IoT’s appeal is rooted in its ability to support real-time monitoring and provide real-time data crucial to effective decision-making.

Similar to fleet management, logistics companies are also moving towards map-based solutions with real-time location data for shipment monitoring. Our survey reveals that more than 50% of logistics companies in the region use map-based solutions for shipment monitoring across all shipment types. Such solutions are finding particular appeal in the Courier, Express & Parcel (CEP) segment.

Again, much like in fleet management, cloud-based solutions are gaining popularity in shipment/cargo monitoring due to the benefits they offer in supporting seamless collaboration among multiple stakeholders and, by extension, end-to-end visibility for all. Around 50% of respondents in our survey indicated that they would be adopting cloud-based solutions across all shipment types over the next two years. About 27% are looking at hybrid—a combination of on-premise infrastructure with public and private cloud—for their shipment monitoring solutions.

Tying the Future to a Trio of Trends

Based on our ongoing research and analysis of the supply chain & logistics sector and our recent voice of customer survey, we believe that logistics companies in the Asia Pacific will anchor their future to three defining trends: automation, IoT, and sustainability.

Among the many advantages that this trio will yield are greater agility, improved efficiency, superior productivity, cost optimization, and resource rationalization. They will enable logistics companies to meet evolving customer demands better while boosting overall return on investment (ROI).

Sustainability imperatives will also loom large, with logistics companies moving to improve efficiencies in fleet operations, fuel management, and energy utilization. In line with this, logistics companies in Australia, Japan, Thailand, and India are already indicating a keen interest in using energy-efficient electric trucks.