By Gautham Hegde, Senior Research Analyst – Mobility

As technological advancements reshape the automotive landscape, consumer preferences for greater connectivity, convenience, personalization, and flexibility are driving significant growth in Feature on Demand (FoD) services. These innovations are revolutionizing the way drivers experience and interact with their vehicles. Through FoD, car owners can now activate features after purchasing their vehicles, paying either through subscriptions or one-time fees. From advanced driver assistance systems (ADAS) to premium infotainment and remote services, the possibilities are expanding at a rapid pace.

With hardware for many features pre-installed during manufacturing, owners can enable these functions through over-the-air (OTA) updates or at dealerships. As the automotive industry evolves toward greater digitalization, FoD is positioned to become a cornerstone of modern vehicle ownership, offering consumers an unprecedented level of customization.

Evolving Consumer Demand

The driving force behind the adoption of FoD is the evolving expectations of tech-savvy customers who prioritize flexibility, personalization, and access over traditional ownership models. With car-sharing and subscription services growing in popularity, FoD offers a solution that allows drivers to choose the features they want and pay only for what they use. This approach reflects a broader industry trend toward software-defined vehicles (SDVs), where manufacturers can introduce new capabilities or update existing ones through OTA services.

This shift not only appeals to consumers’ desire for a dynamic driving experience but also provides automakers with the opportunity to introduce recurring revenue streams. The traditional one-time sale of premium features is giving way to subscription-based models that encourage ongoing customer engagement and allow manufacturers to update and enhance features throughout a vehicle’s lifecycle.

FoD adoption has already begun to take hold, with growth accelerating as consumers become more aware of the benefits, such as convenience, customization, and access to advanced functionalities. By 2030, almost every major automaker will offer subscription-based services for their vehicles. As electric vehicles (EVs) and autonomous driving technology become more prevalent, FoD offerings will diversify even further.

Premium automakers like BMW, Mercedes-Benz, and Tesla have led the way, introducing a wider array of options compared to mass-market manufacturers. However, mass-market brands such as Ford and Volkswagen are quickly catching up, particularly in categories like safety, connectivity, and remote services.

In 2023, connectivity accounted for the majority of FoD services, but its dominance is expected to decline as other segments, such as comfort and convenience, ADAS, and safety, grow in prominence. This diversification will reflect the growing consumer demand for enhanced vehicle experiences and be enabled by rapid advances in technology.

To learn more, please access: Passenger Vehicle Feature on Demand (FoD) Market, Global, 2024-2030, Growth Opportunities in the European Passenger Vehicle In-vehicle Display Industry, or contact [email protected] for information on a private briefing.

Regional Trends and OEM Strategies

Regionally, North America has emerged as a leader in the adoption of FoD services, largely due to fewer regulatory restrictions and a greater willingness among consumers to embrace subscription-based services. By 2030, the region is set to lead in terms of revenue generated from FoD features, accounting for 68.7% of total revenues, with the European Union contributing around 31.0%, and China about 0.3%. At this juncture, North America is projected to generate $3.54 billion in revenue from FoD subscriptions, outpacing both the European Union and China. In contrast, the EU’s more stringent regulations around data privacy and safety will slow the adoption of certain FoD features, although the region will remain a significant player in safety and security features. China, while lagging behind in terms of revenue, is expected to see gradual growth as consumer preferences evolve, particularly with the rise of electric and autonomous vehicles.

Premium OEMs have been particularly adept at leveraging FoD to enhance customer experiences and generate recurring revenue. Mercedes-Benz, for example, has introduced performance-based FoD services for its EQ electric vehicles, allowing customers to activate features that enhance vehicle performance. Tesla, a pioneer in the field, has taken full advantage of OTA updates, using them not only for software improvements but also as a key customer engagement tool. Tesla’s electric architecture allows the company to update critical systems like ADAS remotely, providing customers with a seamless experience and generating continuous revenue.

Mass-market OEMs are also beginning to explore the potential of FoD, particularly as they introduce more electric and autonomous models. Companies like Ford and Skoda are integrating ADAS and remote services as part of their FoD offerings. These manufacturers are incorporating advanced technologies such as AI-driven voice assistants and augmented reality navigation, helping to bridge the gap between premium and mass-market vehicles in terms of features and services.

Our Perspective

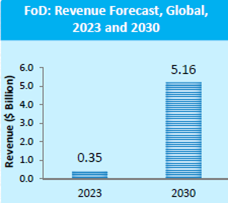

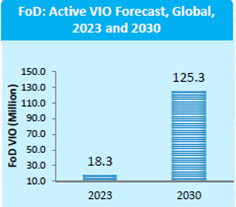

As the FoD market continues to grow, automakers will increasingly rely on subscription models to enhance profitability and offer consumers more flexibility. By 2030, the global FoD market is expected to generate over $5.2 billion in revenue rising sharply from $0.35 billion in 2023, even as automakers explore new growth opportunities within the ecosystem. In parallel, an estimated 125.3 million vehicles (vehicles in operation) in 2030 are set to have FoD, up from 18.3 million in 2023.

The use of data analytics and AI will allow manufacturers to offer personalized recommendations based on individual driving habits, further enhancing the customer experience. Additionally, flexible subscription models—such as daily or monthly packages—will increasingly be introduced to cater to different consumer needs, offering a “pay-as-you-go” option that appeals to occasional users.

In-cabin experiences will be another area of focus, as drivers and passengers will spend more time inside their vehicles while charging their EVs or during autonomous driving. This shift is expected to drive demand for premium features like in-car Wi-Fi, advanced climate control, and customizable ambient lighting. By offering these features on a subscription basis, OEMs can create new revenue streams and ensure that customers have access to the latest innovations throughout their vehicle’s lifecycle.

The convergence of technological advancements and evolving consumer preferences is heralding a new era of automotive innovation, spearheaded by FoD. As automakers continue to innovate, expand their FoD portfolios, and adapt to the increasing prevalence of electric and autonomous vehicles, the future of FoD looks promising.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility