Introduction: The Growing Global Demand for Cardiac Biomarkers Diagnostics

Cardiovascular disease (CVD) remains the leading cause of mortality worldwide, making early detection and intervention essential. The global cardiac biomarkers diagnostics market is poised for significant growth, driven by the increasing prevalence of CVD, technological advancements, and the growing adoption of point-of-care testing (POCT).

Want deeper insights? Download our full analysis on Cardiac Biomarkers Diagnostics.

Click here to download

According to the World Health Organization (WHO), CVD-related deaths are projected to reach 23.3 million by 2030, emphasizing the need for early and accurate diagnostics. Conditions such as acute myocardial infarction (AMI), acute coronary syndrome, and heart failure are at the forefront of clinical attention.

Technological innovations, including high-sensitivity cardiac troponin assays, are significantly improving early detection and patient outcomes. This article explores key trends, growth opportunities, and market drivers in the cardiac biomarkers diagnostics industry from 2024 to 2029.

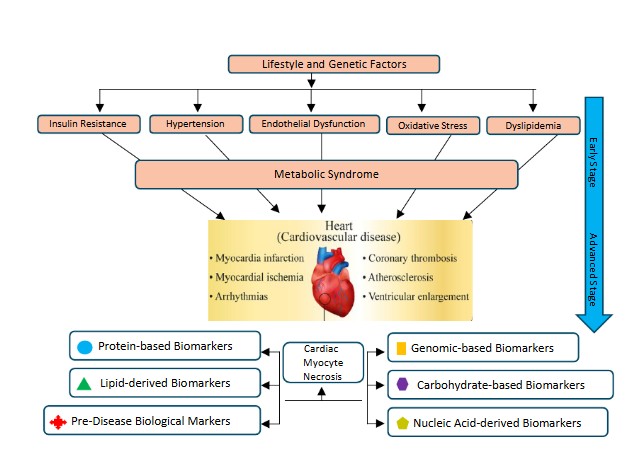

Types of Biomarkers: Graphic illustrating different types of cardiac biomarkers, including lipid-derived, carbohydrate-based, pre-disease, and nucleic acid-derived biomarkers.

Key Drivers Fueling Growth in Cardiac Biomarkers Diagnostics

The cardiac biomarkers diagnostics market is driven by several critical factors that align with advancements in testing technologies and an increasing focus on preventive healthcare.

- Advancements in Diagnostic Testing Technology

Next-generation diagnostic tools like high-sensitivity troponin assays enable faster and more accurate detection of heart conditions. For example, Roche’s Elecsys® Troponin T hs assay is widely used in emergency departments, improving diagnosis and patient care.

- Higher Adoption of Point-of-Care Testing (POCT)

POCT enables immediate diagnosis at the patient’s bedside, reducing hospital stays and improving early intervention. This is particularly beneficial in rural and emergency settings, driving widespread adoption, especially in the Asia-Pacific region.

- Multiplex Biomarkers

Multiplex biomarkers provide a holistic view of cardiovascular health by detecting multiple indicators simultaneously. This improves diagnostic accuracy and enables personalized treatment plans for patients.

- Preventive Healthcare Focus

As healthcare shifts towards preventive care, cardiac biomarkers are playing an essential role in early risk assessment and disease prevention. This trend is expected to drive market growth significantly.

Regional Insights: Asia-Pacific’s Rapid Growth

Asia-Pacific is emerging as the fastest-growing region in the cardiac biomarkers diagnostics market. With an increasing prevalence of CVD and greater healthcare infrastructure development, the region offers immense untapped growth potential. The adoption of advanced diagnostic technologies, including high-sensitivity assays and POCT, is expected to drive market growth in this region over the forecast period.

Competitive Landscape: Industry Players and Ecosystem

The global cardiac biomarkers diagnostics market is moderately competitive, with major players driving innovation.

| No. of Competitors | Approximately 200+ |

|---|---|

| Competitive Factors | Cost, technology, reliability, accuracy, sensitivity, turnaround time |

| Key End Users | Hospitals, diagnostics labs, physicians’ offices, urgent care facilities, nursing facilities |

| Leading Competitors | Roche Diagnostics, Abbott Rapid Diagnostics (formally Alere), Siemens Healthineers, Quidel Corporation, bioMérieux |

| Revenue Share of Top 5 Competitors (2024) | 57.90% |

| Other Notable Competitors | Danaher (Beckman Coulter and Radiometer), Sysmex Corporation, Fujirebio, CTK Biotech, Shenzhen Mindray Bio-Medical Electronics Co., Elabscience Biotechnology, Inc., Quanterix, Response Biomedical Corp., Tosoh Bioscience, Tulip Diagnostics Pvt. Ltd. |

| Notable Mergers & Acquisitions | Roche’s acquisition of LumiraDx’s POC business will enhance its POC capabilities and market presence. |

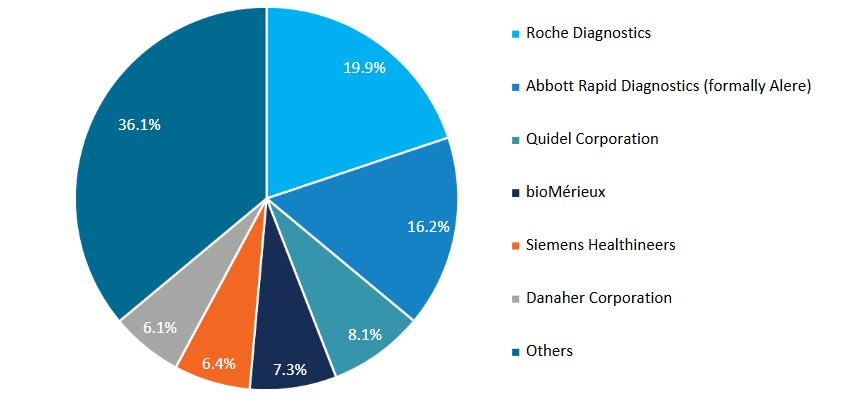

Revenue Share

Market Share Visualization: Chart displaying the revenue share of top cardiac biomarkers diagnostics market players, including Roche, Abbott, Siemens, Quidel, and bioMérieux in 2023

Emerging Growth Opportunities in Cardiac Biomarkers Diagnostics

- High-Sensitivity Assays (HSAs)

As the demand for quick and accurate diagnostics rises, the development of HSAs will be a key growth driver. Companies should invest in novel biomarkers and assay methods to differentiate their products. Additionally, there is a significant opportunity to launch HSAs in developing markets where access to diagnostic testing is limited but the burden of CVD is rising.

- Multi-Marker Cardiac Panels

The development of multi-marker panels that combine biomarkers like B-type natriuretic peptide (BNP), troponin, and emerging cardiac biomarkers such as soluble ST2 is a promising growth opportunity. These panels provide a more comprehensive view of cardiac health, helping healthcare providers make more informed clinical decisions. Companies that can create panels compatible with automated platforms will be well-positioned to capture market share in hospitals and diagnostic centers.

Growth Restraints and Challenges

While the cardiac biomarkers diagnostics market is poised for growth, certain challenges could limit expansion:

- Market Consolidation: The dominance of established players such as Roche and Abbott creates a barrier to entry for new players, limiting competition and innovation in the market.

- Regulatory Hurdles: Stringent regulatory requirements for diagnostics, particularly in the United States and Europe, can delay the introduction of new assays and testing methods. The approval process for high-sensitivity troponin assays, for example, took several years in the US and is subject to ongoing regulatory scrutiny.

The Future of Cardiac Biomarkers Diagnostics

The cardiac biomarkers diagnostics industry is set for transformative growth, fueled by innovation in high-sensitivity assays, multiplex biomarker panels, and POCT advancements. Companies investing in next-generation diagnostics and personalized healthcare solutions will be well-positioned to lead the market.

Staying ahead of technological advancements and emerging trends will be critical for companies seeking to maintain a competitive edge.

For exclusive insights and in-depth industry analysis, download our comprehensive study today!

Click here to download