By Krishna Achuthan, Research Manager – Mobility

The Brazilian agricultural tractor aftermarket is poised for significant growth, driven by the increasing number of tractors in operation and the aging fleet that demands frequent maintenance and component replacement. From 2023 to 2030, the total number of agricultural tractors in Brazil is expected to grow at a compound annual growth rate (CAGR) of 1.9%, reaching 1.6 million units. This expansion will naturally fuel aftermarket demand as more tractors require repairs and replacements over time.

A key factor contributing to this growth is the high utilization rate of tractors in Brazil, which averages 645 hours per year—one of the highest globally due to the region’s two harvests per year. By 2030, this is expected to increase to 797 hours annually with the adoption of automation, connected solutions, and telematics, further driving demand for aftermarket services and components. The Brazilian government’s focus on sustainable agricultural practices, supported by initiatives like the Plano Safra 2023–24, which allocates $73 billion to environmentally sustainable production systems, will also accelerate fleet replacement rates.

However, the market faces challenges with economic uncertainties, inflation, and rising interest rates are likely to delay purchasing decisions in the short to medium term. Despite these headwinds, the overall market is set to reach $3.79 billion by 2030, growing at a 4.7% CAGR from 2022.

To learn more, please access: Brazilian Agricultural Tractor Aftermarket Growth Opportunities, Growth Opportunities in the Excavators and Loaders Industry, 2024-2030, Global Off-highway Equipment Industry Outlook 2024, and Electric Off-highway Equipment Growth Opportunities, or contact [email protected] for information on a private briefing.

Sustainability, Innovation, and Market Competition

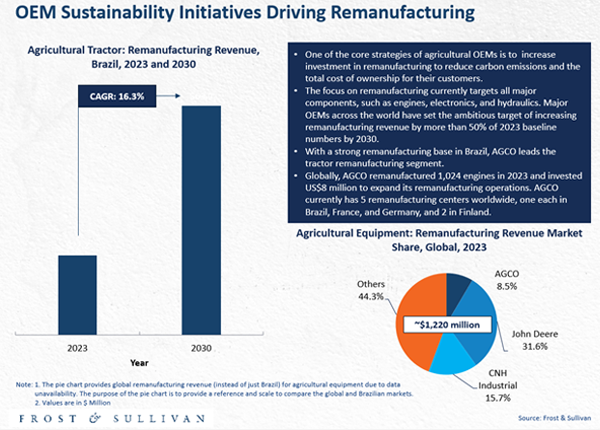

Brazil’s tractor aftermarket is heavily dominated by the demand for lubricants and associated filter replacements, which account for nearly 72% of total aftermarket revenue. With tractors’ active lifespan averaging 12 years, the demand for components that can be replaced in-house or through self-repair is on the rise. The focus on sustainability is pushing OEMs to invest in remanufacturing, enabling up to 95% recyclable content in heavy equipment and 65% sustainable materials in new machinery. This approach not only meets the growing demand for green solutions but also offers cost-effective alternatives to new components, appealing to price-sensitive customers.

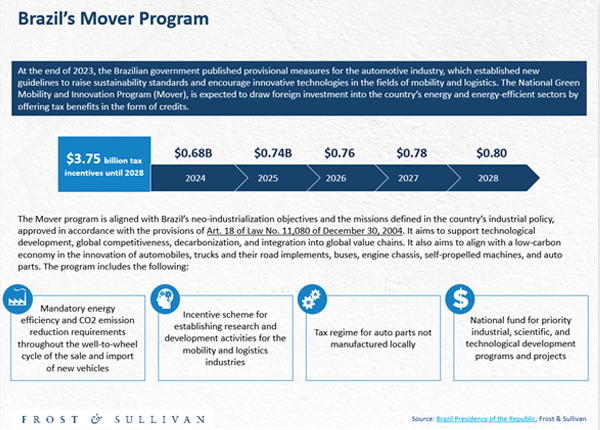

The influx of foreign OEMs and suppliers into the Brazilian market, attracted by revenue potential and federal incentives, is reshaping the competitive landscape. Strategic partnerships and the expansion of manufacturing plants and dealer networks are expected to increase market competitiveness, lowering prices for tractors and components. As the tractor parc expands due to growing agricultural operations and food demand, the aftermarket segment will see continued growth.

Our Perspective

The Brazilian agricultural tractor market has nearly doubled over the past two decades, driven by increased agricultural productivity and the adoption of new technologies. As the tractor fleet continues to grow, there are significant monetization opportunities for OEMs and suppliers. Enhanced fleet and inventory management solutions will become crucial, with connected technologies enabling better tracking of equipment utilization and health.

OEMs will need to collaborate with suppliers and financial institutions to offer flexible payment plans, extended warranties, and subscription-based services. These solutions will help optimize operations and reduce costs for farmers, fostering long-term customer loyalty and creating recurring revenue streams.

Sustainability is a key driver of growth in the tractor aftermarket, with remanufacturing emerging as a vital strategy for OEMs. Remanufactured components offer significant cost savings and are supported by manufacturer warranties, making them an attractive option for customers. The market for remanufactured parts in Brazil is expected to grow substantially by 2030.

Accordingly, OEMs will need to expand remanufacturing capabilities by partnering with local suppliers and leveraging strategic dealer locations. Extending warranties and service contracts to a broader range of components and incorporating maintenance packages will drive sales of remanufactured products, enhancing brand loyalty and extending the life of agricultural equipment.

Brazil’s tractor market is becoming increasingly competitive, with major OEMs like AGCO and CNH currently dominating. However, the recent influx of foreign investment, supported by federal tax incentives and initiatives like the National Green Mobility and Innovation Program (Mover), is opening up new opportunities for OEMs and suppliers.

OEMs must find ways to capitalize on federal incentives and near-shoring opportunities to establish a strong presence in Brazil. Strategic partnerships with local suppliers, particularly in the precision agriculture and connected solutions sectors, will be crucial. By focusing on R&D and innovation, OEMs can strengthen their market position and offer tailored solutions that meet the specific needs of Brazilian farmers.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility