I. CDMOs are advancing the biopharmaceutical industry with superior biomanufacturing capabilities

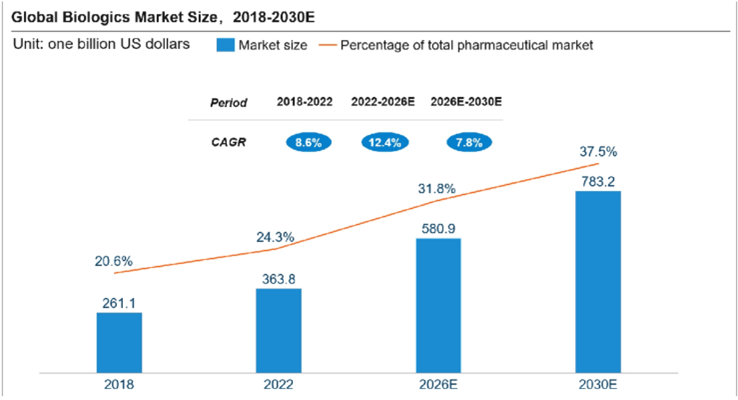

The biopharmaceutical industry is expanding rapidly. According to Frost & Sullivan, the global biologics market grew from $261.1 billion in 2018 to $363.8 billion in 2022, with a CAGR of 8.6%. Its share in the global drug market rose to nearly one-fourth in 2022 and is expected to reach 31.8% by 2026 and 37.5% by 2030.

Source: Frost & Sullivan Analysis

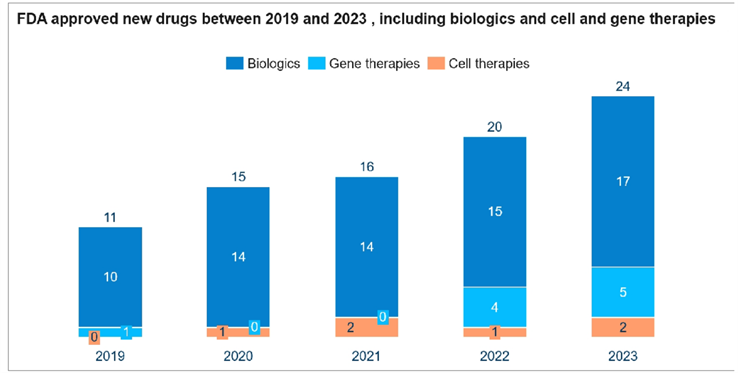

More biologics programs have entered late clinical and commercialization stages globally. The number of FDA-approved biologics and cell/gene therapies rose from 11 in 2019 to 24 in 2023. In 2023, more than half of the top 10 best-selling drugs were biologics with five monoclonal antibodies, one polypeptide, one vaccine, and others being three chemical drugs. The booming demand calls for scaling up commercial production, and efficiency has become essential to enterprises. Due to the trend of specialization and especially contract development, the global biopharmaceutical landscape is increasingly shaped by CDMOs undertaking commissioned productions and offering unique solutions with higher added value.

Source: FDA, Frost & Sullivan Analysis

Various policies were introduced to regulate drug prices and contain healthcare expenditures across the globe. Following the Affordable Care Act, the U.S. landed the Inflation Reduction Act in 2023 to negotiate prices for blockbuster drugs, set the ceiling of price increases to inflation rates, and reduce Medicare payments. In February 2024, the White House announced that Medicare had sent preliminary price offers to 10 pharmaceutical companies, marking the initiation of price negotiations. Japan implemented more stringent measures in response to its aging population. In 1988, Japan launched a centralized procurement program to control the prices of drug entering reimbursement lists of the medical insurance and to re-evaluate the prices of existing drugs. From 2021, drug prices began to adjust annually instead of every two years. In China, price negotiations for drugs to be listed in the medical insurance and volume based procurement are normal practices. From 2017 to 2023, price reductions by negotiations ranged from 44% to 62%. By the end of 2023, volume-based centralized procurement has covered 450 drugs across the country, with 130 procured specifically at the provincial level.

Governments have been promoting the accessibility of biosimilars as a key cost-control measure. Biosimilars hold a significant position in countries of all levels of healthcare budgets. In Japan, there is a growing trend towards generic drugs and biosimilars. According to theMinistry of Health, Labor and Welfare of Japan, the replacement rate of generic drugs reached 79% in 2022. As biologics account for an increasing proportion of health insurance expenses, Japan aims to have the biosimilar replacement rate to reach 60% by 2029. Meanwhile, the core patents of drugs, such as Novo Nordisk’s blockbuster Ozempic, are about to expire. Pharmaceutical companies will face competition from lower-priced generics. Combined pressures of government efforts and the patent cliff are driving both brand-name companies and generic manufacturers, while boosting R&D investments for more innovative products, to improve production efficiency and enhance cost control across all chains.

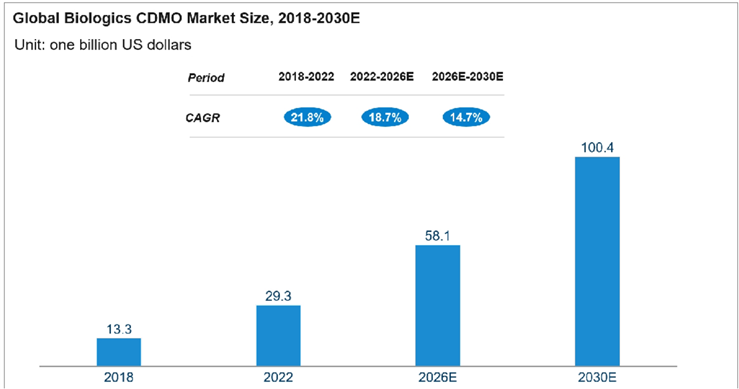

Production expansion for a more complex category of biologics, is facilitated by the flourishing industry, accelerated drug approvals, and booming global demand for biosimilars. This is an opportunity for biologics CDMOs who can address the high costs of self-built production lines, limited experiences in R&D and production, and other challenges faced by traditional pharmaceutical companies. The global market size of biologics CDMOs has grown significantly from US$13.3 billion in 2018 to US$29.3 billion in 2022 and is projected to reach US$58.1 billion by 2026 and US$100.4 billion by 2030.

Source: Frost & Sullivan Analysis

II. CDMOs are shifting towards scale production, flexible capacity, diverse product offerings, and customized services

With highly flexible biomanufacturing capabilities, CDMOs are expanding businesses to cover more client groups, drug types, and regions.

CDMOs serve clients of various scales including biopharmas and biotechs

Diverse product pipelines of biopharmas have a high demand for large-scale productions. As biopharmas encompass R&D, production, and commercialization, many favor an asset-light strategy that divests production activities and rely on outsourcing services to reduce costs. Small and medium-sized biotechs excel in innovation and primarily focus on the R&D stage. They depend on CDMO services to circumvent the time-consuming, costly, and risky nature of building their own production capacities, in which they lack experience and resources.

Order-driven CDMOs should deepen cooperation with biopharmas and accelerating efforts to serve more small and medium-sized biotechs. These pose challenges to the scale production and flexibility of CDMOs.

Diversity is crucial as biologics have diversified production demands

Biopharmaceutical companies choose cost-effective production processes by considering factors such as yield, purity, and separation. Given the challenges in process development and production for different biologics types, specialized CDMO services for each type have emerged. Driven by diversified demands, more versatile CDMOs have also entered the industry. Their platforms encompass mammals, microorganisms, and gene therapies to meet R&D and production needs for clinical use of cellular and gene therapies (CGT), antibody-drug conjugates (ADC), and glucagon-like peptide-1 (GLP-1).

A. Antibody drugs

In the production of antibody drugs, the upstream processing involves cell culture that requires the development of protein-expressing cell lines, optimization of culture media for optimal conditions, and enhanced expression of biologics to minimize production costs. The downstream processing involves the purification and filtration of the products harvested in the bioreactor, followed by storage to maintain the quality of the final product.

ADCs have sparked a R&D surge that intensified competition in capacity expansion and technological upgrades. ADCs demand the production of stable antibodies, as well as highpurity payloads and linkers, presenting significant challenges for CDMOs in areas of smallmoleculecompounds, large-molecule antibodies, and conjugate techniques.

B. Recombinant protein drugs

The manufacturing of recombinant protein drugs includes large-scale cell culture, purification, and quality control. An optimized upstream cell culture process yields a substantial quantity of recombinant proteins through a specific expression system, along with host-related impurities such as proteins and nucleic acids. Separation and purification are pivotal in preparing recombinant proteins, employing techniques such as ultrafiltration, single-column chromatography, multidimensional chromatography, and double-column chromatography. Future techniques aim to enhance the long-term efficacy of recombinant protein drugs

considering their short half-life.

C. Cell and gene therapy

Cell and gene therapy (CGT) is under the spotlight in cancer treatment. Since the FDA approval of Novartis’ Kymriah® and Gilead’s Yescarta® in 2017, the R&D boom in the CAR-T field has swept across the globe. Up to now, there are 10 available CAR-T therapies. However, the commercialization is hurdled by cumbersome production processes, the need for patientspecific customization, a lack of well-established technology, insufficient technical teams andinfrastructures at many R&D enterprises, and higher costs due to stringent quality control. Compared with conventional biologics, CGT products are more dependent on CDMOs because of the above mentioned challenges. As a result, CDMOs are playing an increasingly crucial role in the R&D and production processes for CGT companies.

D. Polypeptide drugs

Sales of GLP-1 polypeptides have benefited their long-acting properties, superior clinical outcomes, and expanding range of indications. Despite the explosive growth, however, their supply has long been constrained by inadequate capacity. In March 2023, the European Medicines Agency (EMA) issued a warning regarding a persistent shortage of Ozempic, which prompted Novo Nordisk to acquire Catalent in 2024 to bolster production capacity. The complex structure of Ozempic requires a synthesis that combines the advantages of biological and

chemical approaches. Specifically, the polypeptide backbone is derived from the fermentation of genetically engineered bacterial strains, followed by chemical synthesis to generate the desired peptide fragments. While the thriving market demand brings opportunities, polypeptide drugs with intricate structures are challenging due to complex purification processes, low yields, and difficulties in scale-up. CDMOs are improving synthesis and purification techniques to gain competitive edges in scale production and cost efficiency.

E. Biosimilars

As the patent expiration draws near, a new frontier has emerged for the biosimilars market. Unlike chemical generics, it is challenging for biosimilars to obtain active substances with identical and homogeneous structures. They also demand more advanced R&D technology, longer development cycles, and higher investments. Given the complex structures of large molecules, minor variations in production processes – such as the control conditions, expression environments, and the purification and preparation methods of host cells – may lead to huge differences between biosimilars and reference drugs in terms of purity, impurity types, and activities. These affect the safety and efficacy of the final product. Nonetheless, due to intellectual property protection and confidentiality, establishing an identical production process for biosimilars is unattainable, which further complicates similarity assessment. Collaborating with CDMOs is an attractive option for biosimilar companies to achieve the desired clinical performance and industrialization via improving R&D efficiency and reducing production costs.

Regions vary in demands for biologics, and manufacturing capacities are shifting towards the Asia-Pacific region

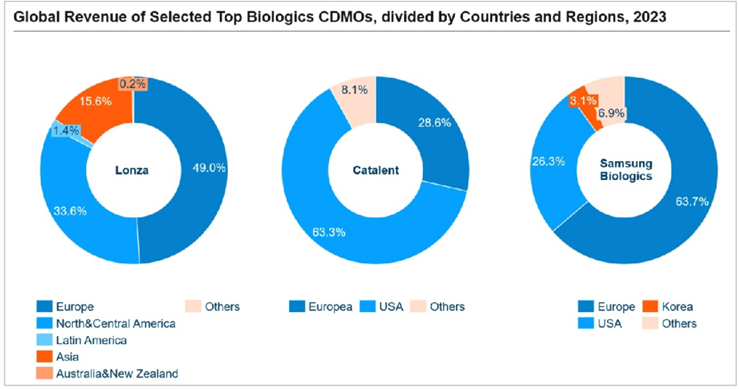

According to Bioplan, global biologics manufacturing capacity expanded from 16.5 million liters in 2018 to 17.4 million liters in 2021. However, capacities are unevenly distributed. In 2021, 10.96 million liters were located in developed regions, including the United States, Canada, and Western Europe. As the largest pharmaceutical market in the world, Europe and America are preferred for marketization of many innovative drugs, leading to higher demand for biomanufacturing capacity. These regions also take the lion’s share of revenue in leading

CDMOs, such as Lonza, Catalent, and Samsung Biologics.

CDMO services rise in the Asia-Pacific region because biopharmaceutical companies are seeking cost-effective and efficient R&D and manufacturing services to address the increasing demand. Global biopharmaceutical production capacity and consequently CDMOs are shifting towards this region as a result of continued efforts in improving infrastructure, industry chain supply, project management, quality management systems, and intellectual property protection. Establishing international production facilities and R&D centers are essential strategies for CDMOs in the Asia-Pacific region to enter the global market.

Source: Corporate Annual Reports, Frost & Sullivan Analysis

III. Bioreactors offer various types suitable for both large-scale commercial production or small-and-medium-scale production

The upstream process of biopharmaceuticals is built on raw materials, excipients, pharmaceutical equipment, consumables, and the design and integration of production lines. Facilities include bioreactors, solution conditioning systems, chromatography systems, membrane filtration systems, bulk fill systems, and packaging equipment. Among them, the critical bioreactors can be categorized into stainless steel bioreactors and single-use bioreactors based on materials.

Stainless steel bioreactors consist of reactors, mixers, reaction control systems, cleaning systems, and air supply systems. Compared with single-use bioreactors, they enable standardized large-scale production processes through more advanced automation and intelligence. They utilize the full potential of cell lines and provides robust process technology, ensuring safe scale-up in commercial applications and large-scale batch productions. Even though stainless steel bioreactors do not require the frequent replacement of consumables, challenges exist in terms of high initial investment costs, lengthy manufacturing cycles, and cumbersome cleaning validation procedures.

Single-use bioreactors are ready-to-use, single-use incubators, with single-use bioreactor bags as the core component. Bags are typically made of plastic materials such as polyethylene, ethylene vinyl acetate, and polycarbonate. Characterized by lower initial costs, faster commissioning, and the waiving of cleaning validations, they are ideal for small-scale production or processes that require frequent cell line replacements and demanding reaction environments. However, in large-scale productions, the material of the bioreactor bags poses limitations due to the need for high robustness, wear resistance, biocompatibility, low endotoxin levels, and strict sterilization which constrains the quality and performance of single-use bioreactors. Furthermore, single-use products necessitate a reliable and sustainable supply chain.

Therefore, stainless steel and single-use bioreactors play differentiated roles in pharmaceutical manufacturing. Single-use bioreactors are predominantly utilized in the clinical stage, supporting small-batch productions from research to pilot scale. In contrast, during the commercialization stage, pharmaceutical companies prioritize process stability and cost efficiency. Stainless steel bioreactors offer superior efficiency and economic benefits when it comes to large-scale commercial production.

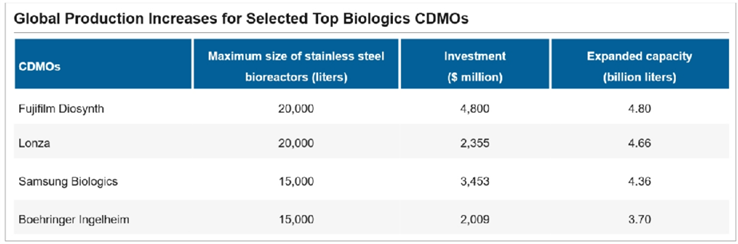

IV. In the fourth revolutionary wave of biologics manufacturing, leading companies invest heavily in production capacity to remain competitive

To ensure a stable supply and efficient cost control in global production, the world’s leading CDMOs are ramping up capacities for the large-scale commercial production of biologics. The construction of stainless steel bioreactors is an integral part of this effort. Top CDMOs such as Lonza, Samsung Biologics, Boehringer Ingelheim, and Fujifilm Diosynth, each with stainless steel bioreactors exceeding 10,000 liters, have announced their ambitious expansion plans since 2021, with an estimated total investment of $12.6 billion and total added capacities of more than 1.7 million liters. This demonstrated their strong momentum in the biologics market. According to public information, in January 2024, Samsung Biologics announced that by 2032, Bio Campus II will have a capacity of 720,000 liters, which will total 1.3 million liters when integrated with Bio Campus I. In March 2024, Lonza announced the acquisition of Roche’s biopharmaceutical plant in Vacaville, USA, for US$1.2 billion, which reportedly owns bioreactors with a total capacity of up to 330,000 liters. In April 2024, Fujifilm Diosynth

announced an additional investment of $1.2 billion in a planned expansion of its biomanufacturing facility in North Carolina, USA, to add eight 20,000-liter stainless steel bioreactors. In this context, CDMOs have become a dominant force in scale production. According to Bioprocess, the proportion of biologics manufacturing capacity utilizing mammalian cells supplied by outsourced contractors or hybrid manufacturers has grown from 27% in 2002 to 33% in 2022 and is expected to reach 44% by 2025.

Source: Corporate News, Corporate Websites, Frost & Sullivan Analysis; Only publicly disclosed capacity expansion and investment plans are counted, as of April 2024

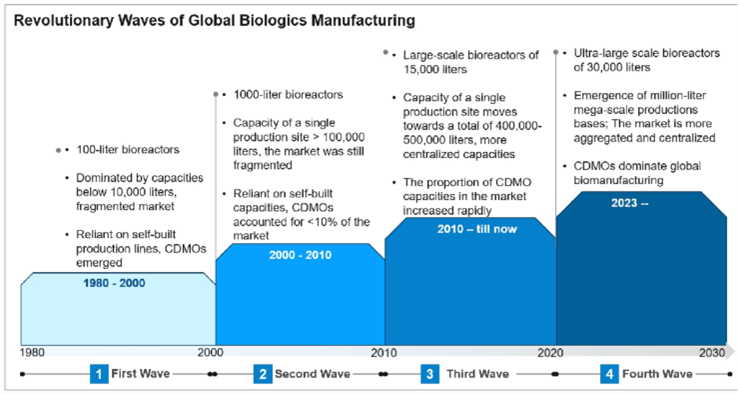

The global biopharmaceutical industry has nourished both in R&D and production. Breakthroughs in innovative production platforms, operation models, and capacity planning have been indispensable throughout its history. Between 1980 and 2000, manufacturing capacity relied on the self-built systems consisting of hundred-liter bioreactors, resulting in a highly fragmented market. As some companies began to outsource their excess capacity, CDMOs emerged as a new force in the industry.

Subsequently, the industry experienced the first wave of significant growth, with the second wave of development occurring between 2000 and 2010 and the third leap from 2010 to the present. During this period, bioreactor capacities increased from hundred-liter to thousand-liter and ten-thousand-liter. The capacity of a single production site now exceeds 100,000 liters. In 2023, BiBo Pharma, founded in Boston, USA, became the first in the world to deliver a new generation of ultra-large production platforms. The working volume of the main stainless steel reactor reached 30,000 liters and a total working volume exceeded 40,000 liters. This marked a new chapter in the biologics manufacturing industry. The global capacity gap and the need for cost reduction ignite the fourth wave for technological revolution, where production sites expand towards million-liter level.

Source: Public Information, Frost & Sullivan Analysis

V. BiBo Pharma pioneers the fourth revolutionary wave of biomanufacturing revolution with the world’s first 30,000-liter ultra-large production platform

Sailing from Boston in 2014, BiBo Pharma has been committed to the commercial production of biologics, achieved through independent design and large-scale manufacturing via stainless steel bioreactors. The past decade has demonstrated that this strategy is well-aligned with the growing demand for commercial production in the biomanufacturing industry. Currently, BiBo Pharma is the first and only CDMO in the world to launch a new generation of ultra-large stainless steel bioreactors with a maximum working volume of 30,000 liters per tank. This is a successful scale-up of the 15,000 liters commonly used in the commercial production of biologics, representing a more than two-fold increase in engineering scale. This breakthrough not only surpasses industry standards but also offers a potential solution to reduce costs.

Source: Public Information

To address the complexities of constructing stainless steel reactors, high initial fixed asset investments, extended construction cycles, and other engineering challenges, BiBo Pharma adopted the distinctive PanFlex®-Engineering technology system. This system balances efficiency improvement and cost control on the basis of ensuring independently designed core equipment and a controllable supply chain. Remarkably, it took only 18 months from the initiation of the project in January 2022 to the delivery of a 30,000-liter ultra-large production platform in June 2023, roughly half the time and half the cost of similar projects worldwide. During the transition from engineering project to GMP production, BiBo Pharma leveraged the world-leading PanFlex®-Operation system to achieve successful production in March 2024 when the platform was put into operation for the first time. Subsequent productions maintained a success rate of 100%, marking an engineering and production milestone.

With stable and efficient solutions, BiBo Pharma has become a commercialization partner for many global biopharmaceutical companies. In the past year, it has signed multiple contracts for clinical phase III products, providing both clinical and commercialization services. BiBo Pharma also offers customized production lines enabled by its cutting-edge engineering technology to international clients. Recently, it has entered into a cooperation with 89Bio to build a production line in the Lin-gang Special Area of Shanghai. This facility will support the commercialization of the active ingredient of pegozafermin, a drug candidate for metabolic dysfunction-associated steatohepatitis (MASH).

Biopharmaceutical companies naturally partner with a trustworthy CDMO throughout the entirelifecycle of R&D, manufacturing and commercialization. Therefore, selecting the right CDMOrequires comprehensive and detailed evaluations. The ability to scale up with essential knowhow and large-scale production capabilities are crucial for ensuring the smoothcommercialization of product pipelines. The decision-making process should also consider end-to-end full-service support, efficient project management, and robust risk prevention and control mechanisms.

BiBo Pharma is motivated by client needs to continuously refine its technologies and systems to remain competitive in an increasingly complex and demanding market. Currently, BiBo Pharma operates three major technology platforms specializing in microbial fermentation, mammalian cell culture, and gene therapy. In addition, Bibo Pharma extends to services for ADC. Bibo Pharma focuses on state-of-the-art technology and quality requirements, with leveraging its R&D center in Boston along with globally distributed production capacities. Currently, the company has established a comprehensive quality and operation management

system that meets the international standards in both the United States and the European Union. This allows BiBo Pharma to provide efficient services to customers around the world. Since its founding, BiBo Pharma has offered CDMO services for more than 130 large molecule projects and is currently developing more than 20 projects at the commercial stage.

With the world’s first and only 30,000-liter production platform as its core strength, combined with tiered production capacities and diversified technology platforms, BiBo Pharma will empower more global biopharmaceutical companies to succeed in both clinical and commercial endeavors through high-quality, efficient, and cost-effective CDMO services.

Source: Public Information

About Frost & Sullivan:

Frost & Sullivan, the growth pipeline company, enables clients to accelerate growth and achieve best-in-class positions in growth, innovation, and leadership. The company’s Growth Pipeline as a Service provides the CEO’s Growth Team with transformational strategies and best-practice models to drive the generation, evaluation, and implementation of powerful growth opportunities. Let us coach you on your transformational journey, while we actively support you in fostering collaborative initiatives within your industry’s ecosystem. Our transformation journey is fueled by four powerful components, ensuring your success in navigating the ever-changing landscape of your industry.

• Schedule a complementary Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

• Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

• Join Frost & Sullivan’s Growth Council and become an integral member of a dynamic community focused on identifying growth opportunities and addressing critical challenges that influence your industry.

• Designate your company as a Companies2Action to increase exposure to investors, new M&A opportunities, and other growth prospects for your business.

For more information, kindly reach out to:

Qian Li

Website: http://www.frostchina.com

Email: qian.li@frostchina.com